Introduction

National governments are increasingly using carbon pricing initiatives as a mechanism to curb emissions among high emitting sectors, including in the agriculture sector. The New Zealand government is targeting a 24-47% reduction in biogenic methane by 2050, with a proposed agricultural emissions pricing scheme to be introduced by 2025 as the primary instrument to reduce emissions. This FAIRR report examines the potential impact of this proposed regulation on New Zealand’s dairy sector, which could serve as a litmus test for the wider animal protein sector and its ability to navigate climate regulation.

Impacts

Carbon pricing will drive up costs and exacerbate debt for dairy farmers

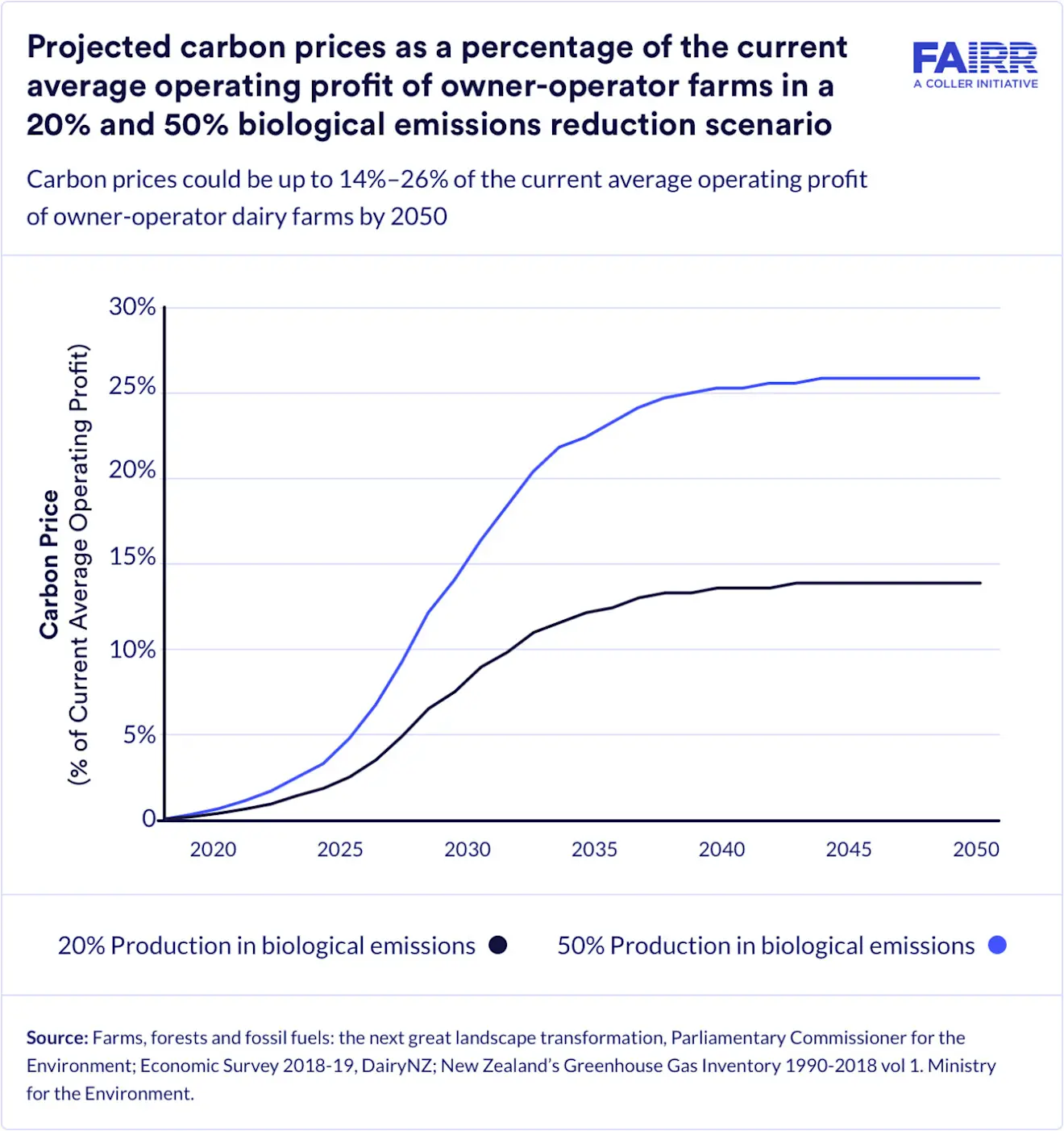

FAIRR finds that by 2050, with a reduction target of 50% (vs a 2019 baseline), the dairy sector’s carbon costs could be up to 26% of the current average operating profit of owner-operator farms and 74% for sharemilking farms, assuming current emissions intensity. Fonterra’s carbon costs could amount to 25% to 48% of Fonterra’s 2020 EBITDA in 2030, rising to 47% to 87% of 2020 EBITDA in 2050.

Figure 1: Projected carbon prices as a percentage of the current average operating profit of owner-operator farms in a 20% and 50% biological emissions reduction scenario

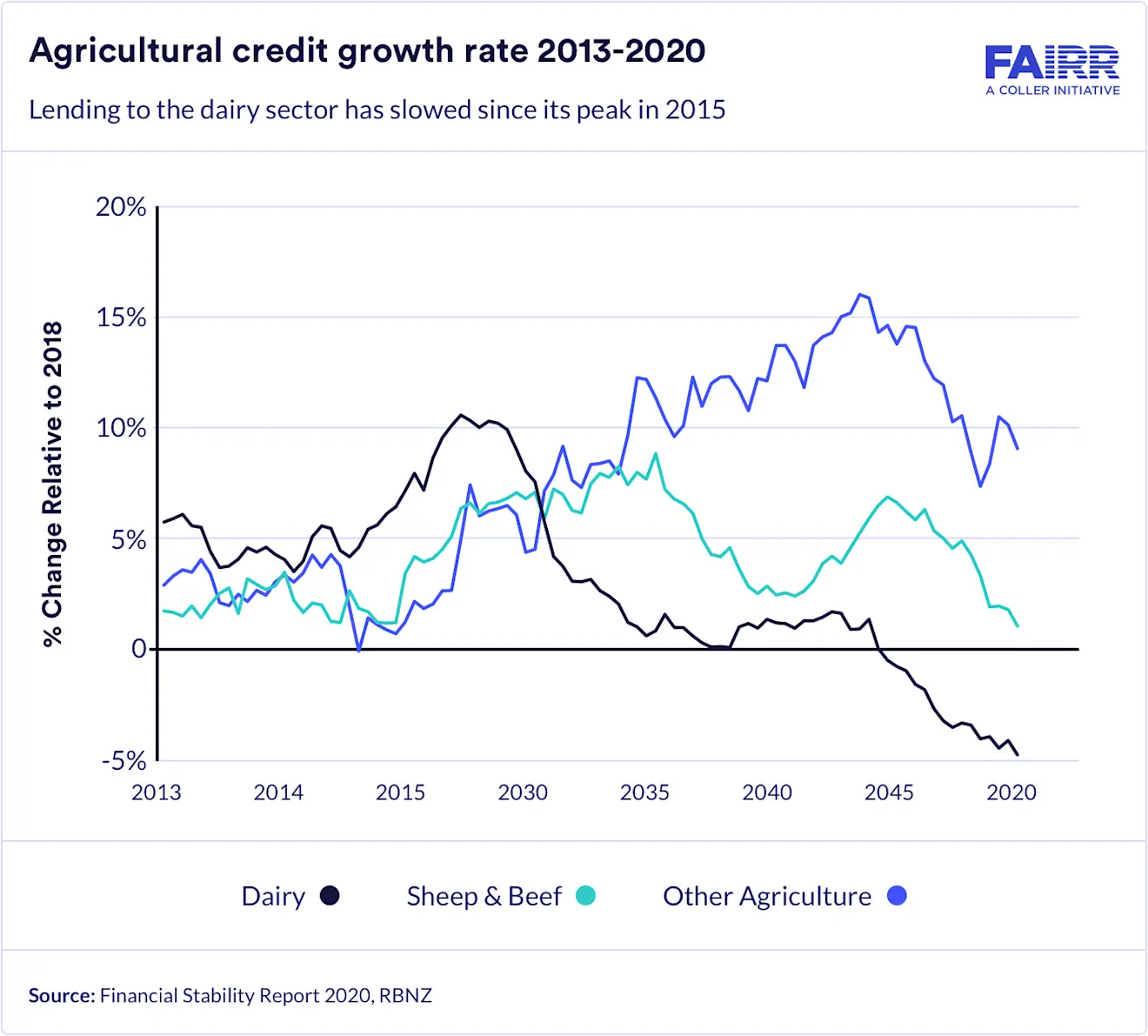

Higher farm-level costs compound an existing problem – dairy farmers in New Zealand already face a significant debt burden. The two dairy price downturns in the past decade have driven existing dairy debt. The Reserve Bank of New Zealand has warned that dairy farm debt is among the country’s highest. In the most recent financial stability report, the Bank highlights that the percentage of non-performing and potentially stressed loans in the dairy sector in the first half of 2020 averaged 11%, compared to 6% in non-dairy agriculture. Lending to the dairy sector has been falling as banks are becoming increasingly hesitant to provide new dairy lending partly due to cost compliance concerns with new environmental regulations, including the incoming emissions pricing scheme.

Figure 2: Agriculture credit growth rate 2013-2020

Meeting carbon targets could incentivise farmers to move out of animal farming, increasing supply chain volatility

Reductions to stocking rates and production may be necessary to meet the government’s emissions targets. Projections find that without significant investments in methane reducing technologies, such as methane inhibitors, methane reduction vaccines, and selective breeding for lower-emitting animals, meeting even the lower end of the government’s methane reduction target would require dairy cattle numbers to decrease by around 15% from 2018 levels. The reduction in cattle numbers would result in a 5% fall in total milk solids by 2035 relative to a projected 2019 peak. Achieving the lower end of New Zealand’s emissions targets will also require dairy as well as sheep and beef land to fall by at least 4% and 11% by 2035 relative to 2018.

The threat of plant-based substitution will amplify carbon pricing risks

In 2019, plant-based dairy made up 12% of the global dairy market, and we see continued growth in New Zealand’s key export markets. Fonterra exports 25% of its dairy products to China, where demand for non-dairy products is growing. Although the plant-based market in China is not as developed as it is in several western countries, the market research firm Euromonitor International forecasts that plant-based beverages’ compound annual growth rate will reach 2.7% from 2019 to 2024.

Turning the risk of carbon pricing into an opportunity: the case of Fonterra

New Zealand co-operative Fonterra, the world’s largest exporter of dairy, can use the carbon price to transition to a low carbon portfolio. Potential avenues the company could use to facilitate the transition include developing its low-carbon portfolio by increasing product and portfolio level diversification towards plant-based alternatives and scaling up on farm efficiencies, mitigation practices, and technologies in dairy production. The company estimates that sales of low or carbon-neutral dairy products could increase its revenue by up to NZ$40 million by 2030, providing further impetus for increasing investment in R&D for low-carbon dairy.

Written by

María Montosa Ródenas

Technical Specialist, Research & Engagements - Nature

María joined FAIRR in 2019 as a lead analyst in the Coller FAIRR Protein Producer Index. She currently manages the investor engagement related to Waste and Pollution, and supports investors to manage other biodiversity and nature-related risks and opportunities, such as regenerative agriculture