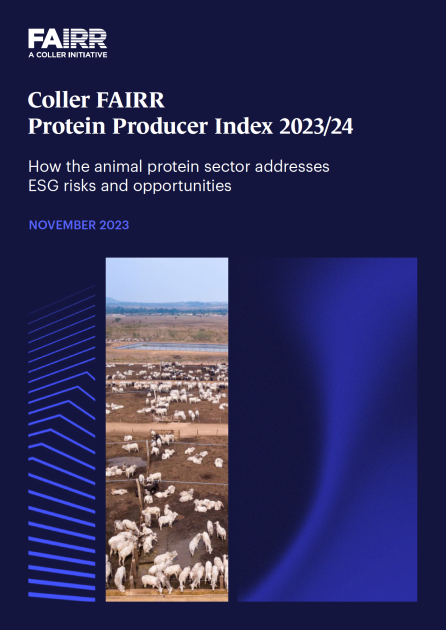

Report Overview

The Coller FAIRR Protein Producer Index was established in 2018 to address the knowledge gap in the environmental, social and governance (ESG) risks associated with the food sector. Recognition of its value has increasingly grown, as has its impact in driving engagement with leading protein producers and supporting investors in the sector. The Index assesses 60 of the largest listed global meat, dairy and aquaculture companies on ten ESG factors. This report focuses on four topics that are increasingly attracting the most significant interest from stakeholders of all types, including companies, investors and policymakers:

SBTi FLAG: more accountability for land-intensive companies

Circularity: going further than footprints

Antibiotics and animal welfare: a vital link

Human capital risks: mounting pressure to demonstrate transparency and equitability

Some 50% of companies provided feedback to their assessments this year, demonstrating an encouraging level of engagement as companies actively try to understand their assessments. There has been a year-on-year decrease in Index companies rated High Risk – from 55% in 2022 to 45% in 2023 – despite methodology changes that have raised expectations of what constitutes best practice. There are not yet companies achieving a Best Practice score across all risk factors, but more are securing a ‘Low Risk’ rank.

We have seen companies hiring ESG professionals to address the risks identified in their assessments, while others are using the Index to prioritise their sustainability strategies. In tandem, FAIRR’s reach as an investor network has grown substantially – from 125 members representing $US14 trillion in 2019 to more than 390 members representing US$71.5 trillion in 2023. FAIRR’s latest investor survey found 79% of responding members use FAIRR research, including the Index, to inform direct company engagement and 85% use it as part of their sectoral and thematic analyses.

Amid these improvements, this report shows some companies have progressed considerably in addressing the ESG risks associated with the food sector. However, they remain in the minority. Many companies are still failing to manage specific risks even at a basic level and the gap between the best- and worst-performing companies is still growing.

Report Highlights

This report can help investors:

To understand the Coller FAIRR Protein Producer Index Methodology

To understand the ESG risks facing the animal agriculture sector

To understand what current best practice looks like for each risk factor

To know how companies’ ESG performance are relative to their peers

To understand the latest policy developments impacting the sector

To understand FAIRR’s analysis of the most pressing issues

To understand why these issues matter

Downloads

Full Report

Detailed methodology

Breakdown of the company universe

Factor specific materiality analysis

Industry trend analysis

Regulatory analysis and policy timelines

Best practice examples and case studies

Overall trends and conclusions

Disclaimer

The Coller FAIRR Protein Producer Index (the “Index”) referred to herein is published by the Farm Animal Investment Risk & Return Initiative (the ‘FAIRR Initiative’) for general informational purposes only.

The Index and the report have been compiled based on information made publicly available by the companies referred to therein or from other public sources, which information has not been independently verified, and neither the FAIRR Initiative nor the Jeremy Coller Foundation takes any responsibility for any such information. Neither the FAIRR Initiative nor the Jeremy Coller Foundation (1) makes any representation or warranty regarding the accuracy, reliability or completeness of this report, the Index or any information or (2) assumes any obligation to correct, update or supplement this report, the Index or any information. There can be no assurance that the Index or related reports or information will continue to be available, and publication of the Index and related reports or information may cease at any time, with or without notice.

The information provided on the terms and subject to the conditions stated herein or applicable to users of any website or other medium through which it is made available. Neither this report nor the Index nor any other information contained herein (1) constitutes advice, an endorsement or a recommendation of any kind or (2) should be used as a basis for making any investment or any other decision. Without limiting the generality of the foregoing, neither this report nor the Index or any other information contained herein (1) constitutes legal, regulatory, financial, tax, investment or other professional advice of any kind or (2) is intended or may be interpreted as, an attempt to market or sell any financial instrument. Recipients of this report have to seek their independent advice and may not rely on the FAIRR Initiative or the Jeremy Coller Foundation for any purpose.

Written by

Director of Research & Data

Senior Manager, Research & Engagements

Senior ESG Analyst

Analyst

China Programme Manager

Senior Analyst

Senior Analyst

Senior Analyst