The impacts of the livestock industry’s contributions to global warming are widely known; the sector contributes to close to 14% of total greenhouse gas emissions. Due to this stark figure, investors are increasingly interested in driving a meaningful transition in this sector. The livestock industry is about US$1.7 trillion, as big as the size of some of the world’s major economies, such as Brazil, which is US$1.9 trillion, and Australia, which is US$1.6 trillion. In an industry of this size, there is promise in the power of the capital market and investors to drive significant change towards a sustainable food systems transformation.

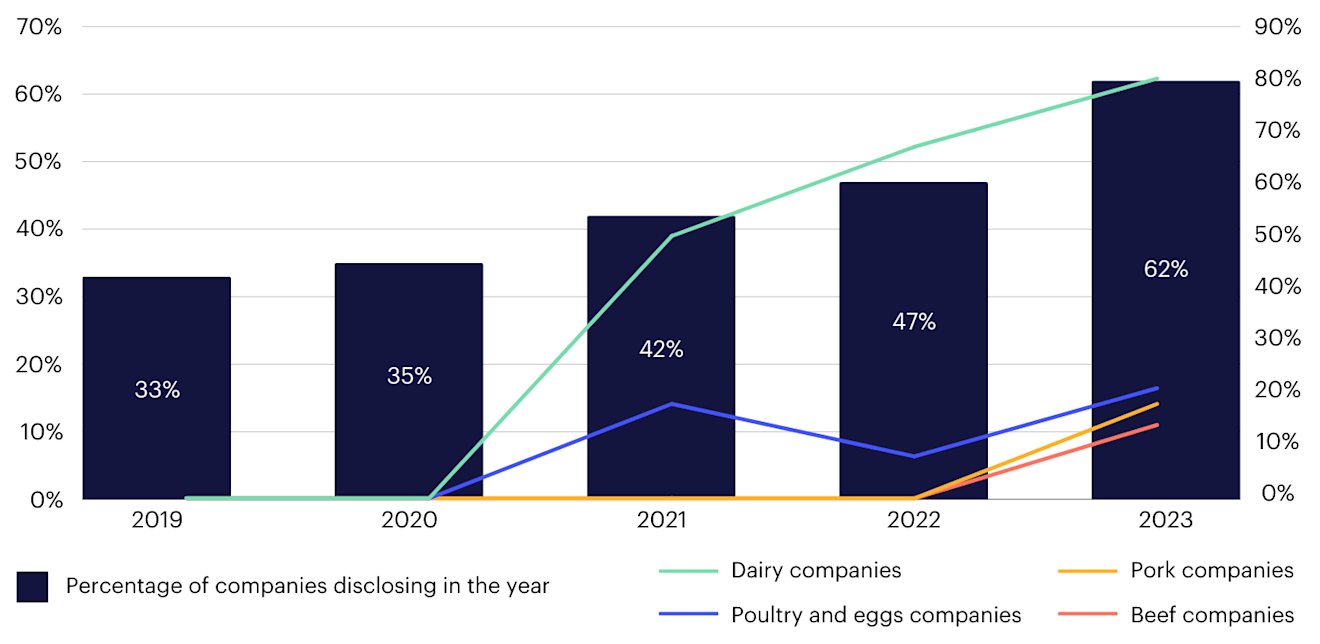

Companies are beginning to make positive progress, as shown by the growing amount of reporting on climate-related disclosures. Based on the recently released CDP factsheet, as many as 23,200 companies reported on climate change in 2023 compared to 9,560 companies reporting in 2020. A comparable trend of increased disclosures is evident from the 2023 status report of the Task Force on Climate-related Financial Disclosures (TCFD), which analysed reports from more than 1,350 public companies over three years from 2020. The percentage of companies reporting on climate-related risks or opportunities, board oversight, and climate-related targets increased by around 25 percentage points each year. Looking specifically at the progress within the livestock industry, we observe a similar pattern of increased disclosures. In the sample of 60 of the biggest protein producers included in FAIRR's Protein Producer Index, the number of companies disclosing to CDP has steadily increased from around 30% in 2019 to 60% in 2023.

Figure 1: Growing trends of climate-related disclosure among livestock companies from 2019-2023

The line chart represents the percentage change of the disclosure compared to previous years.

Source: FAIRR's analysis based on the data collected over the last five-year period for the Protein Producer Index

While an increased disclosure rate is a step in the right direction, there is an urgent need to focus on the quality of climate disclosures and pay attention to those disclosures that highlight material climate risks. The livestock sector is exposed to climate-related risks such as heat stress to animals, higher feed prices, water shortages, rise in energy prices, risks from extreme weather, and regulatory costs such as carbon prices. According to the Coller FAIRR Climate Risk Tool, forty of the largest livestock producers could collectively see profits fall by nearly US$24 billion in 2030 compared to 2020 due to climate change, highlighting that these risks can be material for investors.

Although the quantity of disclosures has increased, there is still scope for improving the quality of climate risk-related cost disclosures of livestock companies. To examine this point, we analysed the climate risk disclosures of some of the biggest livestock public and private companies— 191 companies representing 45% of the US$1.7 trillion global livestock market, as reported in the companies' CDP climate reports and their latest sustainability reports.

Three key findings:

1. Low disclosures on costs related to climate risks in the livestock industry despite it being a material risk.

Just under 20% of the livestock companies in our sample disclose climate risk-related costs. This number comprises 36 of the 191 companies assessed, representing a mere 9% of the total livestock market. Most public companies, about 94 included in the sample, have yet to disclose the potential cost increases associated with climate risks. The number of companies undertaking climate risk assessments is low despite climate risk assessments being part of the IFRS ISSB S2 climate recommendations. Paragraph 22 of the recommendation requires companies to disclose climate-related costs to enable users of the company’s financial information to understand how will a company cope with climate-related uncertainties — both risks and opportunities.

These costs cannot be ignored as these could be material for investors. For instance, Nestlé and Unilever, two major European retail corporations with a reasonable presence in the dairy industry, disclosed that their maximum expected cost due to climate risks is US$15.8 and US$7.4 billion, respectively, as reported in their 2023 CDP reports. These numbers represent about 15% and 11% of their total revenue in 2023. While such big numbers can attract scrutiny, it is essential to recognize that these costs are estimates and must be understood in light of the uncertainty around underlying data and assumptions. Disclosure of such numbers by leading companies can be encouraging for other companies that are not yet disclosing climate risk costs in their publicly available reports.

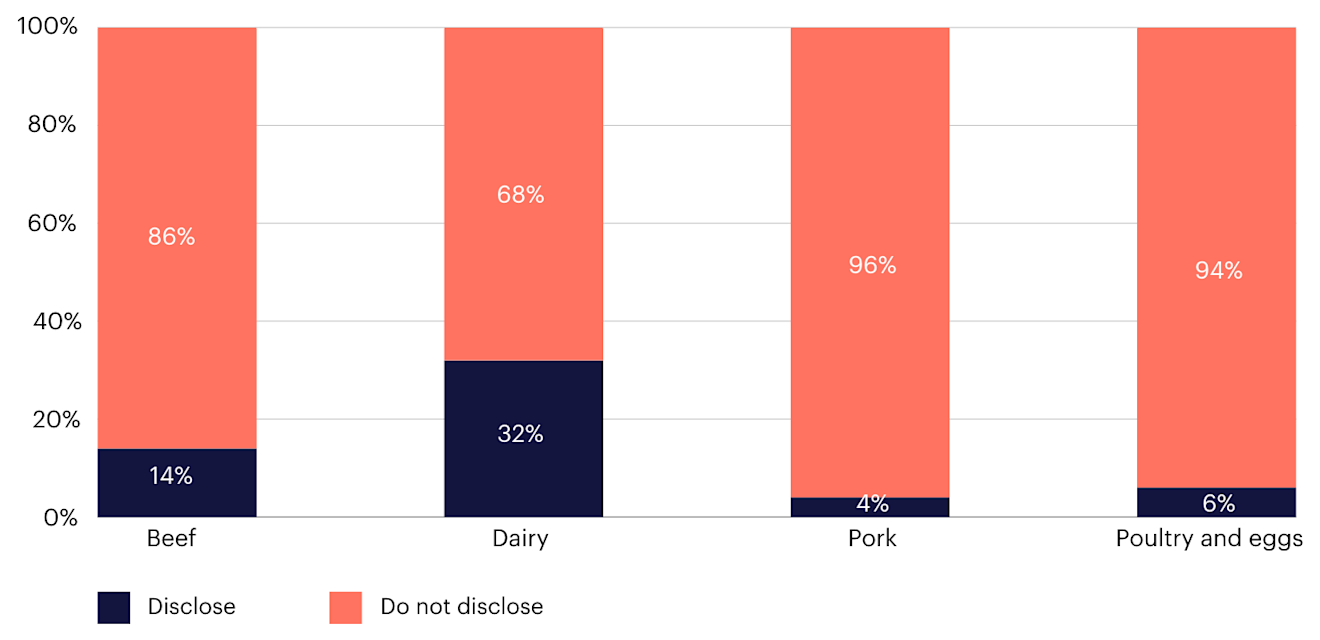

2. Dairy companies are more active in disclosing costs related to climate risk.

About 22 out of 36 companies, or 60% of companies that disclose costs associated with climate risk, are dairy companies. It is possible that the higher level of disclosure is because dairy companies have more direct interactions with consumers. Consumers frequently see dairy brands in supermarkets when making purchase decisions, therefore dairy companies are more motivated to take proactive steps to build a positive reputation.

Many dairy companies report on climate-related costs by reporting results from conducting climate risk scenario analyses. For instance, Danone and Fonterra are two companies with higher scores on climate-related scenario analysis scores than their peers in FAIRR's benchmark Protein Producer Index. The high score has various reasons: They conducted scenario assessments to understand future climate-related costs. Both of them also mention the steps they are taking to address these challenges such as mitigation practices for heat stress. For instance, Fonterra cites mitigation practices for heat stress as a minimum requirement for its farmer's incentive program. Danone mentions the creation of a mobile oasis in the grazing fields to provide water, shade, and relief from heat stress. Both companies also recognise the importance of carbon prices as a risk in this sector and include them in their scenario analysis.

3. Despite exposure to climate risk through animal feed, not enough pork and poultry companies disclose climate-related costs.

Over 90% of pork, poultry & egg companies do not disclose this information even though they could be particularly vulnerable to climate-related risks, such as from animal feed prices. Feed constitutes between 60-70% of expenses on average for meat producers. Pork and poultry producers, in particular, rely on purchased feed for their animals. This dependence on feed is different from cattle that can also feed in pastures. Feed crops such as corn are vulnerable to climate-related risks depending on the region.

Figure 2: Climate risk cost disclosure by main protein category of companies

Source: FAIRR's analysis based on 191 companies

Maize or corn, a key feed crop in North America, is particularly susceptible to climate risk. Livestock in the US are fed a higher proportion of corn than the global average, particularly in pork and poultry feeds, where corn accounts for over 70% of the feed mix, based on our analysis. The Coller FAIRR Climate Risk Tool shows that pork and poultry producers in North America are particularly vulnerable to climate-related cost risk to corn crops driven by climate-related impacts such as seasonal variation in rainfall patterns impacting sowing seasons. The tool, also estimates that by 2030, the price of corn in North America is estimated to increase by 40% under the BAU (business-as-usual) scenario.

The over-dependence on corn and the climate-related impact on the cost of corn, make this a material risk for the livestock companies in the region. Therefore, it is important for companies in the pork and poultry supply chain to report on these costs and tell investors how they are planning to mitigate them.

What can investors do to improve the status of disclosures on climate risk costs?

1. Encourage more disclosure of climate-related costs from companies, not just emissions disclosures.

An increasing number of companies are beginning to report on scope 1, 2, and, to some extent, on scope 3 emissions. However, reporting on emissions is only one part of the IFRS Sustainability Disclosure Standard S2 Climate-Related Disclosures. Another critical component is risk management. Such reporting is essential for investors to understand better how companies value risk in their value chain.

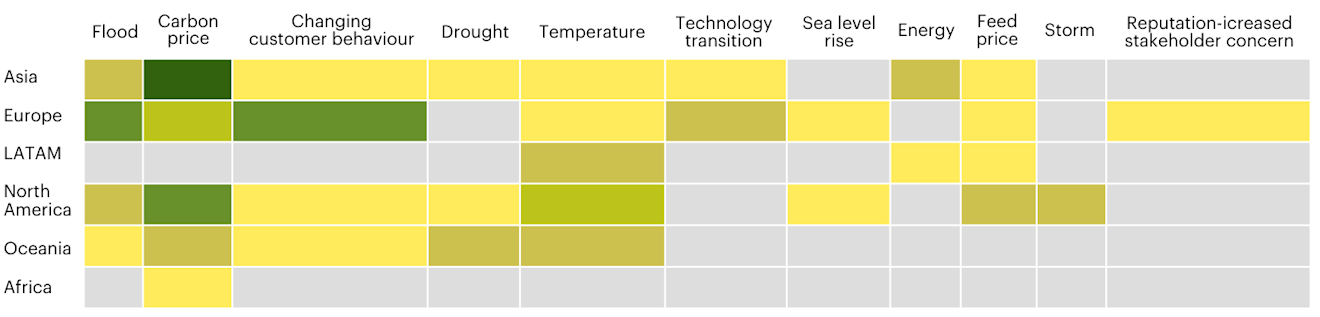

It is not that companies are not reporting at all; some companies are reporting, see table below for a breakdown of cost disclosure by different risk categories. The protein producers that disclose risks and related costs do so by providing estimates from risks, such as floods, droughts, and the impact of carbon prices. Costs related to carbon pricing and floods, in particular, are reported by several livestock companies. Further, companies in Asia, Europe, and North America are already reporting on some of these cost categories.

Investors can encourage companies that are not reporting yet to start reporting, particularly those for whom these costs can be material. For instance, investors can encourage pork and poultry companies, especially those in North America, to start disclosing feed cost-related risks in line with TCFD guidelines.

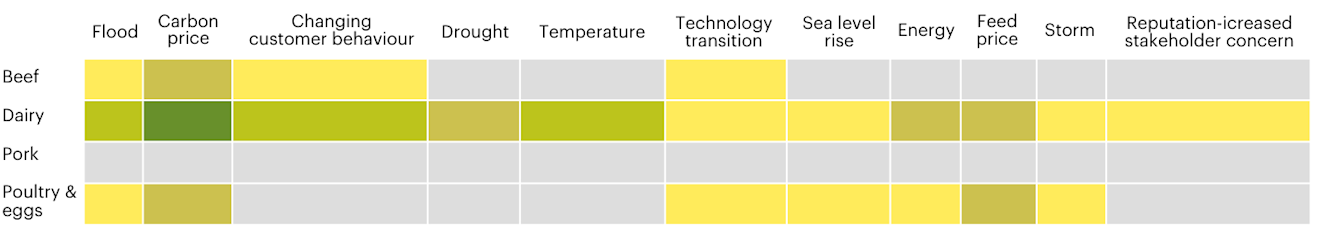

Figure 3: Frequency of climate risk-related costs disclosures by protein producers

Grey cells indicate no reported costs for specific climate risks, with colour gradients from yellow to green reflecting increasing values of disclosures.

Source: FAIRR’s analysis based on climate-related costs reported by companies

2. Investors can encourage companies to disclose the resilience of their business strategies under different global warming scenarios.

Not only can investors benefit from better disclosure of costs by companies, which is mentioned in point one above, but from more communication by companies on how they are thinking about addressing these climate costs or tapping into the opportunities. Such communication is integral to the resilience of their business strategies. Connecting climate-related costs to the implications of these costs on the resilience of the business was identified as a lagging area by the 2023 status report of TCFD. It was reported by only 10% of companies out of a sample of about 1,300 companies and much less reported compared to other points, such as climate-related metrics & targets, board oversight, etc.

Investors can encourage companies that are already reporting their climate risk-related costs to start mentioning how they plan to address these costs and opportunities related to climate change as part of their business models if they are not doing that already. Closing this loop from communication of climate risk-related costs to integrating these costs into business models is vital to ensure resilience to global warming and safeguard returns for investors.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.