The slogan of this year’s Climate Week NYC was ‘Getting It Done’ and recent extreme climate related weather events have signalled to us how crucial it is to take action. The devastating flooding that has hit Pakistan this month is estimated to have resulted in $30 billion in damages to homes, transport, crops and livestock. Flooded farmland has led to low feedstocks for cattle, and officials have estimated that 800,000 cattle have been lost in the floods.

The food sector’s vulnerability to climate risks will worsen as global temperatures rise highlighting the importance of food as one of the key themes of NYC Climate Week. From an investor perspective, it is critical to understand how these risks will impact companies’ bottom lines and how they propose to manage these risks.

Within the food sector, compared to food retailers and manufacturers, the proportion of animal protein companies that have conducted climate-related scenario analysis to assess the impact of climate risks and inform strategy remains worryingly low. The FAIRR Initiative found that less than a fifth of animal protein companies have conducted a scenario analysis. The Coller FAIRR Climate Risk Tool (CRT), a scenario analysis tool, illustrates how livestock-producing companies’ profitability can be eroded if they do not effectively manage their climate-related risks, with several companies expected to see earnings fall by over 50% if they respond to climate risks regressively.

How will climate change impact animal protein companies?

Feed price volatility will drive up feed, especially for pork and poultry companies. Feed makes up a significant part of protein producer costs — 47-76% depending on the protein. Since 2018, several companies including Tyson, have reported facing climate-related financial impacts on feed costs. Compared to 2020, Tyson Foods reports that its operating income decreased by $410 million in the first nine months of the 2021 fiscal year due to increased feed costs, declines in hatch rates and severe weather disruptions. Indeed, the CRT finds that by 2050 increased feed costs will amount to 15% and 13% of 2020 EBITDA for pork and poultry companies.

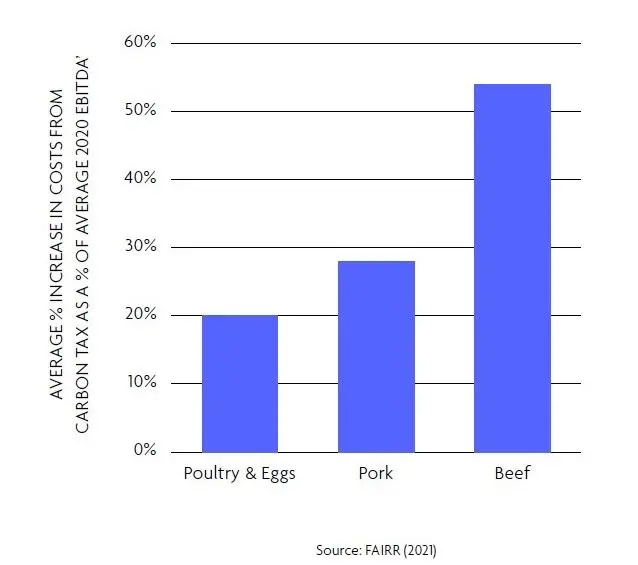

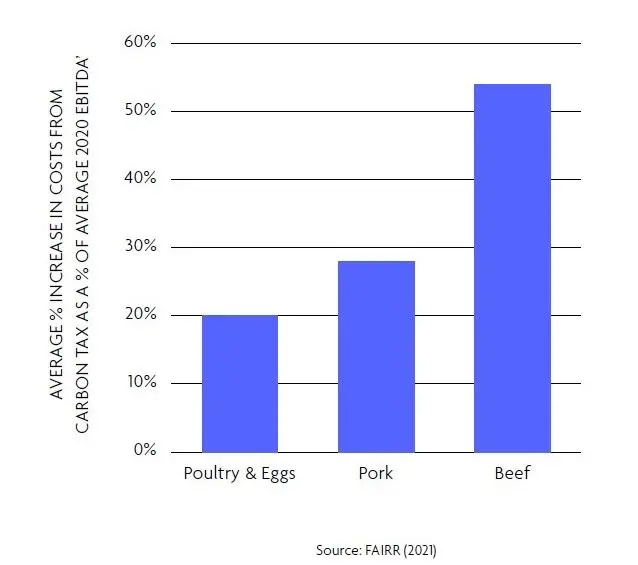

Beef companies will face the highest increases from carbon taxes, with average cost increases exceeding 50% of current earnings. A carbon tax on agriculture will be an important regulatory measure to support countries’ emissions reduction targets and will be especially likely in countries that are economically dependent on animal agriculture. For example, New Zealand is introducing a carbon price on agricultural emissions by 2025 — currently, half of the country’s total emissions come from agriculture and a quarter from the dairy sector alone. The CRT finds that a carbon tax will have the biggest impact on beef producers and could increase costs by up to 55% of current EBITDA for beef companies versus just 20% for poultry companies (see figure below).

Despite rising associated costs, there is poor disclosure of mitigation strategies to combat increased animal heat stress and mortality. Higher temperatures will reduce productivity, animal welfare and fertility, and increase disease susceptibility and mortality. This will also lead to higher veterinary costs. Cattle are particularly dependent on outdoor grazing (compared to intensive pork or poultry production), exposing them to the risk of heat stress. Heat stress costs the US dairy industry around $897 to $1500 million per year in revenue, and the US beef industry $369 million per year. The CRT found that increased cattle mortality could reduce earnings of some of the largest beef producers by up to 29% by 2050. Still, this is a risk that few livestock companies consider in their scenario analysis.

Poultry producers could suffer increased energy costs of over 30%. Combined with the uncertainty of future energy prices that are highly sensitive to supply and demand, increasing carbon regulation will continue to drive up energy costs across sectors. In a net-zero scenario, the IEA predicts that between 2025-2050 carbon prices for electricity will increase by 333%, from US$75 to US$250 per tonne of CO2 in advanced economies, and by 444%, from US$45 to US$200 in select developing economies — including Brazil, China and South Africa . Protein producers rely on natural gas, diesel and electricity to produce and distribute products. Poultry production is particularly dependent on electricity for ventilation and temperature regulation, with energy costs representing around 4%-8% of total production costs. For instance, Astral Foods and RCL Foods are poultry producers based in South Africa. South Africa is heavily dependent on coal, which makes up 70% of the energy supply. With the increase in coal prices— South Africa’s coal index rose by more than 55% in 2021. The CRT can be used to see how the protein mix of the two companies impacts their energy costs. Astral Foods faces higher energy cost increases than RCL Foods — Astral Foods’ product portfolio is exposed to more than 80% poultry. In comparison, RCL Foods only has 30% poultry exposure and has greater exposure to non-protein products (see figure below).

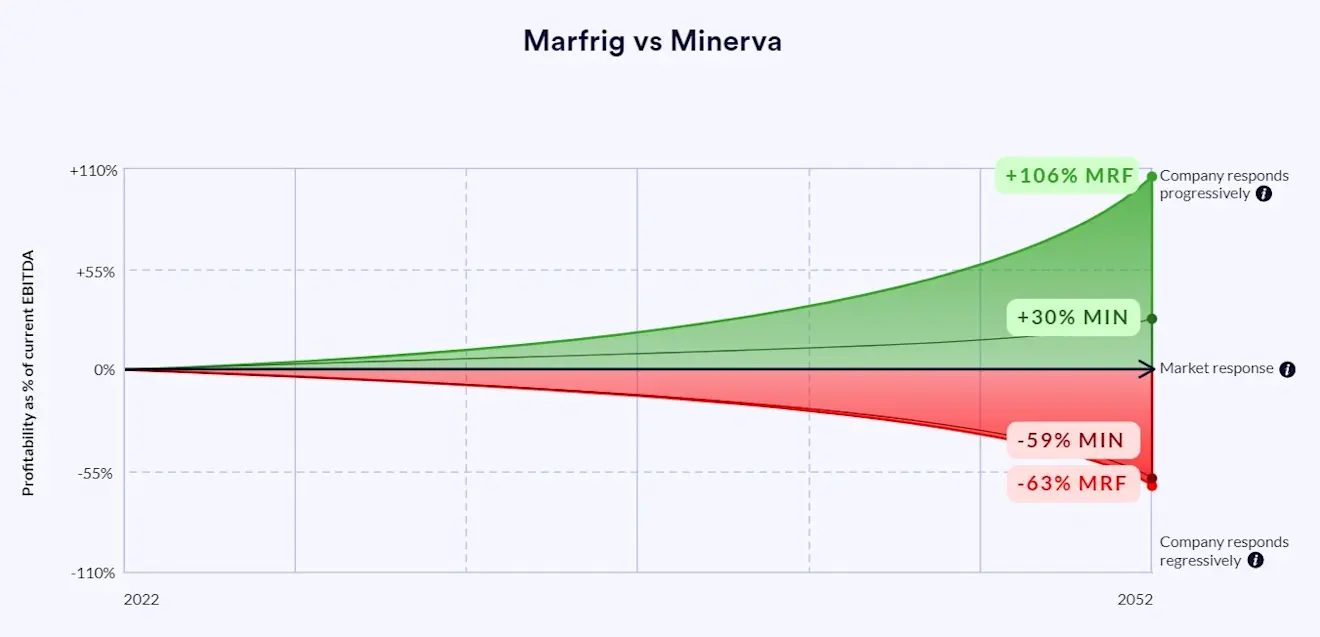

Companies with higher alternative protein exposure can mitigate more of their climate-related costs. Consumer demand for alternative proteins is growing, largely due to environmental concerns related to conventional meat production. In the US retail sales of plant-based foods grew by 6.2% bringing the market value to a record high of $7.4 billion. And the latest IPCC mitigation report highlights that demand-side measures including increasing the uptake of plant-based proteins could mitigate up to 3.6 GtCO2eq per year. When comparing the two Brazilian beef producers, Marfrig and Minerva, the CRT finds that Marfrig is likely to be more profitable in 2050. Marfrig has relatively high alternatively protein exposure, so it will be able to capture more of the alternative protein market growth than Minerva, which has no alternative protein exposure.

Explore more of the findings from the Climate Risk Tool here.

Last week, the FAIRR Initiative’s team was in New York participating in several Climate Action Week events covering topics ranging from the role of investors in building climate resilient food systems to innovations in marine biodiversity. Our team spoke at events including the WBSCD North America Reception as part of the Good Food Finance Network, Taking a Bite Out of Emissions, and We Don’t Have Time’s Road to COP27 Broadcast.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.