The food industry is undergoing significant change. The global pandemic has brought to light the vulnerabilities and inequities of global protein value chains, pushed the meat processing industry to breaking point, and accelerated the adoption of alternative proteins.

For the last decade or so, food companies have been solely focused on addressing climate and other sustainability risks including deforestation and biodiversity loss through supply-side interventions. However, these interventions on their own are simply not enough to address the growing ESG challenges faced by leading food companies in an increasingly resource-constrained world.

Last year’s special report from the IPCC pointed to dietary change and, in particular, the need to shift towards more balanced and diversified protein sources, including a greater focus on plant-based and alternatives (fruits and vegetables, grains, pulses, meat analogues, cell-based meat, and insects), as a major climate mitigation strategy with the potential to reduce 0.7-8 Gt CO2e per year by 2050.

Investors too recognise the need for a dietary transition, hence why FAIRR’s sustainable proteins engagement has grown ten-fold since 2016. Four years after the first report was published, the engagement is now supported by 88 investors including leading institutional investors like Amundi, BMO Global Asset Management, and Northern Trust Asset Management, representing total aggregate support of $13.2 trillion in assets.

Phase 4 of the engagement asks 25 leading retailers and manufacturers to disclose information relating to their long-term plans to develop a global, evidence-based, and board-endorsed approach to transition protein portfolios away from an over-reliance on animal proteins and towards diversified and sustainable alternative protein sources.

Protein diversification is driving business growth and positive climate impacts

FAIRR’s new update report, Appetite for Disruption: A Second Serving launched late July 2020 alongside a new interactive Sustainable Proteins Hub discusses the key trends within the industry and how the leading food companies included in the engagement are turning to protein diversification to drive growth and build climate-aligned portfolios.

Consumer perception and demand is changing rapidly, especially in Asia where concerns around food safety and the link between increased disease prevalence and intensive animal production is driving consumers to reconsider their protein sources. In China, pork consumption is estimated to drop by about 35% this year, which is significant given the country accounts for 40% of global pork demand.

This shift coincides with the accelerated development of food technology in this space, which is giving no indication of slowing down. Despite the uncertainties global markets are facing today, investment in the space is at an all-time high. The first half of 2020 has already seen $1.4 billion invested in plant-based and cell-culture technologies. This is more than double the investment in 2019 and represents 1/3 of all venture investments to date.

It is against this backdrop that we have seen a flurry of activity from Big Food, who are evolving their strategic and sustainability ambitions to ensure brands stay relevant and climate positive.

So how are companies responding to the protein transition?

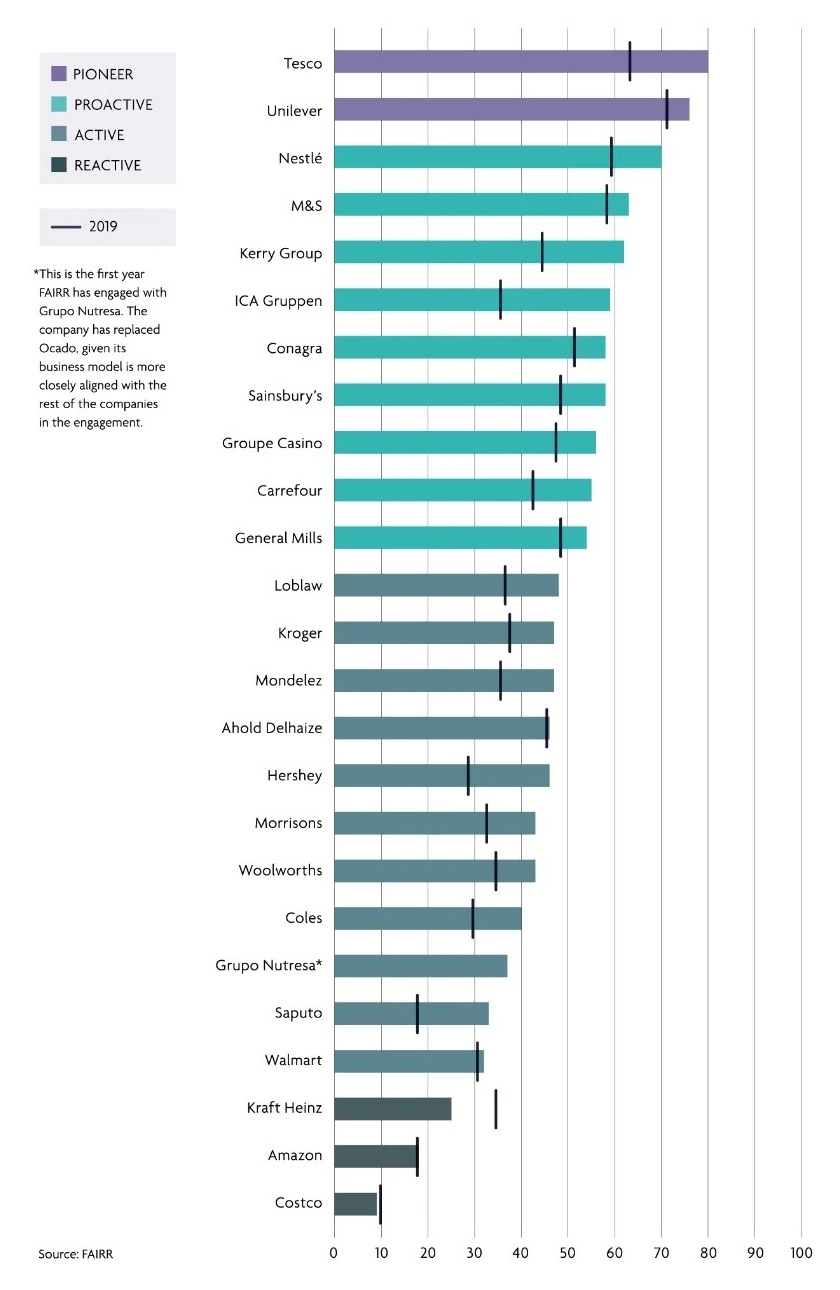

Based on company responses to the engagement, FAIRR’s assessment of the 25 companies shows considerable progress to date.

Tesco and Unilever are the first two companies in the engagement to achieve the ‘Pioneer’ level. This reflects the continued progress made by these companies to evolve their business and sustainability strategies in line with a dietary transition towards low-impact protein sources. Most importantly, both companies are exploring a different way to address consumer demand and promote long-term behavioural change beyond simply increasing product choice for consumers.

However, some companies have not been able to demonstrate much improvement compared to 2019 and their main competitors within the engagement. For instance, Kraft Heinz has dropped down the ranking – mainly due to limited innovation within its portfolio, which has seen its flagship plant-based brand BOCA lose market share to its competitors like Beyond Meat and Impossible Foods. The BOCA burger’s share of the US plant-based burger market has fallen 3.8% in 2019 compared to 7.3% in 2013.

Year on year, Costco remains one of the lowest-performing companies – it is one of the largest sellers of meat in the US and is now a vertically integrated poultry producer after opening a plant in Nebraska. Despite its growing meat footprint, it has taken very few steps to reduce impacts across its animal protein supply chains.

Next on the menu

In the next six weeks, FAIRR will explore the key topics tackled throughout the report and the Sustainable Proteins Hub to dive deeper into the analysis of this year’s findings. We will discuss various challenges and opportunities underlined by the 25 global food leaders starting with the difficult question of defining the journey companies need to take and the approach investors can adopt when engaging directly with portfolio companies.

Sign up to the Sustainable Protein Newsletter to read our dedicated blog series and take part in our weekly discussion.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.