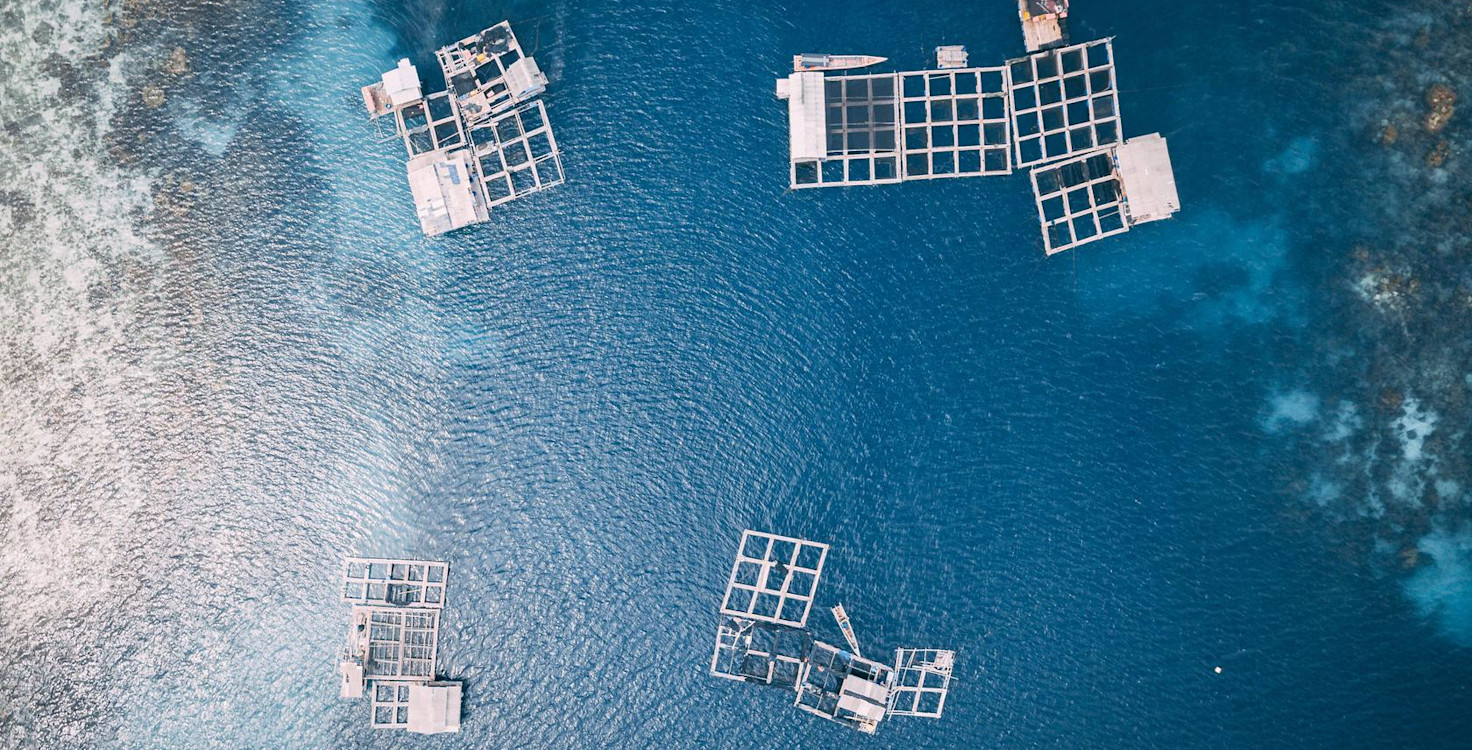

Take a quick glance at the global aquaculture industry and everything seems to be smooth sailing. The sector is in the midst of a period of tremendous growth with the industry expanding at a rate of 6% annually and it has been the fastest growing food production sector over the last 20 years. It is now valued at $232 billion globally with production expected to exceed the 100 million tonne mark by 2025. Yet a closer look through an ESG lens shows that choppy waters are ahead if the industry fails to address serious sustainability issues.

Climate impacts and effects

While much attention has been drawn to the huge environmental impact of cattle and pork, the aquaculture industry is quickly emerging as the forgotten climate culprit. It will come as a surprise to many, but shrimp production can be as emission-intensive as beef production. A study completed earlier this year found that freshwateraquaculture in the top 21 producing nations is responsible for 1.82% of global methane emissions.

Aquaculture is not only a major contributor to climate change, it’s also heavily exposed to it. Rising sea temperatures and ocean acidification could lead to a 10–30% drop in farmed marine fish production in Southeast Asia by 2050. The increasing frequency of extreme weather sparked by climate change could also contribute to farm stock losses. Adverse weather can increase the risk of net failure, leading to mass escapes. Researchers in six European countries found that from 2007–2009 nearly nine million fish escaped from farms. This resulted in a direct product loss of €47.5 million.

The drugs don’t work

Meanwhile, aquaculture’s breakneck pace of growth been accompanied by rampant antibiotic use in some regions. In order to maintain production, some aquaculture companies rely on excessive use of antibiotics, which in turn leaves the sector highly exposed to global efforts to fight antibiotic resistance.

This worrying trend is most pronounced in Chile, where salmon production is estimated to use antibiotic doses up to ten times higher than typically used in chicken production.

As FAIRR’s recently published report on antibiotics showed, we are already on the verge of a public healthcare crisis. In Europe, an estimated 33,000 people die every year due to antibiotic resistant infections while in India approximately 60,000 infants are dying annually.

Aquaculture’s growing contribution to antimicrobial resistance will need to be addressed if we are turn the tide in this battle.

The export factor

Of particular concern for investors is the value at risk unless the fish farming sector can meet its sustainability challenges. For example, as the crisis surrounding antimicrobial resistance worsens, investors should consider the disruption emerging legislation could bring to seafood exports.

For example, the new Seafood Import Monitoring Program recently came into force in the US, requiring importers to provide traceability information back to the farm level. This could be a challenge for the Asian aquaculture industry, which suffers from a lack of transparency. Medicine usage is also a barrier for Asian suppliers. For example, the US imports about 35% of its shrimp from India. In January 2019, the Food and Drug Administration blocked the entrance of 26 shipments of Indian shrimp (15% of the total for the month) due to detection of banned antibiotics. Unless Asian producers take urgent efforts to curb their antibiotics use, rejections from the US market could bring major financial losses to seafood producers.

From emerging environmental and health legislation to export risks, a plethora of ESG issues could sink the fast-growing aquaculture industry. The warning signs are there and companies and investors should pay heed to these ESG risks or risk seeing their profits wash away.

Read FAIRR’s latest report: Shallow Returns? ESG risks and opportunities in aquaculture

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.