Venture Investments

Private investments

Steady growth over time

In 2021, global plant-based meat sales surpassed $5 billion, and plant-based milk sales were just shy of $18 billion for the first time, meeting pre-COVID market estimates. The country with the largest alternative market is the US, where plant-based milk holds 16% of the market share while plant-based meat holds 1.4%.[1]

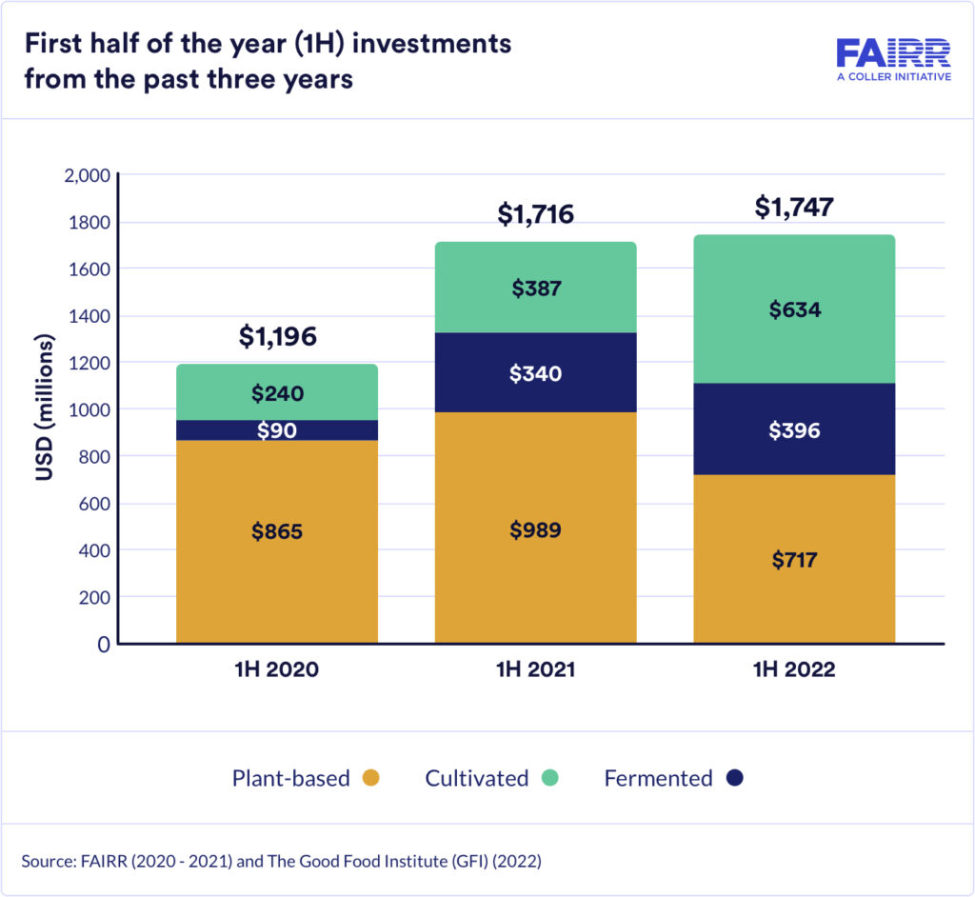

First half of 2022 analysis

Alternative protein companies raised $1.7 billion in the first half of 2022 (1H 2022), demonstrating a stable growth rate (2%) compared to 1H 2021. As the second quarter of 2022 (2Q 2022) ended, investments into the sector reached $833 million, approximately 9% below the $914 million raised in 1Q 2022. Even with the current geopolitical and market volatility context, there has not been a significant investment regression, with this slowing of investment mirroring private investment across other industries. For the first time, investment in cultivated technologies in 2Q 2022 exceeded those from plant-based, with $500 million and $237 million raised, respectively; these investments were spearheaded by $400 million into Upside Foods, a US-based cultivated meat company. Top investments in 1Q 2022 were, on average, larger than those in 2Q 2022, with five companies raising more than $100 million per deal, compared to an average of $40 million in 2Q 2022.

Top deals in 1H 2022:

In April, California-based cultivated meat company UPSIDE Foods raised $400 million in its Series C funding round. Temasek and Abu Dhabi Growth Fund led the series.

In February, US-based cultivated seafood company Wildtype raised $100 million in its Series B funding round. Investors included Cargill, Temasek, Bezos Expeditions and some celebrities.

The 3D-printed plant-based meat start-up, based in Israel, Redefine Meat, raised $135.6 million to support its expansion in Europe. Synthesis Capital led the round that concluded in January.

The Chinese plant-based meat company, Starfield Food Science & Technology, raised $100 million in January, led by Primavera Capital Group

In January, the Israeli cultivated dairy maker, Remilk raised $120 million. Hanaco Ventures led the series with investments from CPT Capital, Precision Capital, Tnuva, Hochland, Rage Capital and OurCrowd.

In March, Colorado-based MycoTechnology raised $85 million in its Series E funding round, led by the Oman Investment Authority. Funds will help the rollout across Asia, Europe and the Middle East.

Global food manufacturers are starting to explore opportunities beyond plant-based alternatives. From last year’s progress report, we found that 24% of companies in the FAIRR Sustainable Proteins engagement were reviewing cultivated and fermented alternative protein technologies. This year we are seeing large corporates executing by going directly to food tech start-ups for collaborations to incorporate novel technologies into their portfolios.

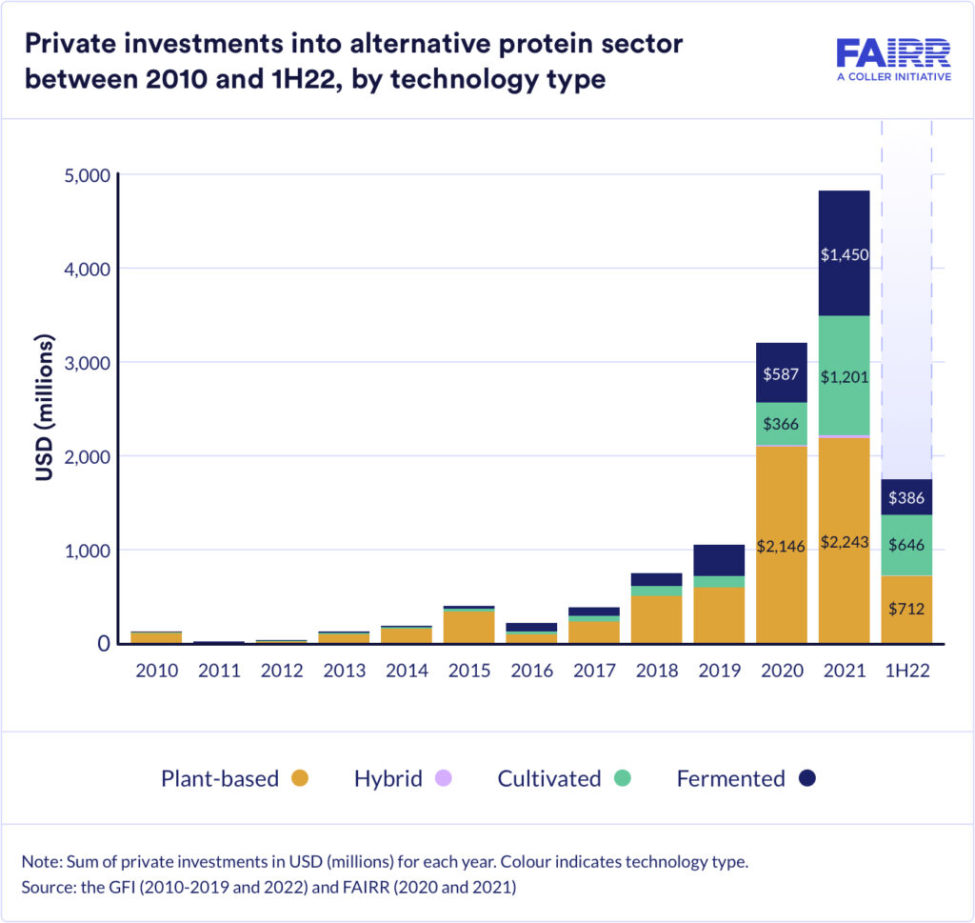

View over the last decade

Innovation in food technology continues to accelerate exponentially, with a Compound Annual Growth Rate (CAGR) of 56% over a 12-year period. In 2021, the global market for alternative proteins continued to grow, despite uncertainty caused by the pandemic coupled with a shift from restaurants to home-based meals. 2021 investment significantly overtook that of 2020, increasing 58% year-over-year and reaching almost $5 billion (Figure 3).

Plant-based alternatives are more widely recognised as the conventional substitute for animal-derived products, relative to other food technologies. 2021, however, saw cultivated and fermented technologies attract more capital, together accounting for more than half of total investments. Investments into cultivated foods rose from $366 million to $1.2 billion (+228%), while fermentation-enabled foods increased from $587 million to $1.5 billion (+147%). Plant-based was the most invested single food technology platform, reaching $2.2 billion in 2021, but recorded the smallest percentage increase (4.5%).

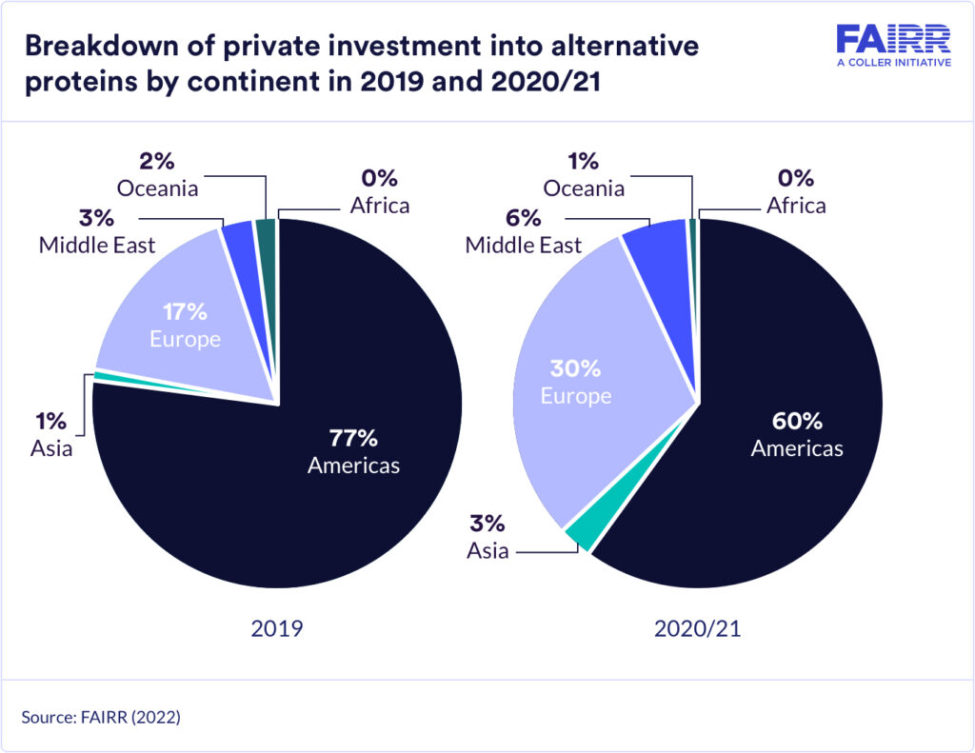

Private investments by region

The geographical allocation of investments into the alternative protein sector has shifted during the last two years. In 2019, 77% of total investments were directed to start-ups based in the Americas. In 2020 and 2021, this decreased to 60%. Investments in Europe—the second largest investment region—increased from 17% in 2019 to 30% in 2020 and 2021. The Middle East occupies the third place, at 6% in 2020 and 2021, increasing from 3% in 2019.

References

[1] The Good Food Institute (2021). Plant-Based state of the industry report.