China's latest policy to cut down soybean meal usage in livestock feed is a game-changer. Facing high import reliance and limited domestic production, the government's Three-Year Action Plan for Reducing Soybean Meal in Feed is transforming the agricultural and livestock sector.

Companies have quickly adapted by implementing innovative feeding strategies that reduce soybean meal usage, replace traditional protein sources, and boost overall efficiency.

This blog explores these adaptations and how they are creating new opportunities for investors, particularly in technologies and resources that support reduced soy reliance, while outlining their potential role in reducing deforestation linked to soy imports.

Considering these emerging trends is crucial, as their impacts are set to extend beyond China, influencing global supply chains and commodity markets.

China's rising soybean meal demand and new policies to reduce import dependency

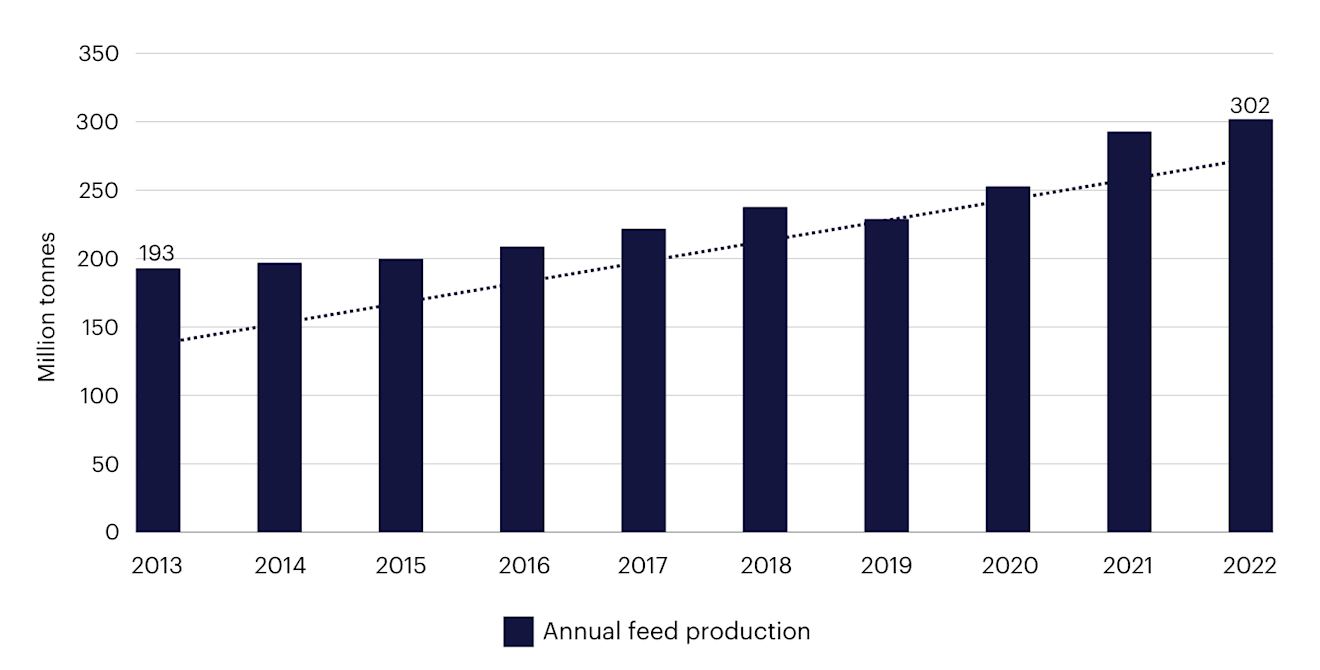

As a leading global player in the livestock sector, China produces substantial quantities of milk, pork, and poultry each year, driving significant demand for animal feed. Over the past ten years, annual feed production in China has steadily increased from 193 million to 302 million tonnes—a 60% increase—with soybean meal serving as a crucial protein component for livestock feed.

Nearly 70% of the soybeans consumed in China are used for livestock feed, creating a heavy reliance on soybean meal. This dependence poses risks to national food security, as over 88% of soybeans are imported, primarily from Brazil and Argentina.

Figure 1: China’s annual feed production from 2013 to 2022

Source: China Feed Organisation

To address these challenges and improve the feed structure, the Chinese government introduced the 14th Five-Year Plan for National Forage Industry Development in 2022 and in April 2023, further released the Three-Year Action Plan for Reducing Soybean Meal in Feed.

These policies aim to reduce the use of soybean meal in feed from 14.5% to below 13% by 2025 and set a 98 million-tonne target for national production of high-quality forage. Although a 1.5 percentage point reduction may seem small, it symbolises a significant shift, expected to cut soybean meal consumption by 6.8 million tonnes, ultimately leading to an 8.7 million tonne-decrease in overall soybean demand.

Technological advances cut 9 million tonnes in soybean feed use

Since the introduction of the soybean meal reduction policies in 2023, many livestock companies have responded by implementing new feeding strategies, driven by technological innovations. These strategies focus on:

Reducing protein - using low-protein diets to avoid waste and reduce environmental impact, while providing animals with essential nutrients through synthetic supplements.

Replacing soybean meal - using alternative protein sources like cottonseed meal to increase microbial protein feed production, and utilising resources such as food leftovers and animal by-products.

Increasing forage – optimising the use of arable, fallow or challenging (e.g. saline-alkali) land to grow high-quality feed crops, such as maize, alfalfa, and oats, instead of traditional grain.

In 2023, such strategies allowed China to produce over 175 million tonnes of meat, eggs, and milk, while reducing soybean meal use by 7.3 million tonnes and overall soybean feed demand by over 9 million tonnes.

This led to a significant drop in feed costs, saving more than US $17 per tonne, while also stabilising market prices for key food commodities and reducing livestock farming costs. These efforts collectively decreased China’s dependency on soybean imports and enhanced food security.

Company example: Pork producer Muyuan cuts soybean meal to 5.7% |

|---|

As one of the world's largest pork producers, Muyuan started implementing low-protein diets in 2000 after discovering that pigs were often fed excessive protein, leading to waste and environmental pollution from high nitrogen content. This initiative has saved 31kg of soybeans per pig and reduced feed costs by US $2 per pig. Muyuan’s approach, if applied to the 650 million pigs raised annually, could save 20 million tonnes of soybeans. Additionally, Muyuan has incorporated alternative grains like barley, sorghum, cassava, and grain by-products into feeds, further cutting down soybean meal use. By 2023, these practices reduced Muyuan's soybean meal usage in feed to 5.7%, well below the industry average of 13%. |

Investment opportunities arising from soybean meal reduction

China’s shifting soybean meal trade patterns are having a clear impact on global markets and prices. Research from Chinese Rural Economy shows that China’s soybean imports exhibit a "large country effect," where policy interventions significantly influence international prices by affecting import volumes. Since 2008, a 1% increase in China’s soybean imports has led to a 0.1% rise in global prices, with stronger interventions having a greater impact.

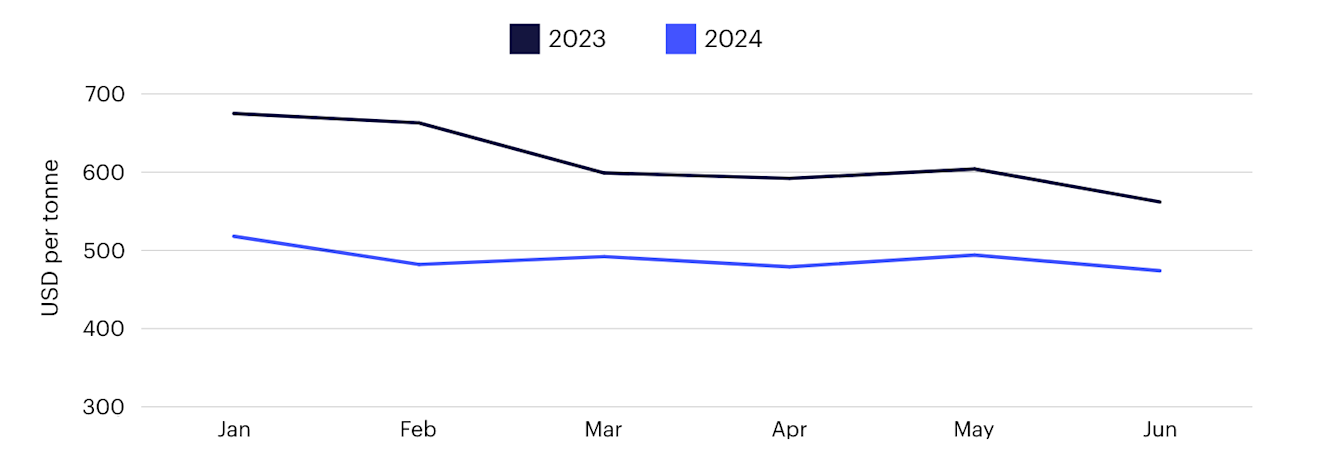

Conversely, when China reduces imports, global prices tend to fall. Data from China Customs in 2023 and 2024 shows that soybean meal imports dropped by 23.6%, leading to lower domestic prices. As shown in Figure 2, monthly prices in 2024 are consistently lower – by 20% on average - than in 2023. This domestic price decline is also putting downward pressure on global soybean meal prices, amplifying the broader market impact.

Figure 2: China soybean meal monthly price in the first half of 2023 and 2024

Source: General Administration of Customs of the People's Republic of China

In such a landscape, industries related to soybean meal alternatives and innovative protein technologies present promising new opportunities for investors, with the market for alternative protein sources, such as rapeseed meal, cottonseed meal, and microbial proteins, expected to expand.

For example, the cottonseed meal market is projected to reach US $150 billion by 2031, with a compound annual growth rate (CAGR) of 4.5% from 2024 to 2031, while the global feed yeast market is expected to reach almost US $2 billion by 2029, at a 4.8% CAGR.

Indeed, some companies are already positioning themselves for heightened demand. Angel Yeast, a biotech leader, uses solid-state fermentation to reduce soybean meal usage in feeds. According to its website, its low-temperature techniques boost microbial efficacy, reducing feed costs, while integrated yeast hydrolysates help lower protein levels in feed formulations while maintaining animal growth rates.

New soy policy fuels commitment to sustainability

Deforestation from soy cultivation remains a focal point in discussions around sustainability risks, as China has been a major importer of Brazilian soybeans. In 2020 alone, the country’s reliance on imports led to the clearing of 229,000 hectares of Brazilian forest.

Policies that reduce soybean meal demand and thus curb imports can have a significant positive impact. In May this year, COFCO International and China Mengniu imported the first 18,000-tonne batch of deforestation-free soybeans, verified by the Visec tracking system. This marked a major advance in sustainable agricultural practices and reaffirmed China’s commitment to sustainability principles.

Catalysing industry shifts

China's proactive measures to reduce soybean meal usage are catalysing a shift in global agricultural trends, unveiling attractive potential opportunities in alternative protein markets for investors while boosting the country’s food security and reducing its environmental impacts.

Investors are encouraged to explore these opportunities while aligning their portfolios with initiatives that foster responsible financial growth and support global environmental objectives. Doing so could put them at the forefront of a sustainable agricultural transformation.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.