Over the past year, food price inflation has been driven by a dangerous combination of war, climate change, the hangover of COVID related supply chain disruptions and labour dynamics. As a result, food costs across the G7 increased by 12.7% on average.

Consumers and companies across the food value chain have struggled to absorb the brunt of this burden that has led to price increases, eroded margins and falling revenues. Results from the latest IPCC report have highlighted that the expected severity of future climate risks has worsened, implying the food sector will continue to experience climate driven food price rises.

As the food sector is sensitive to commodity price volatility and several supply chain players are already operating on tight margins, climate driven price increases could lead to sector wide underperformance.

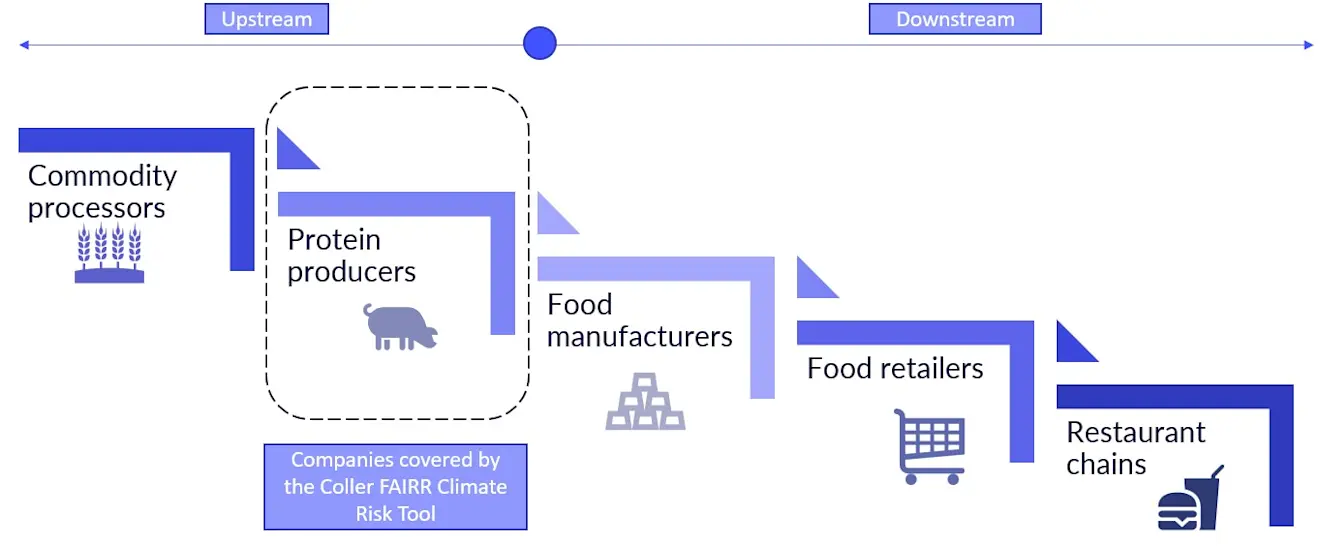

Given their dependency and impacts on nature, companies across the livestock-producing value chain will be particularly vulnerable to climate-related risks. To assess the financial impact of these risks, the new Coller FAIRR Climate Risk Tool takes a top-down approach to climate scenario analysis on 40 of the world’s largest listed livestock companies, based on a robust science-based model. The results are provided for three scenarios, “High Climate Impact”, “Business as Usual” and “Net Zero Aligned” in the medium- and long-term.

The Tool has highlighted how producers will see costs being driven up, particularly from carbon and feed prices. However, costs will likely have implications across the value chain. As a result, companies will have to narrow their margins or hike prices. This creates a risk of sales declining should price-sensitive consumers seek out cheaper options, as they have been amidst the current cost of living crisis.

Upstream impacts: Crop price increases mean commodity processors risk losing livestock-producing customers

Commodity processing giants, including ADM, Bunge, Cargill and LDC (aka the ABCDs), hold critical supply contracts with several companies analysed by the Climate Risk Tool, particularly producers highly dependent on feed crops (i.e. pork and poultry companies). Some of the largest North American pork and poultry producers report that feed makes up over 60% of production costs.

Indeed, last year we saw crop prices soar due to supply shortfalls linked to Ukraine’s invasion of Russia, on top of reduced harvests linked to poor weather the year before. And so protein producers saw sharp rises in their operating costs: Tyson, for example, saw $595 million of higher feed ingredient costs in 2022. And this sustained high customer demand, which outpaced supply, meant the ABCDs still experienced strong results.

However, as climate change leads to sustained high crop prices for already volatile commodities, several livestock producers could see costs escalate severely, forcing them to operate at a loss. So, commodity processing giants risk losing customers that cease to become profitable and will have to find room to manoeuvre in their already very slim margins to avoid passing all cost increases downstream.

Upstream impacts: Livestock companies could face revenue hits as retail giants express reluctance to pass increased costs onto consumers

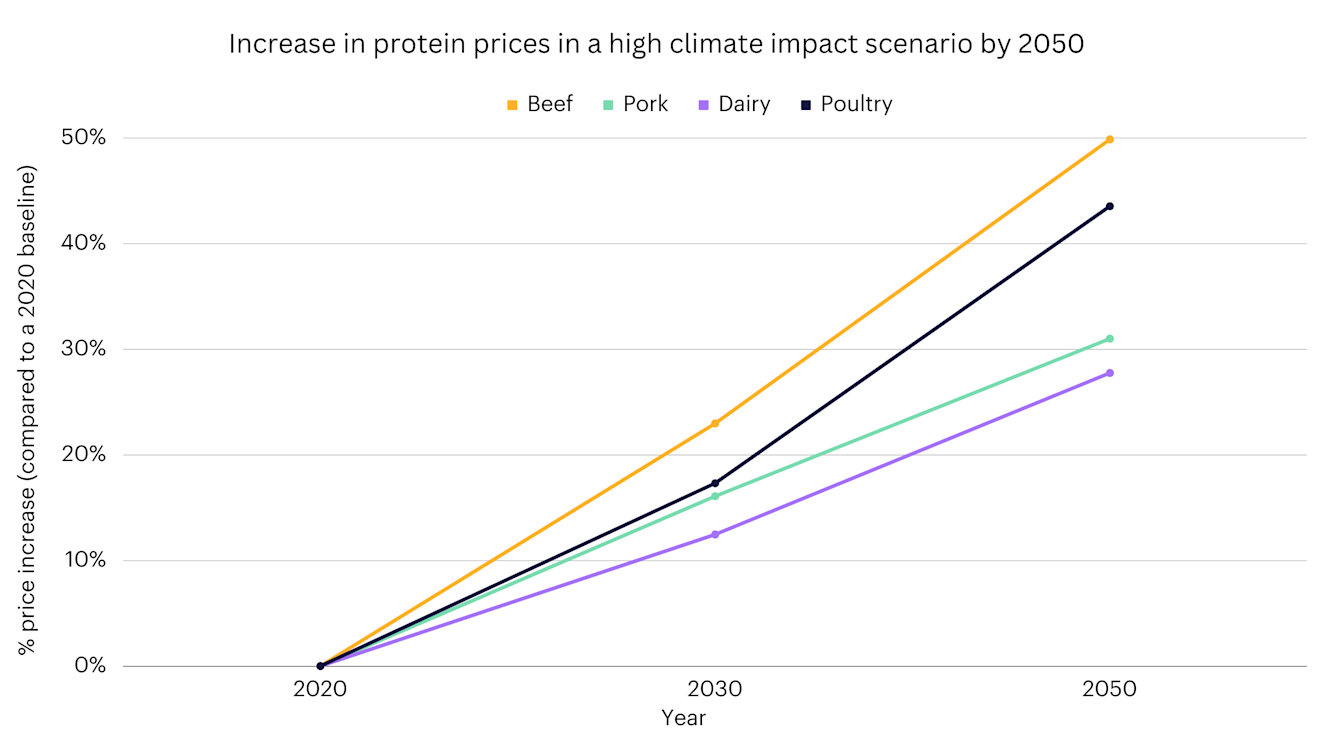

In one of the three scenarios presented in the model, the high climate impacts scenario, meat and dairy prices are shown to drive up significantly (see chart below), particularly for beef, mainly due to climate-related cost impacts.

Beef is expected to be the most vulnerable to increasing carbon prices as it is the most carbon-intensive protein. However, despite already operating on relatively slim margins, producers may struggle to pass on these costs to customers, as recent cost increases have resulted in a shift to other proteins in some markets.

As illustrated by the recent tomato shortages in Britain, due to inflated energy prices, hypercompetitive retail giants were unwilling to hike up tomato prices and pass increased costs on to customers but instead chose to ration the quantity sold. As climate-related costs drive up meat prices in particular, livestock companies may face similar reluctance from their mass-market retail customers to pass costs on to consumers, given their high competition. Instead, retailers may choose to sell lower quantities of the more expensive meats, hurting the revenues of some livestock producers.

Downstream impacts: Restaurant brands’ business models that rely on cheap meat risk narrowing margins

Despite operating on much wider margins than retailers, commodity price increases will impact the profits of quick-service restaurants, including the likes of McDonald’s and KFC.

While retailers have diversified portfolios, quick-service restaurants depend highly on key commodities like beef, chicken and potatoes. McDonald’s is one of the world’s biggest buyers of beef, and Bloomberg estimates indicate that Tyson and JBS, two companies covered by the Climate Risk Tool, account for nearly 20% of McDonald’s ingredient and paper related costs1. The Tool finds that both Tyson and JBS’ costs could increase by around 15% in 2030 in a “Business-as-usual” scenario. The risk of climate impacts on its raw material costs is acknowledged by McDonald’s in its Climate CDP response.

Big restaurant brands, including KFC and Nando’s, have faced increased chicken prices recently due to a combination of increased energy and feed costs. They have responded by absorbing some of the costs, eroding margins, but have also had to push prices downstream to customers.

McDonald’s has also had to increase its prices amidst the cost of living crisis. But as beef is particularly vulnerable to climate costs, restaurant brands dependent on beef have yet to face the worst of increased beef prices. Businesses dependant on cheap beef will see margins narrow further or have to shift menus to cheaper proteins, as McDonald’s and Burger King have done in the past.

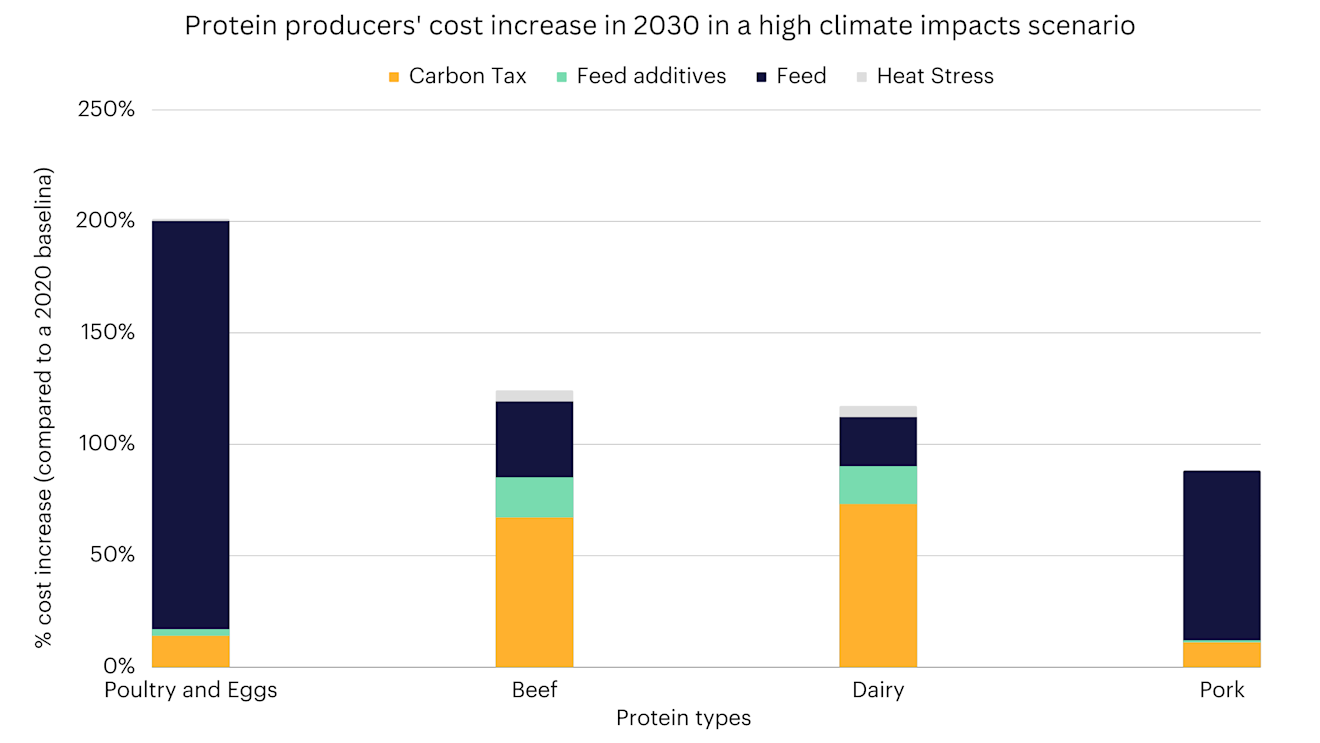

Downstream impacts: Manufacturers are particularly vulnerable to carbon prices on dairy

Food manufacturers, including Nestlé, Unilever and Mondelez, are key purchasers of dairy products – with Nestlé revealing dairy to be its biggest purchased commodity.

The Climate Risk Tool finds that the dairy sector will be particularly vulnerable to carbon prices (see chart below), given the emissions intensity of dairy cattle. And in its scenario analysis, Nestlé expects it could face carbon price related costs of $3 billion by 2025, and acknowledges dairy as an area of particular concern as it is the company’s largest emissions source.

While carbon prices on agriculture have not yet been implemented, New Zealand plans to introduce one by 2025. And FAIRR analysis on one of Nestlé’s suppliers based in New Zealand, Fonterra, found that these carbon prices could amount for between 25-48% of Fonterra’s EBITDA by 2030. And as the coverage of carbon prices on agriculture widens to meet national emissions reduction targets, Nestlé could see more of its suppliers pass down their carbon price related costs.

In the wake of industry-wide food price inflation over the past year, Nestlé has seen its sales decline as consumers respond to higher prices and trade down to cheaper options, including own-brand products. And as prices, particularly dairy prices, continue to rise, customers may become less willing to pay for Nestlé’s brand premium. Although, it is promising to see Nestlé outline its strategy to mitigate its emissions, thereby reducing carbon price risks, including by improving dairy farming productivity in its supply chain and diversifying to alternative proteins. But whether it can effectively work with its suppliers to drive these mitigation efforts remains to be seen.

It is clear that consumer-facing companies are already struggling to manage the impacts of commodity price increases, and the Climate Risk Tool has highlighted that climate risks will exacerbate these price rises in livestock supply chains. Yet, FAIRR analysis has found that upstream livestock producers lag behind their customers in their climate-related risk disclosures. So to avoid the most severe commodity price rises expected by the Tool, crop and livestock commodity producers must improve their disclosure and management of climate-related risks. Importantly, investors have a pivotal role to play here, using their influence to drive better climate-related disclosure and strategy.

FAIRR members can access in depth analysis and data on protein producing companies’ exposure to and disclosure on climate-related risks from both the Coller FAIRR Protein Producer Index and the Coller FAIRR Climate Risk Tool.

Footnotes:

1Bloomberg Finance L.P.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.