Over the past decade, the alternative protein sector has evolved from a niche market towards a mainstream contender, with companies and investors capitalising on the financial opportunity posed by a dietary shift. Despite this progress, alternative proteins and the companies producing them still have a tough journey ahead to disrupt the market and convince consumers to adopt these novel technologies and products.

Reflecting on the evolution of the alternative protein niche

A decade ago, public awareness of the link between animal agriculture and climate change was on the rise. People concerned about both climate and health were beginning to alter their consumption habits, aiming to incorporate more plant-based foods into their diets, with the flexitarian diet gaining momentum. Global dietary guidelines were also starting to recognise the need to reduce red and processed meat consumption for both environmental and health reasons. For instance, the UK’s Eatwell Guide advocated an increase in plant-based consumption and an overall reduction in animal protein intake.

This growing demand for more sustainable and nutritious protein resulted in increased sales; between 2011 and 2015, sales of meat alternatives in the United States grew by 58%, reaching $109 million. In Germany, 23% of young people were reported to regularly consume alternative proteins. Recognising this trend, companies throughout the food supply chain, from producers to retailers, began to invest in these opportunities. In 2017, Danone acquired The WhiteWave Foods Company for $12.5 billion, and in the same year, Cargill invested in Memphis Meat, a cultivated meat start-up. Similarly, venture investors recognised the value reaction potential of this dietary shift, with 29 deals totalling $116 million in 2016.

This influx of investment, combined with advancements in R&D - such as Impossible Foods' 40% reduction in input costs in 2017 - resulted in optimistic industry projections. The global sector was expected to maintain a compound annual growth rate (CAGR) of 8% from 2017 to 2021, with a market forecast of $5.2 billion by 2020. For both investors and companies, the outlook for alternative proteins appeared promising.

Taking stock of the alternative protein landscape

Fast forwarding to 2023, has the alternative proteins sector met expectations? The alternative milk sector has succeeded in attracting mainstream consumers. In the US, sales of plant-based milk experienced strong growth, increasing by 19% between 2019 and 2022. In contrast, sales of animal-based milk declined by 4%. This category has received a warm reception from consumers, with 76% of US households repeatedly purchasing plant-based milk in 2022. Similarly, in Europe, sales have soared to over $2.1 billion in 2022, with plant-based milk securing an 11% market share of the total milk category.

Unfortunately, the meat alternatives market has not enjoyed the same scale of success. Initial consumer interest in meat alternatives, largely driven by curiosity, has not translated into sustained repeat purchases. In the US, retail sales for meat alternatives dipped by 0.4% in 2022, primarily due to a 14% reduction in refrigerated meat alternative sales. The UK has also seen lacklustre sales. After five years of growth, the market declined by 6% in 2022, dropping to $684 million. These declines have affected key players in the market, with Beyond Meat experiencing a 6% sales decrease in the UK last year, and Nestlé withdrawing its plant-based brands, Wunda and Garden Gourmet, after deeming them 'non-viable' in the UK retail market.

So why are consumers scaling back on meat alternatives?

Poor sensory experience: Consumers are failing to make repeat purchases because most meat alternatives simply do not taste as good as their traditional counterparts. The struggle to replicate the flavour and juiciness of meat is a key barrier to mass adoption.

Price premium: Meat alternatives are expensive relative to animal proteins, and consumers don’t want to pay a price premium. These higher retail prices are linked to increased costs associated with post-processing, production scale, and supply chains. We have seen some companies making efforts to reduce costs, such as Co-op committing to price match its own-brand plant-based range with meat equivalents in 2021, and Beyond Meat committing to having at least one product in a category priced at parity or below animal proteins by 2024. However, since the cost of living crisis began, there is increased strain on consumers' wallets, and the price premium is increasingly becoming a barrier to adoption.

Perceived health concerns: Consumers want healthier, more nutritious foods. While plant-based whole foods like legumes and pulses are inherently more nutritious, the health benefits of alternative proteins has come under scrutiny. There is increasing media criticism of these products, often describing them as ultra-processed. While there is definitely room for improvement, studies have found they are actually better for consumers' health.

The alternative proteins revolution continues

While some consumers have grown frustrated with alternative protein products, due to taste, price, and health concerns, the alternative proteins revolution is far from over. Ultimately, the dietary shift must continue for planetary and human health reasons.

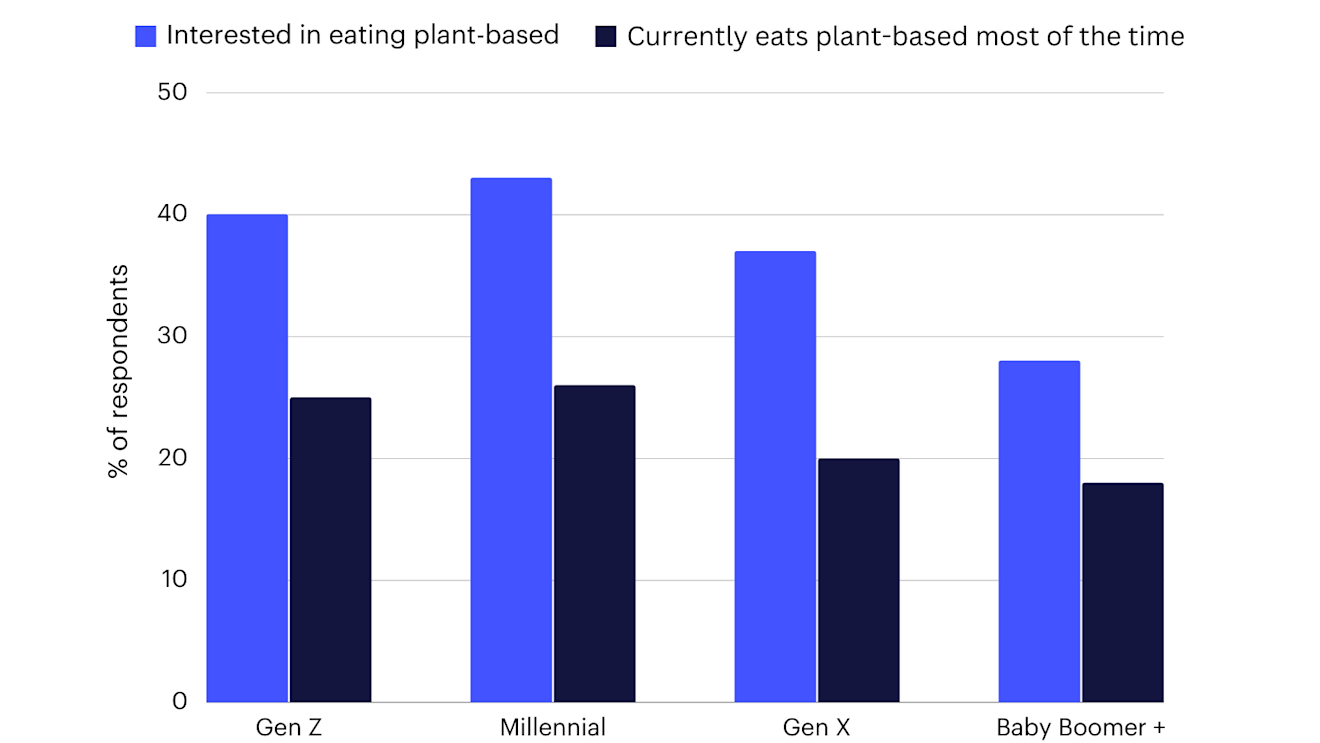

Consumers recognise this, and there is a growing awareness of the importance of adopting a more plant-rich diet. However, while 40% of Gen Z individuals are interested in adopting a plant-rich diet, only 25% of them are actually consuming more plant-based foods. This aspiration and action gap highlights that there continues to be a market opportunity for companies producing alternative proteins, with consumers wanting to increase their consumption of healthy and sustainable proteins.

Data: EAT (2022) Grains of Truth

It is perhaps not surprising that alternative proteins have not yet fully penetrated the mainstream market when you consider that the plant-based market is still in its relative infancy. Since 2010 in Europe, the plant-based market has grown on average 10% year on year through to 2020; periods of ebb and flow are to be expected as the industry continues to innovate, and the market stabilises.

Achieving cost parity will be crucial, and industry experts anticipate that price parity will likely be reached by the mid-2020s. Simultaneously, the development of novel technologies will improve the quality of alternative proteins; precision fermentation and cultivated technologies hold promise, and it is likely that ‘hybrid’ products produced using a combination of technologies will become more popular as they enable taste, texture, and nutrition to improve.

Additionally, government action is essential to foster a favourable environment for investment. Governments can allocate their own resources for the development of these technologies as well as develop an enabling environment through legislation, such as the US recently became the second country to approve the sale of cultivated chicken, granting permission to both Upside Foods and Good Meat. This sends a positive signal to companies and investors, encouraging further investment in this sector. Furthermore, the livestock industry currently receives 1200 times the funding that the alternative proteins sector receives. Levelling the playing field by increasing government investment, will allow for more innovation in the industry and enable price parity to be reached sooner.

In the meantime, there is a noticeable increase in ‘vegetable forward’ products—items that do not aim to mimic meat but instead prioritise the inclusion of nutritious wholefood proteins. In contrast to alternative proteins, consumers view these products as healthier and with cleaner labelling. This approach is currently being tested and has witnessed significant benefits for both health and the climate. For example, New York's public hospitals have achieved a 36% reduction in emissions by introducing plant-based meals as the default option. This presents an opportunity for the food industry to innovate and create something new. These products can act as a bridge, meeting consumer demands for healthy and affordable protein sources while novel technologies continue to evolve.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.