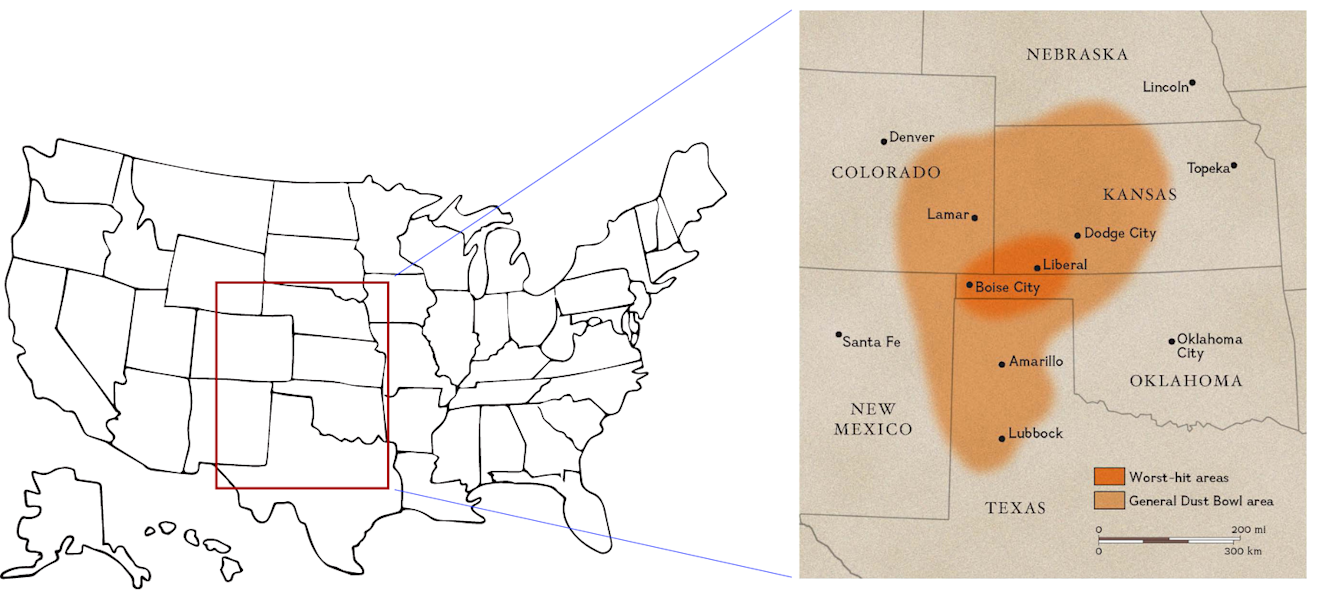

Will the Cerrado Go the Way of the American Dustbowl?

The Great Plains of America were once some of the most fertile grasslands on Earth, supporting countless farming communities in the USA. Extensive agricultural expansion from the late 1800s converted vast swathes of natural grassland into cropland. In the absence of native vegetation, combined with severe droughts in the early 1930’s, fertile topsoil began to disappear via erosion in what came to be known as the ‘American Dustbowl’.

Figure 1: Map of the American Dustbowl

Source - National Geographic

Despite the Dust Bowl and its impacts being cemented in American history, lessons have not been learnt. The supply-driven, conversion of natural lands and ecosystems is taking place across the world, with one area of acute concern being Brazil’s Cerrado.

Degradation within the Cerrado not only represents a risk to the wealth of agribusiness within the region and associated supply chains, but also a potential opportunity which financial institutions could capitalise on.

Could History Repeat Itself in the Cerrado?

Covering an area the size of Mexico, and home to almost 5% of all species on Earth, the Cerrado biome in Brazil is one of the most biodiverse areas of our planet and acts as a water source for 8/12 of Brazil’s river basins.

Despite its unequivocal value, and previous calls for the Cerrado’s conservation, deforestation surged by 43% in 2023. Notably, less than 3% of the Cerrado is legally protected.

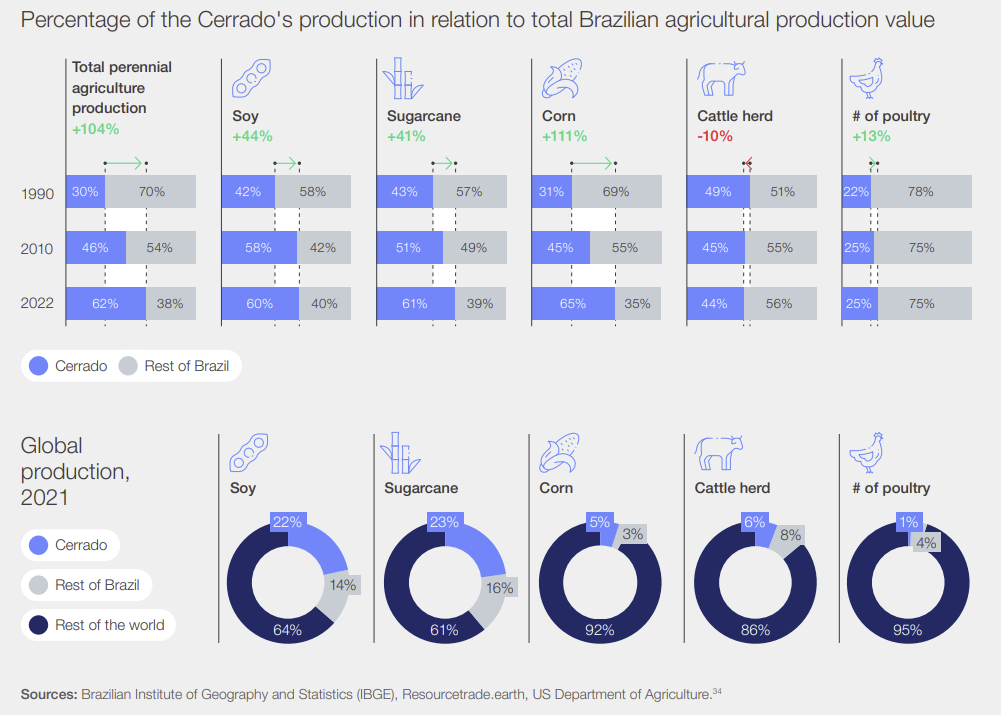

Similar to the Great Plains of America, the Cerrado has undergone extensive agricultural development. It’s the centre of production for soy, cattle, corn and sugarcane, and represents 60% of Brazil’s agricultural output (see figure 2 below).

Figure 2: Production in the Cerrado in relation to total Brazilian agricultural production

Source: World Economic Forum

70% of companies in the Coller FAIRR Protein Producer Index already cite physical risks to feed supply, of which soy is a key component, and the associated price volatility as a material risk. Concerningly, some estimate the Cerrado could functionally collapse in under 30 years if agribusiness expansion continues, likely exacerbating this already acute material risk.

To prevent further conversion of the Cerrado, sustainably increasing the productivity of existing agricultural land, alongside regenerating degraded areas is paramount. This represents an acute economic opportunity potentially increasing Brazilian GDP by $40 billion annually. Stakeholders are already taking action with Marfrig, Cargill and Louis Dreyfus all undertaking projects aimed at improving degraded land in Brazil. Alongside this, NGO’s have also collaborated to accelerate private investment in these areas.

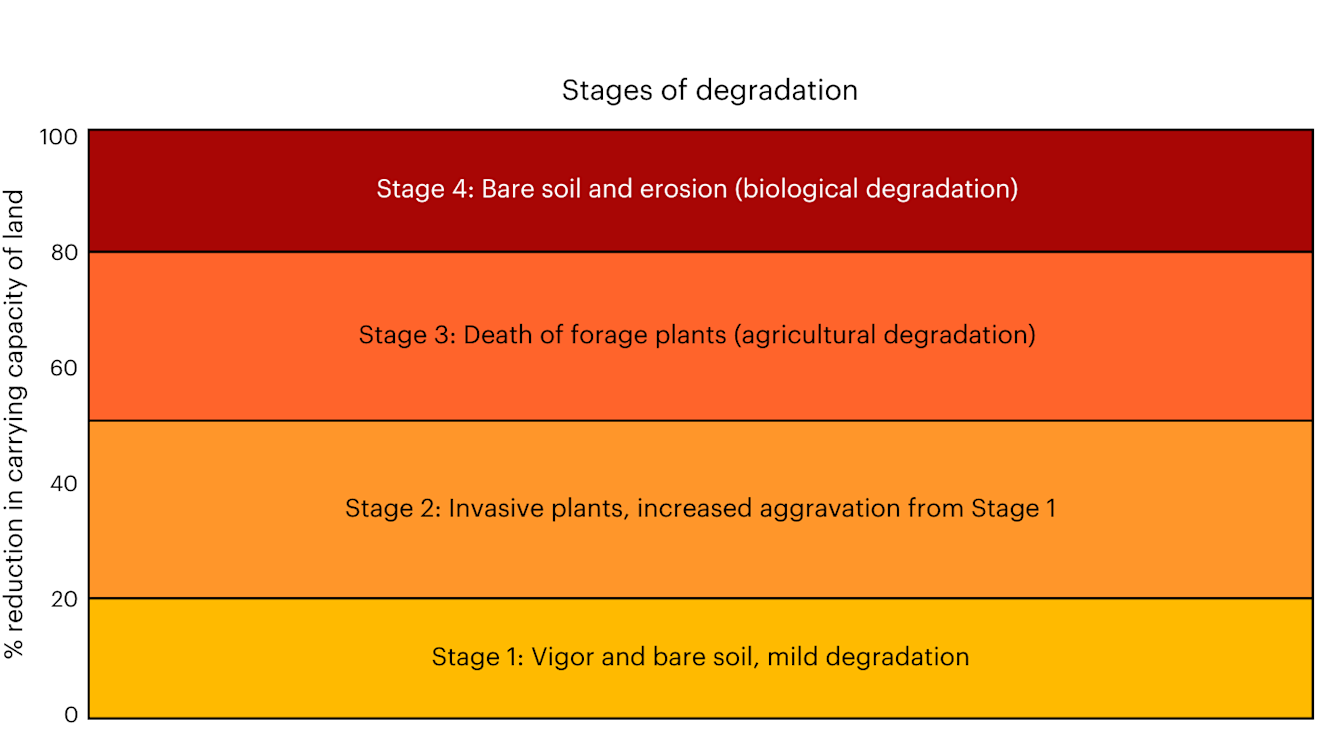

Sub-Optimal Practices Lead to Degraded Pasture

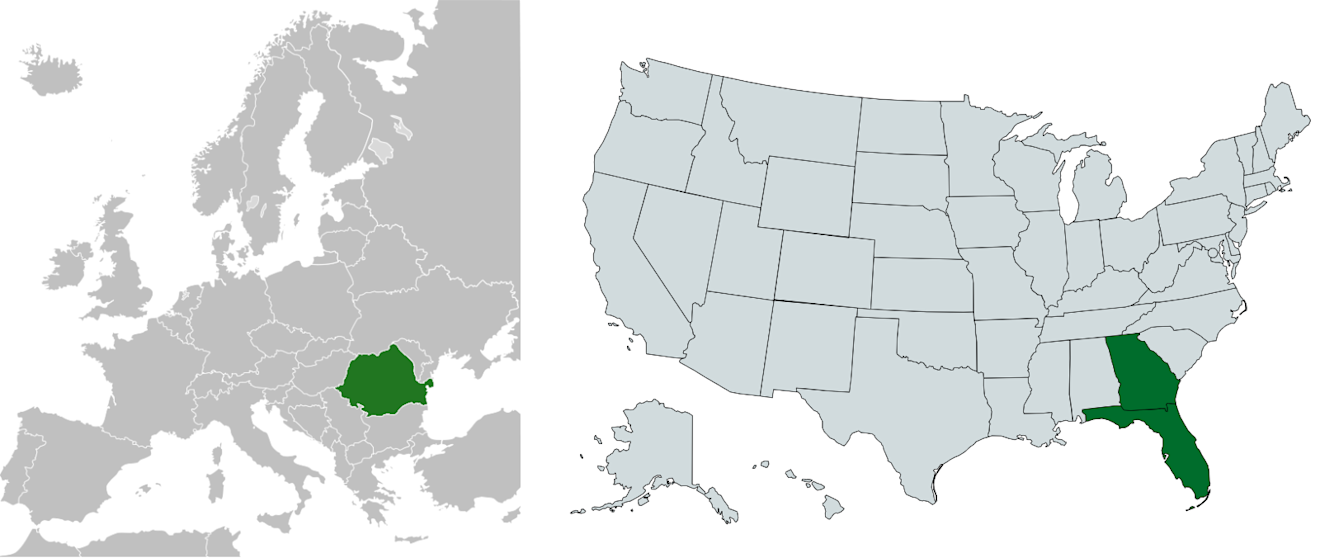

Currently, a lack of good farming practices and pasture management has resulted in degraded lands and pastures. Examples of suboptimal practices include inadequate soil, plant, or herd management, overgrazing, insufficient weed, and pest controls, and lack of fertilisation. In Brazil this has occurred at scale, resulting in two conditions: 1. agricultural degradation where a significant increase in the number of weeds impacts the land's ability to support grazing animals; 2. biological degradation where the soil loses its ability to support plant life and there is a drastic decrease in productivity. Of the pasture land within the Cerrado, approximately 23.7 million hectares show some level of degradation.

Figure 3: The area of degraded pasture in the Cerrado is equal to a country the size of Romania in Europe or the US states of Florida and Georgia combined.

Figure 4: Pasture degradation stages and level of degradation.

The Degraded Pasture Opportunity and Imperative

“Global food demand is projected to increase by nearly 50% by 2050”, with crops and agricultural products supplied by Brazil being in particular demand. The increased demand for animal protein will likely drive expansion of farmland for soy production used in animal feed. Brazil is the number one producer and exporter of soybeans in the world representing approximately 30% of global production. Cropland dedicated to soybeans increased by 10 million hectares between 2010 to 2020, and by 2030, it is estimated that a further 7.2 million hectares of land will be allocated to soybeans. The Nature Conservancy models that in a business-as-usual situation, approximately 2.2 million hectares of native vegetation would be cleared to meet this demand. The question is how do we produce and protect?

Farmer Choices and Profitability of Expansion on Degraded Land Vs. Native Vegetation

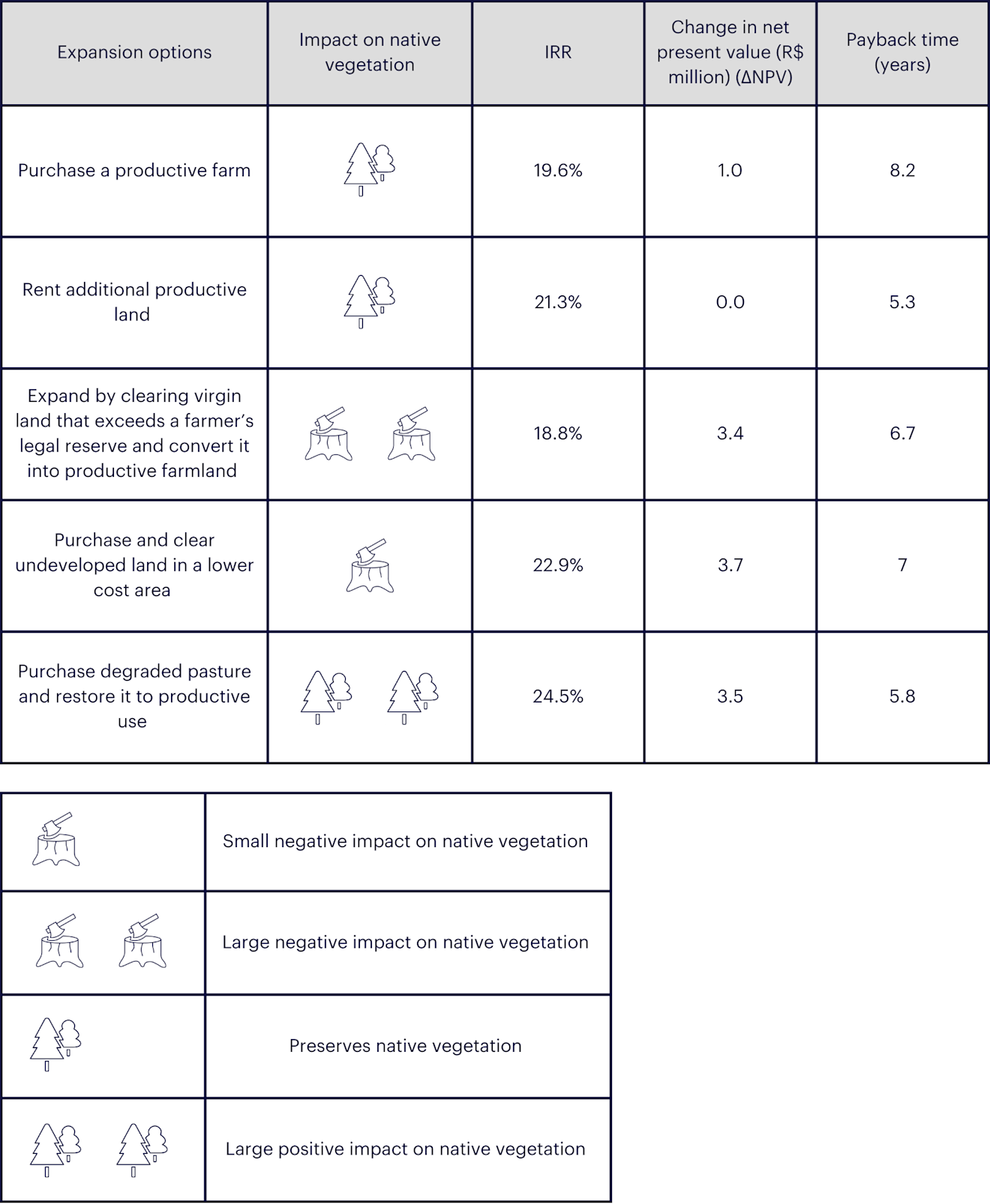

There are several choices a farmer can make when choosing to expand to meet demand (See Table 1).

Whilst the purchase of an existing productive farm and renting productive land to farm are solid options that generally preserve native vegetation, a greater focus is needed on how to make clearing native vegetation a non-starter and make expansion utilising degraded pasture the preferred choice.

Both The Nature Conservancy and Agroicone studied the profitability of expansion on degraded pasture vs. native vegetation, concluding that there is a negligible profit difference between the two expansion models. However, if the provision of long-term financing for degraded pasture expansion can be provided to farmers to scale, the degraded pasture option can become the more profitable choice. This is due to the lower acquisition costs and earlier achievement of maximum productivity enabling a greater financial return (See Table 1).

Table 1: Farmer Expansion Options

The IFACC Connects Investors to Opportunities

One promising example of collaboration in this space is the Innovative Finance for the Amazon, Cerrado, and Chaco (IFACC). This was launched to scale up financial mechanisms and accelerate initiatives such as degraded land restoration by attracting investment from signatories. The IFACC assists these signatories through its connections with key stakeholders and market intelligence to direct investment towards nature-positive agriculture in the region.

One signatory that provides such funding is AgDev, a joint venture between Carroll Family Farms and InDev Capital. Its investment vehicle is structured as a US$ bond offering in an overseas market aligning with the currency used by soybean farmers which are largely dollarized due to the export-oriented nature of the product. Further, the US$ vehicle enables global investors to invest capital in a senior position to AgDev’s meaningful investment.

Capital is then provided to select farmers to expand via the restoration of degraded lands, with AgDev assisting in degraded land sourcing, financing, land restoration, and agricultural best practices.

The Need and Opportunity for Financial Institutions to Accelerate Solutions

Reversing the current loss of nature in the Cerrado is of unequivocal importance and lessons must be learned from the American dustbowl. Financial institutions are in a unique position to both capitalise on the degraded land opportunity and also mitigate the extensive material risk that nature loss in this global breadbasket represents.

Achieving this goal requires an understanding of the options farmers face, alongside an ability to operate both at a farm level and in capital markets. If FI’s can secure and deploy long-term capital at a sufficient return, either by themselves or through organisations like the IFACC, they can provide scale of impact and lend capital at a cost acceptable to farmers.

Through engaging expansion oriented farmers to shift their growth plans to the acquisition and restoration of degraded lands; investors can capitalise on the opportunity to both produce within, and protect the Cerrado.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.