Executive Summary

Practically every government in the world faces challenges when it comes to balancing their budgets, and an increasingly attractive target for revenue creation is a tax on goods deemed to be unhealthy or damaging to the environment or both. For example, over 180 countries now impose a tax on tobacco, 60 jurisdictions tax carbon and at least 25 tax sugar.

Could meat be the next product on this list?

In the global livestock production sector, sustainability megatrends and changing dietary patterns driven by a growing global middle class are creating enormous challenges. Population growth has driven up up global meat consumption by over 500% between 1992 and 2016 and this trajectory is likely to continue in the future, especially in emerging markets. For example, demand for meat produced in Asia alone is predicted to grow a further 19% in the twelve years to 2025.

However meeting this growing demand has proven a difficult endeavour for the global livestock industry, and in recent years the sectors has been linked with a range of environmental, health and social problems. This includes emerging evidence connecting meat consumption with:

Greenhouse gas emissions that exceed emissions from the transport sector;

An increasing incidence rate of global obesity and associated higher risks of type 2 diabetes and cancer;

Increasing levels of antibiotic resistance;

Threats to global food security and water availability;

Soil degradation and deforestation.

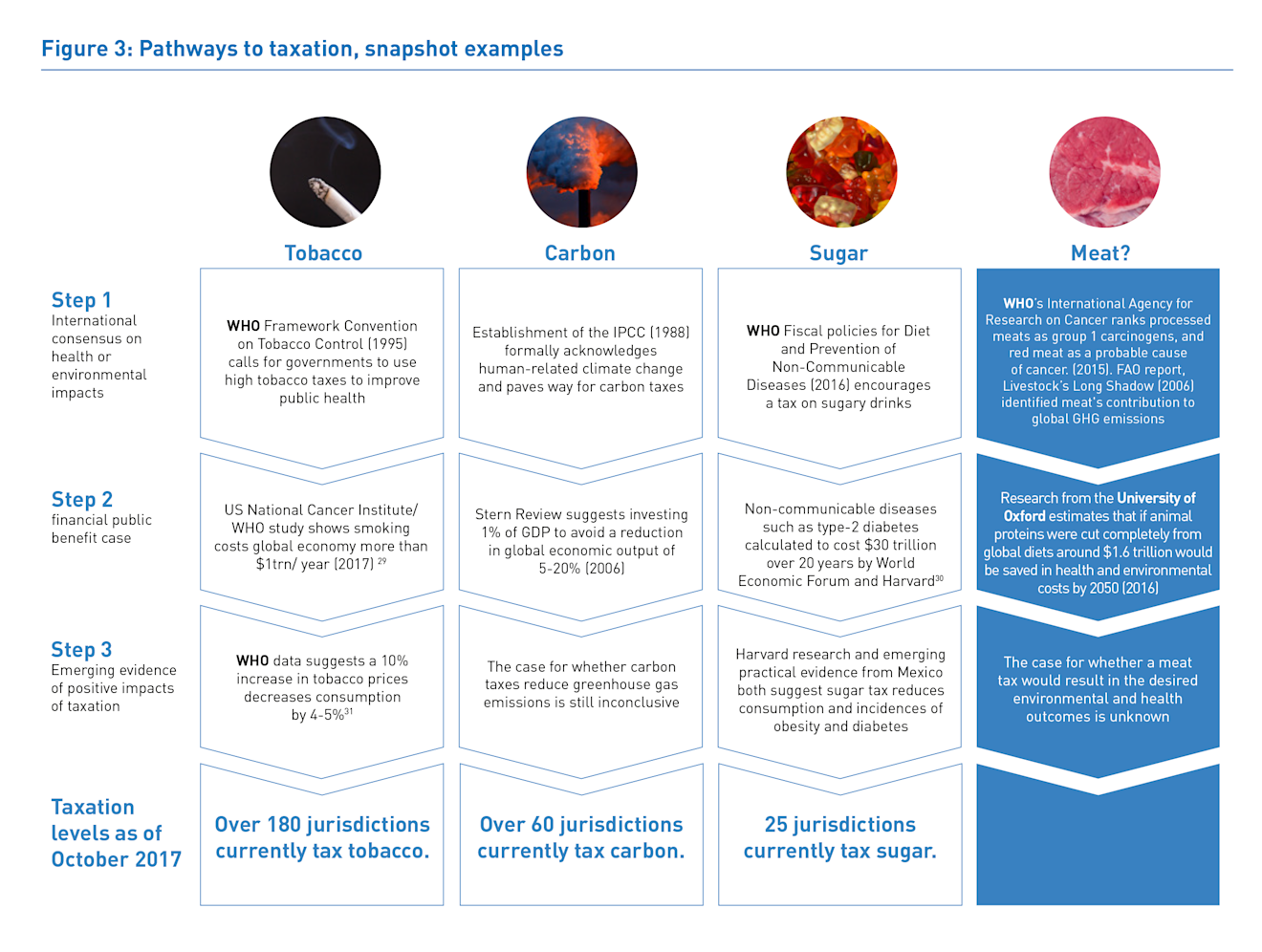

Could taxation of meat products be a way to mitigate these global challenges? The pathway to taxation typically starts when there is global consensus that an activity or product harms society. This leads to an assessment of their financial costs to the public, which in turn results in support for some form of additional taxation. Taxes on tobacco, carbon and sugar have followed this playbook.

For example, a 2015 report from the World Health Organization (WHO) classifying processed meat as carcinogenic echoes similar reports on the harmful effects of tobacco and sugar; while the work of the University of Oxford quantified the potential cost savings from reductions in meat consumption, echoing the UK’s Stern Review in 2006, which first made the case to invest now to mitigate climate change or risk paying much more later.

Meat taxes are already on the agenda in Denmark, Sweden and Germany, and although no proposals have advanced into actual legislation, long-term investors should take note of the compelling arguments being made, especially in Denmark and Sweden. It was in the Nordics that the first carbon tax was introduced in 1990.

Meat taxation is not a short-term risk for investors. Yet large pension funds and asset managers would be remiss not to put it on their agenda. As the international community works to implement the Paris Agreement and the UN Sustainable Development Goals, governments and other international institutions will need to create a pathway to a more sustainable global food system meat taxation may well feature on that road.

Could meat follow a similar pathway to tobacco, carbon and sugar?

Tobacco:

The negative health impacts of tobacco first became clear in the early 1950s, with the link between smoking and lung cancer becoming clearer in the following decades. Today, nearly all countries tax tobacco on the grounds of health reasons, and 33 countries have taxes that make up more than 75% of the retail price of a pack of cigarettes.

Carbon:

A carbon tax was first introduced in Finland in 1990 and they have become increasingly prevalent as the impacts of climate change have become more apparent. Today 40 jurisdictions worldwide have some form of carbon tax the biggest carbon trading scheme being the EU. This is set to rise as more cities, states and countries seek to implement the 2015 Paris Agreement on climate.

Sugar:

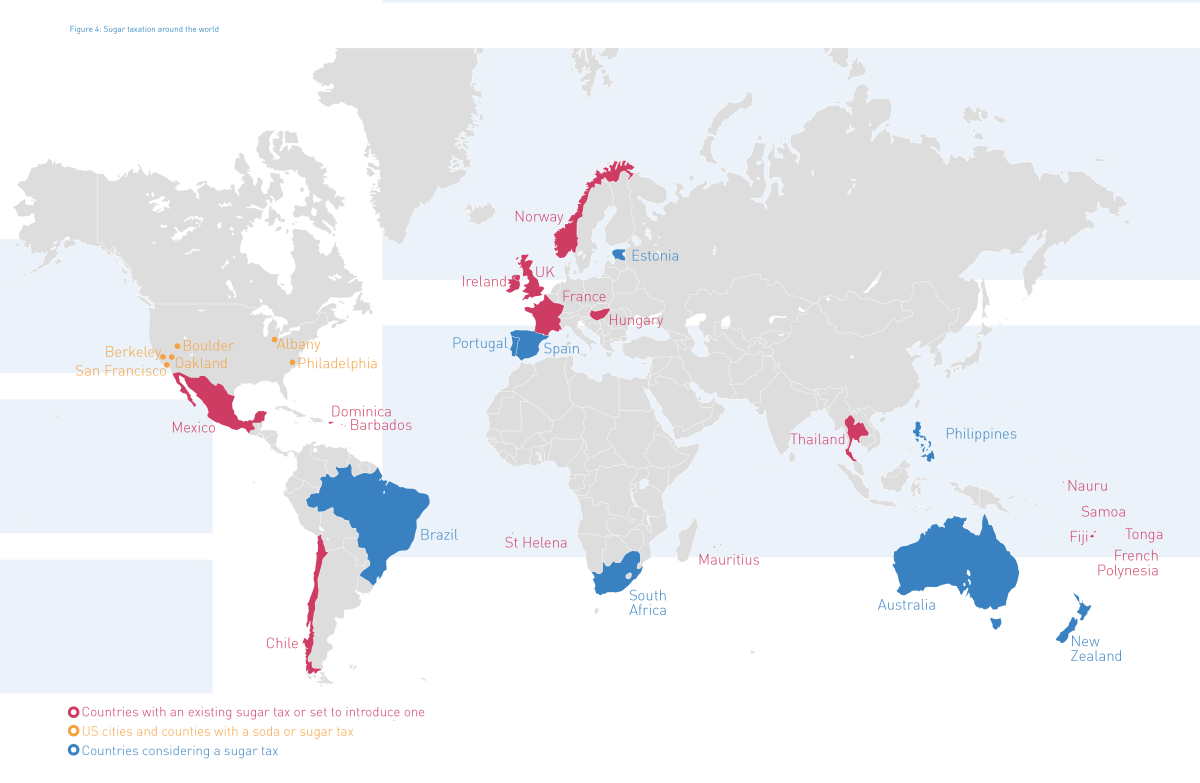

While taxes on sugar have a long history, it wasn’t until the 1990s that Governments started to link a reduction in sugar intake with public policies to reduce rising levels of obesity and diabetes. Today, at least 16 countries have some form of sugar tax in place including the UK and Mexico.

Meat:

There is an emerging body of evidence that connects meat consumption with both public health issues such as obesity, diabetes, cancer and antibiotic resistance, and environmental issues such as climate change and pollution. This has so far led to meat tax proposals in Sweden, Denmark and Germany

Introduction

This Policy Paper explores a growing trend of national and local governments introducing forms of pigovian taxes – better known as ‘sin taxes’ or behavioural taxes. These are levies on products or activities deemed to cause harm and/or pose financial costs to the wider wellbeing of society and the environment. It considers the likelihood of animal products being subjected to such a tax on health and environmental grounds.

What is a behavioural tax?

The term ‘behavioural tax’ in this paper is used to define a particular form of state-levied excise tax (i.e. a tariff levied against a specific product rather than a general sales tax for all products). It is a tax that imposes an extra cost on those products or services deemed to have unaccounted costs to wider society in terms of their environmental or social impacts. They are also known as ‘sin taxes’ or in economic terms ‘pigovian taxes’.

Unlike other taxes, the aim of behavioural taxes is not solely to generate revenue for governments. Rather their prime purpose is to reduce consumption of the commodity in question (by making it more expensive) or to lessen its impact. For example, behavioural taxes on tobacco in Britain make up more than 75% of the total cost to the consumer

Understanding the meat of the problem

Behavioural taxes: A growing trend

The concept of behavioural taxes arguably dates back to 15th Century France when the Monarchy introduced the gabelle an infamous tax on salt. Historians can also point to similar levies on beer, tea and other goods in the following centuries. Yet it is arguably only in the last thirty years that governments have started to embrace behavioural taxes as an effective way to simultaneously moderate behaviour and raise revenue. For example, The Economist estimates that in the UK nearly 10% of all taxes collected come from those levied against alcohol, tobacco, gambling, fuel and vehicle use.

Like all taxes, behavioural taxes are not universally accepted, and are criticised at both ends of the political spectrum. Supporters of ‘small-government’ argue that a behavioural tax is a prime example of nanny-stateism and government overreach. Critics from the left of the political centre label behavioural taxes as regressive because they disproportionately affect the poor. Other critics argue that such taxes are an ineffective mechanism for behaviour change, particularly if they are not accompanied by awareness raising and education campaigns.

An emerging international consensus on the negative health and environmental impacts of meat

There is a growing body of evidence linking current levels of meat consumption with negative health, social and environmental impacts. This vidence is emerging within a context of rapidly rising healthcare costs especially in the developed world. The OECD has warned that public health financial requirements in advanced economies are rising so fast that they will become unaffordable by mid-century.

Health issues

Perhaps the biggest problem facing the animal protein sector is the increasing evidence of the association of high meat consumption with a number of health risks, including increased risks of colorectal cancers, cardio-vascular disease, obesity, diabetes and antibiotic resistance. In October 2015, a report from WHO classified processed meat (including bacon, sausages and ham) along with tobacco and asbestos as products that definitively cause cancer.

Following a comprehensive assessment of the scientific evidence the experts concluded that 50g of processed meat a day increased the chance of developing colorectal cancer by 18%. The same WHO report classified red meat as likely to be carcinogenic.

There is also a growing body of evidence that links high levels of meat consumption with obesity and diabetes:

Research from Harvard School of Public Health found that a daily serving of red meat no larger than a deck of cards increased the risk of adult-onset diabetes by 19%, while for processed meat a daily serving of one hot dog or two slices of bacon increased diabetes risk by 51%.

Research from the University of Adelaide in 2016 studied obesity rates in 170 countries and found that the consumption of meat contributes just as much as sugar to the prevalence of global obesity.

The OECD has warned that under business-as-usual scenarios, public health costs across the developed world will become ‘unsustainable’ by 2050.

In response to these health issues a number of governments around the world have published dietary guidelines highlighting the need to reduce meat consumption. In 2016, Public Health England’s new dietary advice recommended people halve their dairy intake and eat less meat. As discussed later in this paper new dietary guidelines drawn up by China’s health ministry in 2016 saw a downward revision of the lower end of its recommended meat consumption range, challenging the view that those who did not eat much meat were unhealthy. Other countries that have included sustainability into their nutrition advice, or are seriously considering doing so, include:

Brazil;

Netherlands;

Germany;

Australia; and

Sweden.

Another rapidly emerging health threat attributed to meat consumption is antibiotic resistance.

Modern medicine relies on antibiotics, yet resistance is rapidly increasing and the pharmaceutical industry is proving unable to produce new antibiotics at an adequate rate. Widespread and prophylactic use of antibiotics in livestock is a significant contributor to this phenomenon. Antibiotic resistance is already responsible for over 20,000 deaths a year in the US, costing $20bn every year in excess direct healthcare costs. If unaddressed, the growth of antibiotic resistance is widely believed to become one of the biggest public health crises of our generation. A recent UK government research paper estimates antibiotic resistant infections could cost the world $100 trillion in lost output by 2050.

As livestock density increases and is in closer confines with wildlife and humans, there is a growing risk of disease that threatens every single one of us. In total 66% of the emerging diseases in humans have animal origins and one or two new diseases emerge every year.

Along with the global health risks levelled at the livestock sector are growing concerns on the impact of the industry on communities local to intensive farming sites. A 2016 report by the European Environmental Agency found that 94% of ammonia emissions in Europe is now generated by agricultural activities, such as manure storage and slurry spreading.13 Another study found that in the Netherlands, the lung function of people living close to pig farms was on average 5% worse than that of people living further away from such farms.14 In the US, meat processor Tyson Foods has faced several community issues, including disbursing a $500,000 community service payment for an accidental discharge from a Tyson Foods facility in Missouri in 2014,15 and local protests that have derailed plans to build a new poultry plant in Kansas in 2017.

Environmental issues

The production of livestock products is increasingly associated with a number of negative environmental impacts including global warming, water scarcity, deforestation and biodiversity loss.

Livestock is responsible for 14.5% of global greenhouse gas emissions (GHGs) according to the FAO, or around 7.1 gigatonnes of GHG emissions each year, more than the transport sector. This is because, as shown in Figure 1, meat is the most greenhouse gas (GHG) intensive protein source to produce. Ruminant meats such as beef and lamb emit 280 more GHGs per calorie than legumes. Even chicken, the least carbon-intensive meat, generates 65 times more emission per calorie produced than legumes.

Grams of GHG emissions per kilocalorie of food product

Food Product | g/Kcal |

|---|---|

Rumiant meat | 5.6 |

Trawling fishery | 4.8 |

Recirculating aquaculture | 4.4 |

Pork | 1.6 |

Poultry | 1.3 |

Vegetables | 0.68 |

Eggs | 0.59 |

Dairy | 0.52 |

Butter | 0.33 |

Rice | 0.33 |

Tropical fruits | 0.14 |

Maize | 0.03 |

Sugar | 0.02 |

Legumes | 0.02 |

Rearing livestock also accounts for 75% of agricultural land use and is a leading cause of deforestation. According to Yale University, cattle ranching is the largest driver of deforestation in every Amazon county, accounting for 80% of current deforestation rates in Brazil.

The meat industry is also a significant consumer of increasingly scarce fresh water resources – with one study estimating the water footprint of beef to be around 15,400 m3/ton, and 6000m3/ton for pork. When California was hit by a severe drought, a study by the Pacific Institute highlighted that the meat and dairy industries alone accounted for a remarkable 47% of California’s consumptive use of water.

According to a recent report by WWF our appetite for meat is the most significant driver of biodiversity loss across the globe. The vast scale of growing crops such as soy to rear cows, chickens, pigs and other animals puts an enormous strain on natural resources leading to the wide-scale loss of land and species, with 60% of total global biodiversity loss attributed to food production.

With 19 billion chickens, 1.4 billion cattle and 1 billion sheep and pigs on our planet today, animal welfare issues are also of significant and growing concern to investors, governments and civil society groups. Many of these are intensively reared and as such, raise many ethical concerns, particularly for animal welfare and working conditions, but also regarding food safety

The multi-billion public benefit case

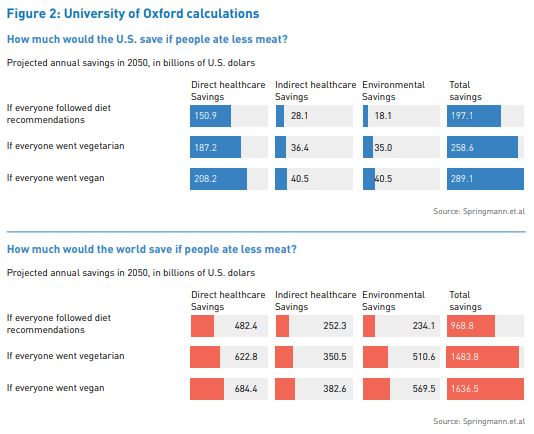

Research on the financial cost of meat consumption is rapidly emerging. For example, research from the Oxford Martin Programme on the Future of Food at the University of Oxford estimated that eliminating all animal products from diets by shifting towards nutritionally balanced plant-based diets by 2050 could avoid USD 600 billion in climate damages and USD 1 trillion in healthcare expenses associated with treating diet-related chronic diseases. In the US alone, the savings were estimated to be USD 40 billion in climate damages and USD 250 billion in avoided healthcare expenses (Figure 2).

In comparison, the annual cost of type-2 diabetes which to a large extent is related to sugar consumption and has driven sugar-tax initiatives around the world, was estimated at USD 827 billion by the WHO. The total health and environmental costs of unhealthy diets are almost double that, and the portion related to animal products alone is about a third more. Oxford’s research also estimates that if everyone followed global nutritional guidelines to eat a diet of more vegetables and less meat by 2050, (specifically if red meat consumption was reduced to 300 grams per week), we would see a:

6% decrease in the global mortality rate;

29% decrease in food-related greenhouse gas emissions;

$735 billion in savings globally every year.

Can a tax improve people’s health and environment?

Early in 2017, the same researchers from the University of Oxford and researchers from the International Food Policy Research Institute published a paper showing how the implementation of a tax on greenhouse-gas intensive foods such as red meat could help the environment and improve people’s health. The paper concluded that adding a tax could change consumer behaviour and result in both environmental and health benefits if designed in a health-sensitive manner.

The study found that taxing foods, in particular emissions intensive animal-based ones, by incorporating the price of the associated climate damages into the price of the foods could reduce global greenhouse-gas emissions by about one billion tonnes, more than the global aviation industry emits currently. Beef prices, for example, would have to increase by 40% on average, something that would reduce global beef consumption by about 13%. The study also found that implementing the tax scheme could avoid half a million diet-related deaths if designed such that the tax revenues are partly rebated to poor households and used for health promotion programmes that would lead to greater consumption of fruits and vegetables.

A study specifically focused on the UK found that a climate tax on foods would see UK weekly shopping bills increase by about the cost of a latte, while the revenue generated by the government could be as much as £3.6 billion. The associated reduction in emissions would be in the range of 16.5 million and 18.9 million metric tons of carbon dioxide equivalent, which is equivalent to taking nearly 3.6 million cars off the road.

Another suggestion from Oxford is that a meat tax could be levied only on meats containing antibiotics, as a way to combat the rise of antibiotic resistant superbugs. The idea is that imposing a tax on meat containing antibiotics would discourage consumers from buying this kind of meat, and to help fund a transition to more sustainable methods of rearing livestock.

Tobacco, carbon and sugar

The path to taxation

Here we explore the history, pricing, impacts and criticism of the behavioural taxes that have emerged for three different goods: tobacco, carbon and sugar. Analysis of taxes on all three of these goods shows a common three-step path that led to a behavioural tax being introduced. As shown in Figure 3 the pathway is:

Step 1 – Consensus: Scientific evidence of negative societal impacts culminating in international consensus, backed by a UN body.

Step 2 – Quantification: A compelling financial public benefit case to justify the imposition of a tax. This usually justifies a cost incurred now (tax), to avoid the risks of more severe consequences in the future.

Step 3 – Taxation: The emergence of evidence, winning political support, that a tax can help lessen the societal/environmental harm being caused.

2.2 Tobacco

Brief history

Taxes on tobacco are one of the oldest excise duties in existence, dating back to the 17th century when tobacco from the Americas was first brought to the UK. However the first taxes on tobacco were simply a source of government revenue, rather than a ‘behavioural tax’. Initially, smoking was widely regarded as a healthy activity and some cigarette advertisements would often claim health benefits such as, remarkably, their ability to reduce coughing.32 The negative health effects of tobacco became more widely understood in the 1950s, and in 1964, a US Surgeon General’s report established a link between smoking and lung cancer. This marked the beginning of a significant shift in public attitudes about smoking and a growing body of evidence on both the negative health consequences of tobacco smoking and the role of price and tax in the reduction of tobacco consumption.

In 1995 an international instrument for tobacco control was formally initiated by the United Nations, and the World Health Organization Framework Convention on Tobacco Control (WHO FCTC) was signed in 2003. The WHO FCTC calls for governments to use higher tobacco taxes as a measure to improve public health; since its adoption, many signatories have significantly increased taxes on tobacco as part of broader strategies to reduce incidences of smoking-related diseases and the associated public health costs.Research published in the British Medical Journal in 2017 found that the total economic cost of smoking associated with health expenditures and productivity losses combined was $1,436 billion in 2012, equivalent to 1.8% of the world’s annual gross domestic product. Another 2017 study by the WHO and the U.S. National Cancer Institute came to a similar conclusion.

Today 90% of global governments impose some form of tax on tobacco.

Tobacco taxes in practice

The rates of tax imposed on tobacco vary widely from country to country and tend to be higher in more developed countries. According to data from the WHO, the average tobacco tax in high-income countries equates to approximately 53% of the total retail price, while in low-income countries it is about 25% of total retail price.

Recent EU tobacco legislation commits member states to a minimum excise duty of 57% of the retail price (or €90 per 1,000 cigarettes), regardless of the retail selling price. Within the US, tax levels vary widely on a state by state basis. New York has the highest tobacco tax rate with a levy at the time of writing of $4.35 per pack of cigarettes; at the other end of the spectrum, Missouri charged just 17 cents per pack.

Impact of tobacco taxes on rates of smoking

There is significant evidence to indicate a strong correlation between a price increase and a decline in tobacco demand. According to the WHO, higher prices on cigarettes can encourage people to quit smoking, discourage them from starting in the first place and help to reduce the chance of relapse. This effect is particularly pronounced among adolescents and children. On average, a 10% price increase on a pack of cigarettes would be expected to reduce demand for cigarettes by about 4% in high-income countries and by about 5% in lowand middle-income countries.

For example, in Turkey, tobacco taxes were raised to 80.3% of the total price between 2008 and 2012, while the smoking rate for men dropped 11% over eight years from 2008. It is important to note that tobacco taxes are almost always imposed as part of a wider antismoking campaign, which includes other measures aimed at reducing consumption such as public information campaigns or bans on indoor smoking. Market-based developments are important too, for example the introduction of patches and e-cigarettes. This makes it difficult to attribute a direct impact to one factor alone.

Arguments against taxing tobacco

One of the most significant criticisms of tobacco taxes is that they are regressive and place a disproportionate share of the tax burden on those with lower incomes. For example, a packa-day smoker who makes €25,000 per year will pay a much bigger portion of their earnings on a tobacco tax than someone who makes €250,000 per year. Smoking rates among lowerincome groups tend to be higher.

To some extent, these criticisms can be mitigated or nullified if the revenues generated by tobacco taxes are allocated to stop-smoking programmes that target the poor. Such programmes can take the form of counselling for low-income smokers trying to quit, or focus on reducing income-related disparities in both tobacco use and its negative health effects.

Another criticism of tobacco taxes is that such policies hurt business and lead to job losses. Over the last 50 years, production of tobacco has shifted from high to low and middle-income countries. For example, there are more than 20 African countries currently growing tobacco,and many farmers and government officials in producing countries argue that tobacco has become a cash crop essential to economic development. Declines in tobacco use in developed countries can also hurt sectors of the economy that derive part of their revenue from tobacco, such as retailers or marketing agencies. The counter argument to this is that consumers will spend the money they spend on smoking on other products or services.

2.3 Carbon

Brief history

In 1988, human related climate change was formally acknowledged with the establishment of the Intergovernmental Panel on Climate Change (IPCC) – backed by both the United Nations and the World Meteorological Organization (WMO). With scientific near-certainty on climate change came the idea of taxing carbon emissions.

The first carbon tax was introduced by Finland in 1990,47 and momentum for carbon taxes increased after the Kyoto Protocol in 1997. In 2005, the European Union Emissions Trading Scheme (EU ETS), which is the world’s largest, launched its first phase; the next year, California signed a law to develop its carbon market and the UK Government released the influential Stern Review on the Economics of Climate Change. The Sternreport, authored by the renowned economist Nicholas Stern, labelled climate change as a biggest market failure and called for one percent of global GDP per annum to be invested to avoid the worst effects of climate change and avoid more severe impacts on global economic output of between 5-20%.48 It also called for concrete actions to avoid/ mitigate climate change, such as taxation or emissions trading.

The Paris Climate Agreement in December 2015 saw most of the world commit to reduce carbon emissions; many countries are now looking to carbon taxation as an instrument to realise that goal. By 2016, a total of 40 national markets and over 20 cities, states and regions had priced carbon, or had established a price on carbon. In total, 13% of global GHG emissions are currently covered by carbon prices,49 and the World Bank estimates 25% of all emissions will be covered by carbon prices if China, South Africa and Chile follow through with national plans to introduce new carbon regimes.

Carbon taxes in practice

Typically carbon taxes are levied on the goods and processes that produce greenhouse gas emissions. Some of these are applied as VAT or corporate taxes, however the main form of taxation to emerge for carbon has been cap and trade systems which, similar to a taxing mechanism, puts a price on carbon.

The long-term aim for most carbon taxes is to incentivize emission reductions, and thus a typical carbon tax calculates GHG emissions (measured in metric tons of carbon dioxide equivalent (tCO2e)) of a product or process and taxes proportionate to this figure. This provides a financial incentive for taxpayers to lower their emissions by adopting more resource efficient practices, choosing less carbon-intensive fuels or, in the case of consumers, changing lifestyle habits.52 In the case of an emission trading system (ETS), a cap is set on the total emissions allowed within the jurisdiction and companies must pay for or trade their allowance.

In 2016, prices on carbon ranged from less than US$1/tCO2e to US$131/tCO2e, with about three quarters of the covered emissions priced below US$10/tCO2e, according to the World Bank.

Impact of carbon taxation on global warming

It is almost certainly too early to judge whether carbon taxes are an effective instrument for reducing industrial GHG emissions.

At the outset, facts seem to suggest they are not effective. In the 20 years since the Kyoto Protocol, the concentration of carbon dioxide in the atmosphere has steadily risen from around 360 parts per million to over 400 parts per million.

However many carbon taxation schemes are still relatively new and even those that have been in existence for over a decade, such as the EU ETS have been beset by problems such as a low carbon price or an oversupply of allowances that have undercut their ability to be effective. Those problems are still being addressed and we almost certainly need longer to judge effectiveness in this area.

It is also worth noting a study in Sweden which uses carbon taxes quite extensively, and found that although total emissions have increased there was a significant reduction in emissions per unit of GDP due to reduced energy intensity. The partial effect from lower energy intensity and energy mix changes was a reduction in CO2 emissions of 14%, and the carbon taxes were estimated to contribute to a total of a 2% reduction.

Arguments against carbon taxation

One of the main arguments against carbon taxes is unintended consequences such as carbon leakage—where emission reductions in the taxed jurisdiction are then offset by an increase in emissions elsewhere. Fundamentally, critics argue that climate changeposes a classic ‘tragedy of the commons’ problem of collective action. Any one country’s introduction of a carbon tax will only succeed on all terms if accompanied by comparable regulations in most or all nations around the world.56 But that is not the way international markets tend to behave.

There is also evidence that they disproportionately affect low-income groups or certain geographical regions. According to a US study, a tax of $40 per ton of carbon adds about two cents to the average price of a kilowatt-hour of electricity. Higher energy prices in turn raise costs for both industry and households. The financial impact of a carbon tax will differ among economic groups, depending on regional energy production and consumption patterns. On average, a carbon tax of $20 per ton would account for about 0.8% of pre-tax income for households in the lowest income quintile, compared to 0.5% in the highest income quintile.

2.4 Sugar

Brief history

Sugar is perhaps the most recent commodity to have a behavioural tax levied against it. Overconsumption of sugar is associated with a number of health issues across the world including the ‘modern epidemics’ of obesity and diabetes. WHO data shows that the global prevalence of obesity more than doubled between 1980 and 2014, and type 2 diabetes more than quadrupled over same time. Diabetes is now the sixth leading cause of death globally and the WHO estimates that it will cause $1.7 trillion in losses to GDP between 2011 and 2030.

Since the 1990s, almost 20 countries from France to Fiji and eight US jurisdictions have implemented a tax on sugar or sugary drinks, with the bulk of these introduced since 2010. Hungary also introduced a ‘fat tax’ on products containing lots of sugar, salt or caffeine in 2011.

In 2016 a WHO report ‘Fiscal policies for diet and the prevention of non-communicable diseases’ encouraged all countries to introduce a tax on sugary drinks of 20% or more as an effective way of curbing the soaring obesity rate, especially in children.59 Next year will see the UK introduce a new tax for sugary drinks, adding approximately 10% to the cost of sugary soda drinks, and similar moves are under way across the world, from Spain to South Africa.

Sugar tax in practice

At present taxes levied against sugar or sugary drinks are relatively low. In the UK for example, tax accounts for about three quarters of the cost of a £9.40 pack of cigarettes. But when the sugar tax comes into force in the UK in 2018, it is expected to add less than 10% to the cost of a can of cola.61 Mexico has a tax of one peso per litre of soda since 2014, and in France the tax is between three and six cents per litre.

Proposals coming from countries currently debating a sugar tax generally appear to be higher and more aligned with the WHO recommendation of 20% or more. The Philippines propose to impose a $0.20 per litre tax on soft drinks while Portugal looks set to introduce a two-tier tax where drinks with the highest sugar content face a tax of 16.46 cents per 100 litres.

Impacts of sugar taxation on public health

Sugar taxation is a relatively recent phenomenon and is generally applied at a level that is low relative to the product price. Both these factors mean it is too early to make any definitive conclusions about its impact.

However, an emerging body of research suggests that sugar taxation does change consumer and commercial behaviour. The best example of this from Mexico, which has a population of 122 million people and is the fourth largest consumer of fizzy drinks and soda by volume. Mexico also has very high rates of obesity and diabetes: 70% of the country’s adult population and 34% of children between the age of 5 and 11 are classifiedas obese, while 12% of the population has diabetes.

Since the introduction of a tax on sugary drinks in 2014, the country has seen a decline in sales of sugary drinks, and expects to see a reduction in obesity and diabetes. Recent analysis by the University of North Carolina and the Mexican Instituto Nacional de Salud Pública has found that sales of sugary drinks dropped 5.5% in the first year the tax was levied and a near 10% decline the following year.

In Berkeley, the first US city to introduce a tax on sugary drinks, a study suggests that the tax prompted a 21% drop in consumption of sugary drinks in low income neighbourhoods. Research from Harvard T.H Chan School of Public Health argues that if a further 15 major US cities introduced a soda tax of one cent per ounce, 115,000 cases of obesity could be avoided and diabetes rates could drop 6%, saving up to $759 million in healthcare costs over ten years. In Hungary, research indicates that 30% of people have reduced their consumption of pre-packaged sweets, 22% of people have reduced their consumption of sugary energy drinks and 19% of people have reduced their intake of sweetened drinks since the tax system was changed.

There is also some evidence that sugar taxation changes corporate behaviour. For example, a 2012 impact assessment of Hungary’s ‘fat tax’ by the WHO showed that about 40% of manufacturers changed their product formulas to reduce or eliminate unhealthy ingredients. Similar changes are already being seen in the beverage industry. For example, the introduction of a tax on sugary drinks has resulted in Coca-Cola and Tesco working to reformulate products or to launch new low- or no- sugar alternatives.

Coca-Cola have released ‘Coke Life’ which uses alternative sweeteners such as stevia to reduce overall sugar content of the product, while Tesco announced it has halved the sugar content in some drinks such as its own-brand cola to a level below 5g per 100ml the level at which the UK sugar tax kicks in.

It has also seen major restaurant chains such as Pizza Hut and TGI Fridays scrap free refill offers on sugary drinks as part of an attempt to reduce child obesity obesity.

Arguments against a tax on sugar

As with most behavioural taxes, the main criticisms of sugar taxes have been that they are regressive. Soda manufacturers in particular argue they are likely to hit lower socioeconomics groups hardest, cost jobs and that taxing goods to change diet and lifestyle is ‘nanny-stateism’. Chatham House research agrees that measures to restrict physical and economic access to food products may have a disproportionate effect on the poorestdemographic groups.

Other criticisms suggest that taxing sugar and sugary drinks will encourage people to choose other equally unhealthy foods or drinks instead, shifting the burden rather than reducing it. The Institute for Fiscal Studies, an independent think tank, points out the potential drawbacks of focusing on a single ingredient. Consumers might switch to untaxed substitutes such as chocolate, which is ‘also high in sugar and contains saturated fat to boot’. Their analysis concludes that a 15% tax on sugary soft drinks will only lead to a 3% decline in total sugar purchases.

The Institute of Economic Affairs agrees, “There is no guarantee that the substitute products will have fewer calories or be better for health”. In Britain, a business coalition launched a ‘Face the Facts, Can the Tax’ campaign. It claimed that the proposed levy threatens 4,000 jobs, basing this on analysis by Oxford Economics, which said the hospitality trade and small retailers would be hardest hit.

Existing meat tax proposals

Several governments around the world have already begun to consider taxes or other regulatory action on meat or dairy in some form. We explore some of these proposals in this chapter.

3.1 Denmark: A levy on red meat sales

In 2016, the Danish Council on Ethics, an advisory body to the Danish parliament, released a report examining whether the choice of consuming foods with a large environmental footprint should be left to the consumer – or whether regulation should be introduced to reduce the climate impact of food consumption. The report included a call for the introduction of a tax on red meat.

The Council recommended a tax on red meat based on climate impact, specifically a sales tax levied on consumers as opposed to producers. This recommendation was partially informed by a belief that a tax on Danish livestock farmers would give foreign producers an unfair advantage and unduly harm the Danish agricultural sector (as consumers would simply choose to buy imported beef). The Council also feared a tax on farmers would create ‘carbon leakage issues’ where emissions from meat production would simply shift from Denmark to another country rather than be reduced. A consumer sales tax allows both domestic and imported beef to be taxed, (though it does not provide farmers with an incentive to lower emissions).

The Council’s report and recommendations did not put forward a suggested tax level for red meat. However we interviewed Mickey Gjerris, former Chairman of the Ethics Council and Associate Professor of Bioethics at the University of Copenhagen, for this paper and he argued that a tax must be high enough to realistically influence consumption patterns and discourage consumers from buying beef.

In early 2017 the Danish opposition party, The Alternative, put forward a follow up proposal for a Danish meat tax that suggested a tax of 17 DKK (approx. $2.7) per kg/ beef. The proposal forms part of a wider green tax reform championed by the party. It would levy a higher tax on food products with large carbon footprints, while those associated with lower emissions would benefit from tax cuts.

Is there support for a tax on meat in Denmark?

Public reaction to the meat tax proposals, both in Denmark and internationally have been mixed. The Council’s proposal for a meat tax received more responses than any other in its 27-year history, clearly indicating that it “hit a nerve”, according to Gjerris. The initial response from government and industry however has been largely negative.

At a political level the proposal was rejected in parliament and the immediate political reaction was that the Council was acting out of the bounds of its remit. The response of the Danish agriculture sector was also resistant, highlighting the consequences for farmers of reduced meat consumption and warning it would exacerbate social inequality. Gjerris suggests that future proposals could be more viable if they ensured that new tax revenue be used to help livestock farmers transition towards the production of more sustainable, plant-based alternatives.

While the proposal ultimately did not gain any political traction, it significantly increased public awareness of the connection between food and climate change, with policymakers agreeing that action is needed to lower meat consumption if commitments under the Paris Agreement are to be met.

3.2 Sweden: A climate tax on food

In 2016, three MPs for the Swedish Green party tabled a motion in the Swedish Riksdagen (Parliament) calling for the introduction of a climate tax on food. The motion comprised of two steps the first of which was the introduction of a tax on beef.

The motion argued that the average annual carbon footprint of a Swede is ten tons of CO2 with about 20% of this linked to beef and dairy consumption – equivalent to all road transport in Sweden. It called for the development of a climate label for food to help consumers understand the climate impact of their dietary choices and easily identify products with a smaller carbon footprint. It also included a call for a system of repayments to citizens to avoid it being seen as regressive.

As in Denmark, the Swedish proposal sought to impose the levy on consumers rather than producers to avoid carbon leakage and a switch to imported beef. Imported beef in Sweden is already significantly cheaper than the Swedish reared equivalent.

The Swedish proposal does not include a fixed level for the tax, but suggests a potential figure of about 20SEK (approx. $2.3) per kilogram.

The proposal came about following a 2016 survey in Sweden that indicated 25% of people support a tax on red meat. In our interview with Green Party MP Stefan Nilsson, he argued that as the climate impacts of diet become better understood, public support will increase even further. Currently the climate tax proposal has widespread support in the wider Swedish Green Party, the junior coalition party in the current government administration.

A second motion on the topic is planned by the same MPs for autumn of 2017. This will modify the previous proposal by suggesting that half the tax revenue generated from a climate tax on meat is repaid to citizens, with the remainder to fund subsidies for Swedish farmers to transition towards plant-based protein, and to help protect Sweden’s biodiversity.

3.3 China: New dietary guidelines target meat consumption

Although there has not been any proposal to place a specific levy on meat consumption in China, the recent changes to the government’s dietary guidelines are significant, especially given the broader cultural context surrounding meat consumption. The expected growth in meat consumption in China is widely expected to create a number of social and environmental impacts. In 2016, a report by non-profit organisation WildAid calculated that the predicted increase in China’s meat consumption would:

Add an extra 233m tonnes of greenhouse gases to the atmosphere each year (equivalent to 539 million barrels of oil);

Put increased strain on China’s water supply, which generally is already heavily polluted;

Degrade China’s arable land;

Exacerbate obesity and diabetes. An estimated 100 million Chinese citizens or about 10% of the adult population have diabetes, more than any other country, costing over RMB 173.4 billion (US $25 billion) a year in medical costs and growing.

There are very strong cultural traditions attached to the eating of animals in China, especially pigs. The Chinese character for “home” depicts a pig underneath the roof of a house and the Chinese government even holds a ‘strategic pig reserve’ in the same way the United States keeps a vast petroleum reserve.

In 2016, the Chinese health ministry released new dietary guidelines that recommend that the nation’s 1.3 billion population should consume less meat. In particular, they introduced a downward revision of the lower end of its recommended meat consumption range. This implied a maximum annual per capita meat consumption of 27 kg, which is 45% below the 2013 consumption figure of 49.7 kg per capita. The guidelines, which are released once every ten years, are designed to improve public health. However the reduction in meat consumption could also help to significantly reduce China’s greenhouse gas emissions – which are the largest in the world by volume.

The dietary guidelines also followed a new tax on larger farms to restore damaged waterways: The tax, introduced by the Chinese Ministry of Environmental Protection brought in a new charge of RMB 1.40 ($0.20) per animal for larger farms. The aim of the tax primarily is to reduce wastewater emissions and generate revenue to clean up the country’s polluted waterways. The Chinese government estimates the tax will raise RMB 50 billion per year to help clean waterways.

3.4 Germany: Sales tax on meat and dairy for climate reasons

In May 2017, Germany’s federal environment agency proposed raising taxes on animal products such as liver sausages, eggs and cheese from seven to 19% for environmental reasons.

The tax rise is designed to offset the impact of the agricultural industry on climate change through high methane emissions. According to a recent study conducted by the authority, 90% of industry subsidies – totalling €57 billion per year, according to 2012 data – are harmful to the environment and work against Germany’s implementation of the Paris Agreement.

Currently meat and dairy in Germany are subject to a 7% value added tax (VAT) alongside fruit, vegetables and cereals, rather than the regular 19% tax rate. This led the Environment Agency to conclude that VAT reductions on animal products such as meat and cheese amount to environmentally harmful subsidies, and due to the environmental harm caused by meat and dairy products, these commodities should face a higher tax rate.

The proposal followed an announcement in February 2017 by the Minister for the Environment to ban the serving of meat from all official functions ue to the environmental impacts of meat.

Implications for Investors

Food and agriculture is one of the world’s largest industries, estimated to constitute 10% of global GDP (gross domestic product) by the World Bank. Livestock production is at the heart of the industry, constituting approximately 40% of the global value of agriculture.

It is an industry that practically all investors have some exposure to, and one that is of particular concern to those pension funds and institutional investors whose fiduciary horizon extends into a future that will see a more crowded planet with a more volatile climate and a growing obesity epidemic.

Looking at the long-term horizon in this way, the potential of a behavioural tax on animal protein products will be of material interest to investors

Meat tax: A material risk for investors

It is becoming clear that meat is on a similar pathway to tobacco, carbon and sugar. It is highly probably that over the medium to long-term some form of taxation on meat products will be implemented in some jurisdictions.

There is a growing and widespread international consensus that current levels of meat production generate health and environmental problems, and there is increasing evidence and quantification of the financial burden these issues put on the public purse. In the case of tobacco, carbon and sugar, the introduction of taxes came about relatively quickly after the first two factors – consensus and quantification – were accepted.

The most common argument against behavioural taxes, that they are regressive, is also already being addressed in the case of meat. For example, the charge that a meat tax will damage the farming industry is being addressed in Sweden by a new proposal that suggests reinvesting new revenues into both economic development and in transitioning farmers towards plant-based protein production.

Perhaps the biggest driver of change is the ‘less meat, less heat’ argument. Although a specific ‘meat tax’ has not gained any real traction in global legislatures, the idea of introducing a broader climate-related levy on food in general has enjoyed a relatively positive reception. Such a food climate tax is likely to tax different food stuffs proportionate to their environmental impact, and as such would likely be a ‘meat tax’ in all but name, given meat’s disproportionally high greenhouse-gas intensity compared to other food stuffs.

Although no legislature has currently adopted a formal meat tax, the analysis in this document suggests that investors with exposure to the global meat production should be conscious of this situation changing over the longer term.

A medium to long-term risk

Currently there is little short-term political will to introduce a significant tax on meat or dairy products. Where proposals have been introduced – such as in Sweden, Denmark and Germany – these have been largely consumer-facing and failed to win broad support. In the environmental arena, government policy action on climate tends to focus on incentivising incremental changes such as recycling rather than highly personal lifestyle choices such as eating less meat. However as global governments work to honour their commitments at the Paris Agreement and achieve the Sustainable Development Goals, and consumer awareness continues to rise over the impacts of intensive livestock production systems, the potential for this dynamic to be reshaped is clear.

The meat tax proposals that have emerged so far, such as those in Denmark and Sweden, have also had to contend with several practical issues such as which meat or dairy products would have a tax levied, and where in the value chain the point of taxation would be. In the case of Denmark and Sweden, both are focused on red meat and taxed at the point of sale to the consumer.

Furthermore, the case for a tax on meat as an effective mechanism to mitigate its production and consumption is still unclear. The early consensus that is emerging seems to be that the level of tax would have to be substantial to make a meaningful reduction in the negative social and environmental impacts being targeted. In order to radically reduce the impacts of livestock consumption and meet climate change targets, any tax on meat would also likely have to be combined with a range of other measures, such as changes to the agricultural subsidy system, investment in alternative proteins or financial incentives to encourage consumer consumption of plant based protein substitutes.

What might investors do

Enlightened investors will want to take note of this long-term trajectory and ensure they take action before further consumer pressure and regulation moves markets.

It’s clear that investors have a huge role to play in leveraging change within the corporate world. Corporate engagements such as FAIRR’s sustainable protein engagement will be key to managing this risk. The sustainable protein engagement, currently supported by 57 investors with $2.3 trillion AUM, highlights the risks and opportunities posed by reliance on industrially produced animal proteins and asks 16 major food multinationals to future-proof their supply chains by diversifying protein sources.

There is opportunity for investors here, as those who have identified and invested in food companies with a higher exposure to plant-based protein rather than animal protein are likely to reap rewards should there be taxation to penalise the meat industry.

Investors may also want to consider other options for managing this regulatory risk. For example, by asking food companies to adopt an internal accounting system that plans for he potential introduction of new food taxes in the same way companies heavily exposed to fossil fuels manage an internal price on carbon. According to environmental charity CDP, the number of companies adopting an internal price on carbon have risen dramatically from just 150 in 2014, to almost 1,400 in 2017.

In areas such as sugar we’ve seen investors catalyse quicker action from companies than might otherwise have been the case. For example a group of investors with $1 trillion of assets under management have used their influence with companies to ask them to adopt clear strategic goals to adapt to health and wellness trends and promote healthy eating.

Issues such as natural resource scarcity, climate change, antibiotic resistance or increased healthcare costs all pose economy-wide financial risks to large investors. As companies look to address these issues through their own strategies and explore how they can deliver on some of those global commitments working in collaboration with others, there is a real opportunity for the investor community to actively engage with them, with real opportunities to improve long term return on investments. It is critical that investors consider how regulation to mitigate such issues might affect the value of their holdings and their ability to meet future liabilities. The evidence suggests that meat taxes should be on the agenda.

How to engage investee companies

Has the company considered the implications of potential regulatory pressures on meat, including the possibility of a meat tax. What might the financial implications be in this scenario?

Has the company considered diversifying its protein portfolio exploring more plant based products tapping into changing consumer demand on this issue

Have targets been set to reduce meat content of certain composite product ranges?

Has the company got clear meat supply standards to mitigate potential health and environmental risks. For example does its meat production supply chain seek to reduce its environmental impacts or reduce the use of antibiotics

Are there opportunities for the company to promote healthier and more sustainable product ranges?

Is the company using its brand equity to promote healthy and sustainable diets and lifestyles more broadly, and to educate consumers on making better choices?