With a growing interest in biodiversity and nature risks globally, pesticide usage has come under recent scrutiny. Studies have shown that several types of pesticides, such as neonicotinoids, are associated with the loss of pollinators, particularly bees. This is important because agricultural production worth an annual US$235–577 billion worldwide is dependent on insects for pollination, meaning that not addressing these risks poses material risks for investors. In fact, some experts estimate that around one in three mouthfuls of the food we eat depends on bees.

Around 90% of wild plants and 75% of crops depend on pollinators to some extent, making pollination a key ecosystem service that underpins the global food system. Loss of pollinators has also been named as a key risk that food companies should report against in the new Taskforce on Nature-related Finance Disclosures (TNFD) framework.

Biodiversity and Health Risks Associated With Pesticide Use

Animal feed supply chains are the major users of pesticides. It has been estimated that around half of the highly hazardous pesticides sold in 2018 were sprayed on just two crops: soya beans and maize, and around 75% of the world’s soya beans and maize production ends up as animal feed for the meat industry.

For glyphosate, one of the most common pesticides, residues allowed in animal feed are more than 100 times that allowed on human crops. This may mean that animal feed supply chains are having a disproportionate impact on biodiversity and the environment, such as loss of pollinators.

There also remains an ongoing issue of pesticide residues in the global food chain that raises serious concerns about the health risks associated. Given the interconnected nature of food systems, local bans can have limited impact on reducing potential health risk and highlights the need for globalised action on highly hazardous pesticides.

New Data: How Are Companies Performing on Pesticides?

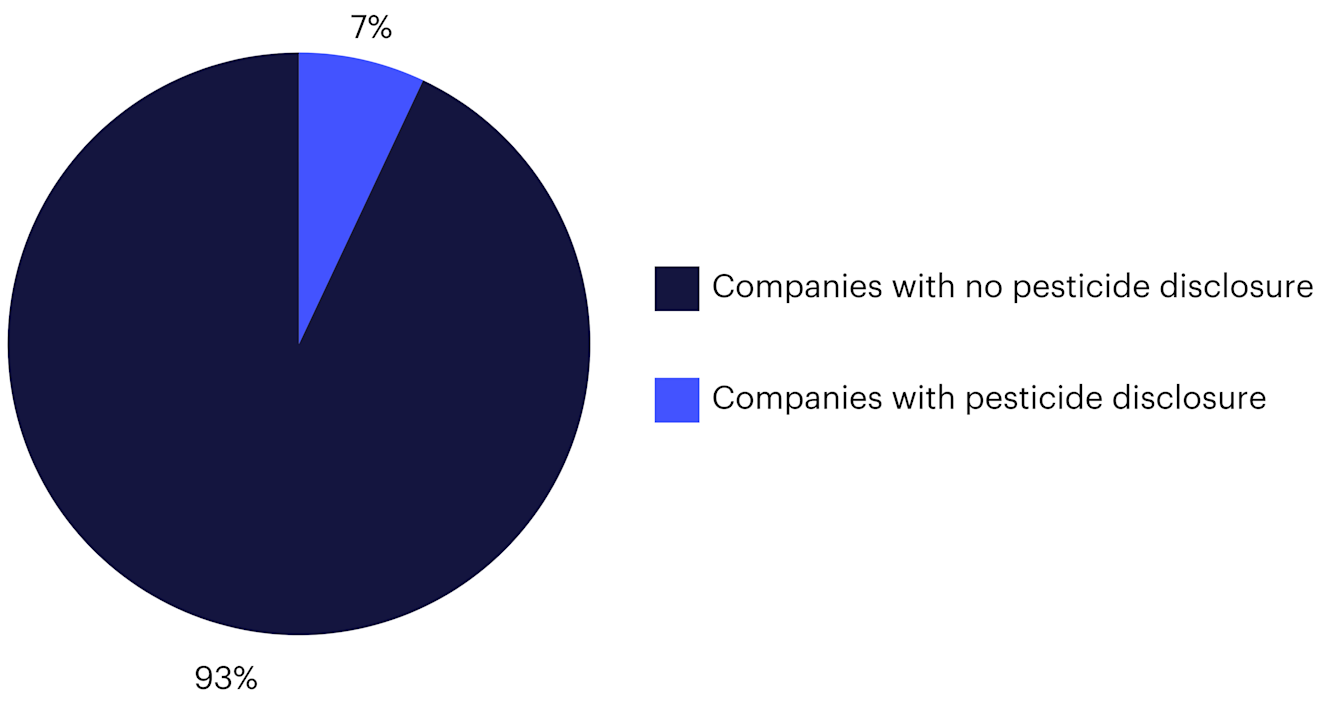

The 2023 edition of the Coller FAIRR Protein Producer Index evaluated for the first time the extent to which companies disclose information on pesticide utilisation within their supply chains. The latest figures from FAIRR suggest that, out of the 60 companies analysed, a staggering 93% fail to report any data on pesticides, while a mere 7% do offer insights into pesticide usage in their supply chain (see Figure 1).

Figure 1: Companies which disclose information on pesticides usage

For investors, this information is valuable as it aids in understanding a company's risk profile on environmental sustainability and on potential regulatory headwinds. Without this disclosure, it becomes challenging to make informed decisions or to adequately assess the impact of a company's operations on biodiversity.

FAIRR recently collaborated with ShareAction in developing an investor guide to agrochemicals which summarises the key risks and opportunities the sector faces in a transition to sustainable agriculture systems that are less harmful to biodiversity.

Examining the Disclosure of Companies

While the majority of companies within the Index do not disclose information on pesticide usage, those that do provide information to stakeholders offer a window into their operations. One such example is Mowi, a salmon producer based in Norway, which discloses its approach to pesticide use, handling and storage protocols, and pesticide rotation to ensure minimal pest resistance and adherence to regulations. Thai Union Group, a Thai-based seafood producer, also implements a set of guidelines aimed at minimising agrochemicals, setting expectations for their suppliers to abstain from using hazardous pesticides thus mitigating supply chain risks.

Vital Farms, a US-based organic eggs producer, indicates that its egg farmers refrain from pesticide use on pasture. Despite being certified organic egg farmers, the lack of information about their feed supplies may be seen as a potential oversight or risk. Similarly, Vinamilk, Vietnam’s first EU certified organic dairy farm, lacks a broader narrative on their pesticide practices across all operations.

These divergent practices indicate varying degrees of regulatory and reputational risk exposure. Companies with better disclosure practices position themselves more favourably in managing these risks. Meanwhile, companies with limited disclosure heighten uncertainties and risk perceptions.

Policy and Regulation

Effective policy and regulation are essential for managing pesticide use in food systems and promoting broader actions to reduce pesticides dependence.

In October 2023 the EU Parliament voted to ensure sustainable pesticides use and reduce the use and risk of all chemical pesticides by at least 50% by 2030. This ambitious goal reflects a growing recognition of the need for more stringent pesticide management to protect both human health and the environment. However, in a contentious move, the European Commission extended glyphosate's approval across the EU for another decade after member states failed to reach a consensus. The renewal has sparked criticism from environmental NGOs, highlighting a disconnect between scientific evidence of health risks and regulatory actions.

In the US, the proposed Agricultural Labelling Uniformity Act is provoking debate. This act, endorsed by multi-national pharmaceutical company Bayer and other agricultural sector groups, seeks to provide protections for pesticide companies and their products, preventing local governments from implementing restrictions on pesticide use. Over 150 lawmakers argue that this proposal would undermine public safety and corporate accountability, particularly in light of recent damages awarded to individuals harmed by pesticide exposure.

Costly Risks but Growing Opportunities

Managing these risks has significant implications. The loss of pollinators is already adversely impacting agricultural production, with high-value crops like blueberries and almonds in the US reliant on imported bees for pollination. Experts warn that the loss of pollinators could threaten food security, both globally and nationally. Currently, most companies are not effectively addressing the nature-related risks associated with pesticide management. As global interest in this issue grows, it will become increasingly important for investors to access data on pesticide management across supply chains and to advocate for an overall reduction in highly hazardous pesticide use among protein producers, including by raising the issue directly with portfolio companies. Emphasising transparency and sustainable practices is crucial for ensuring a resilient and sustainable food system and bolstering investor confidence. This transparency will not only align with sustainability goals but also build trust in how this nature-related risks are managed.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.