Climate Overview

Intensive animal agriculture is a significant contributor to climate change, responsible for approximately 19.6% of global greenhouse gas emissions, yet its impact is underrepresented in existing climate change engagement efforts despite its critical role in the global transition to Net Zero by 2050.

The risks associated with intensive livestock operations also extend to nature, and the negative feedback loops from climate and nature-related risks have resulted in a range of financially material impacts for the livestock sector and the agri-food value chain.

Despite these challenges, opportunities are emerging to help companies mitigate and adapt to climate change. Innovations in farm management, supply chain improvements, new technologies, and alternative protein products are helping the global agri-food value chain transition towards sustainability.

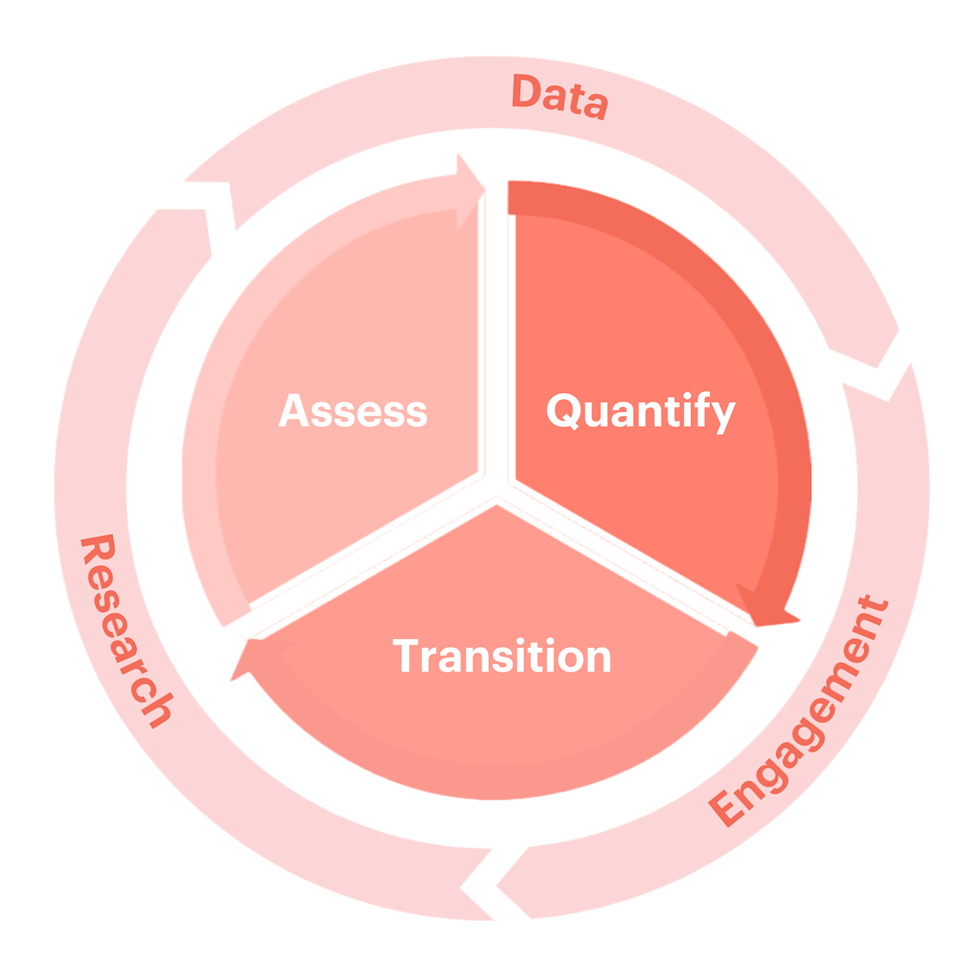

FAIRR supports investors in navigating these climate risks and opportunities through three key pillars:

Assess: Track climate-related disclosures and performance of the largest livestock companies via the Protein Producer Index

Quantify: Analyse physical and transition risks impacting costs, revenue, and profitability through the Climate Risk Tool

Transition: Identify opportunities such as Protein Diversification and Regenerative Agriculture to achieve net-zero targets and mitigate environmental risks

Additionally, FAIRR's recent efforts, such as the COP26 Investor Statement calling on the UN FAO to deliver a climate transition roadmap, have gained significant support from investors, representing US$18 trillion in combined assets. These initiatives equip investors with the tools and data necessary to minimise climate risks and seize opportunities in the livestock sector.

Latest Activity

Sign-on Open: China Agri-Food Engagement Phase 1

FAIRR is pleased to launch the first phase of its new China Agri-Food Engagement. This engagement asks leading Chinese companies to manage climate and nature-related risks across their operations and supply chains. It will remain open till Friday, 24 April 2026.

Report Launch: Grains, Gains and Growing Climate Risks: Building Resilience in Soft Commodity Supply Chains

FAIRR’s new report examines how climate and nature risks are reshaping livestock supply chains. The report highlights the material financial impacts of these risks, identifies corporate disclosure gaps, and highlights solutions that are emerging. It also aims to support investor actions that can strengthen the climate resilience of livestock portfolio companies.

Report Launch: Taking Stock of Industrial Animal Agriculture: The Macro Trends Shaping the Global Food Supply Chain

Using 2024 Coller FAIRR Protein Producer Index data, this report looks at where company commitments and practices demonstrate progress compared to 2019.

It also showcases the research, tools and investor engagements that provide FAIRR investor members with a better understanding of the material risks associated with intensive animal agriculture and the opportunities to drive systemic change in the global food system.

Research Launch - An Investor Primer: Water Insecurity in the Agri-Food Value Chain

This briefing aims to help investors understand the material risks of water insecurity for livestock companies in the agri-food sector and the importance of strengthening their water resilience. It also outlines the actions that investors can take to support companies to mitigate current and future water-related risks.

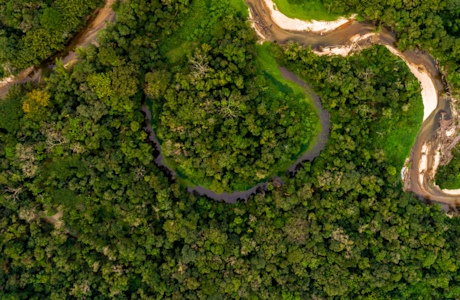

Climate and Nature-based Interventions in Livestock

This report presents a first-of-its-kind integrated climate-nature assessment framework to help investors identify and assess the mitigation potential and business case of 22 on-farm livestock interventions. It also maps public and private capital flows to the interventions to show how current financial investments fall short of supporting sustainable livestock production practices.

Latest release: Coller FAIRR Protein Producer Index 2024/25

The Coller FAIRR Protein Producer Index is the world’s only comprehensive assessment of the biggest producers of animal protein. The most material ESG risks facing investors of 60 companies are identified across nine risks and one opportunity factor.

New Report: Tackling the Climate-Nature Nexus

Livestock production is a significant contributor to the world crossing the safe operating space for the planetary boundaries. This report uses the planetary boundaries framework to illustrate climate and nature-related risks and the financial materiality of exceeding the planetary boundaries from livestock production. It also details the relationship and interdependencies between climate and nature and provides a list of climate and nature-based solutions, highlighting the synergies and trade-offs between different solutions. Understanding these solutions can help investors better engage with their portfolio companies to adopt solutions and allocate necessary capital to scale up promising solutions to reduce financial risk and drive the transition towards a net-zero and nature-positive future.

New Asia Trends Report Coller FAIRR Protein Producer Index 2022/23

The Index assesses 60 of the largest listed global meat, dairy and aquaculture companies on 10 ESG factors. Asia is home to 27 of these companies, including 12 in the People’s Republic of China. This report demonstrates how some Asian companies have progressed considerably in addressing the ESG risks associated with food production. Compared to 2021, there has been improvement almost across the board – most notably with regard to food safety, antibiotics and alternative proteins.

NEW & improved Coller FAIRR Climate Risk Tool has now launched

Introducing the Coller FAIRR Climate Risk Tool - the only climate risk analysis tool that quantifies the materiality of risks and opportunities of the largest livestock producers. Working with three distinct climate scenarios based on IPCC and NGFS - High Climate Impact, Business as Usual, and Net Zero Aligned – the Tool illustrates how each scenario could impact the cost and profitability of each of the 40 meat and dairy companies. The underlying model focuses on three material climate-related costs - carbon tax, feed costs and heat stress – and provides investors with a critical lens to assess how these costs may affect them in future. By leveraging the tool, investors can make informed decisions to better identify climate-related risks and opportunities in their investment portfolios.

Latest Release: Coller FAIRR Protein Producer Index 2023/24

The Coller FAIRR Protein Producer Index, FAIRR’s foundational piece of research, helps to identify the most material ESG risks currently affecting the animal agriculture industry. The Index assesses 60 of the largest global meat, dairy and aquaculture companies on 9 ESG risk factors and one opportunity factor.