Introduction

The global food industry is currently undergoing enormous transformation led by rapidly evolving sector dynamics. Consumers are leading the charge, prioritising products and ingredients that are novel, nutritious, locally sourced and ethically produced.

Technology in animal protein production presents opportunities to improve product innovation and food safety but, equally, signals disruptive forces at work and amplifies risks that were once hidden by opaque supply chains. Hanging over this is the sectors' unique vulnerability to climate change impacts, and the implications on agricultural sourcing in a 2ᵒC - 4ᵒC world.

Nowhere are these dynamics more intensely felt than in the world of protein. The sector has enjoyed unrivalled growth as meat production has increased by more than 372% since 1960. A staggering 70 billion animals are slaughtered for food each year. The industry generates economic value of more than $1.3 trillion, a number that likely does not capture its full commercial value.

However, the protein sector is under increasing scrutiny due to the impact of its scale on people and the planet. And consumers are paying attention. In the US, where per capita meat consumption is among the highest in the world, a Johns Hopkins study found that 66% of consumers are eating less of at least one type of meat. Similar trends in the UK and continental Europe have led to a gap in the market as consumers seek protein substitutes that meet the taste, texture and flavour of meat, fish and dairy, without all the health and environmental implications. This demand growth has coincided with a food technology revolution that can provide such substitutes without using the actual animal.

These developments have challenged the long-held thesis that the only way for the food sector to grow (and feed a world of 10 billion people by 2050) is through the expansion of an intensive animal production system that prioritises cost efficiency over ethical, health and environmental concerns. For the first time since the advent of industrial animal agriculture nearly 60 years ago, alternative proteins - whether plant-based or cell-based - present a viable path forward to meet the global demand for proteins sustainably.

Main Drivers of Protein Diversification

2019 Market Snapshot

The plant-based foods market maintained a strong growth through 2018 and into 2019, with market analysis stating that "the shift towards flexitarian, vegetarian and vegan lifestyles is undeniable."

New data showing market growth and opportunity for the plant-based sector is compelling, both on a global and regional level. A new Euromonitor four-year outlook released in February 2019 estimates that the global meat substitute market is currently worth $19.5 billion globally. For meat substitutes excluding tofu, current global market size is between $4 and 5 billion. In terms of growth estimates, forecasts for annual global growth vary between 6.8% and 9.4% CAGR to 2025.

The US

New market analysis by GFI and Nielsen shows that between 2017 and 2018, retail sales of plant-based meat grew 23%, compared to 2% growth for total US retail food sales.

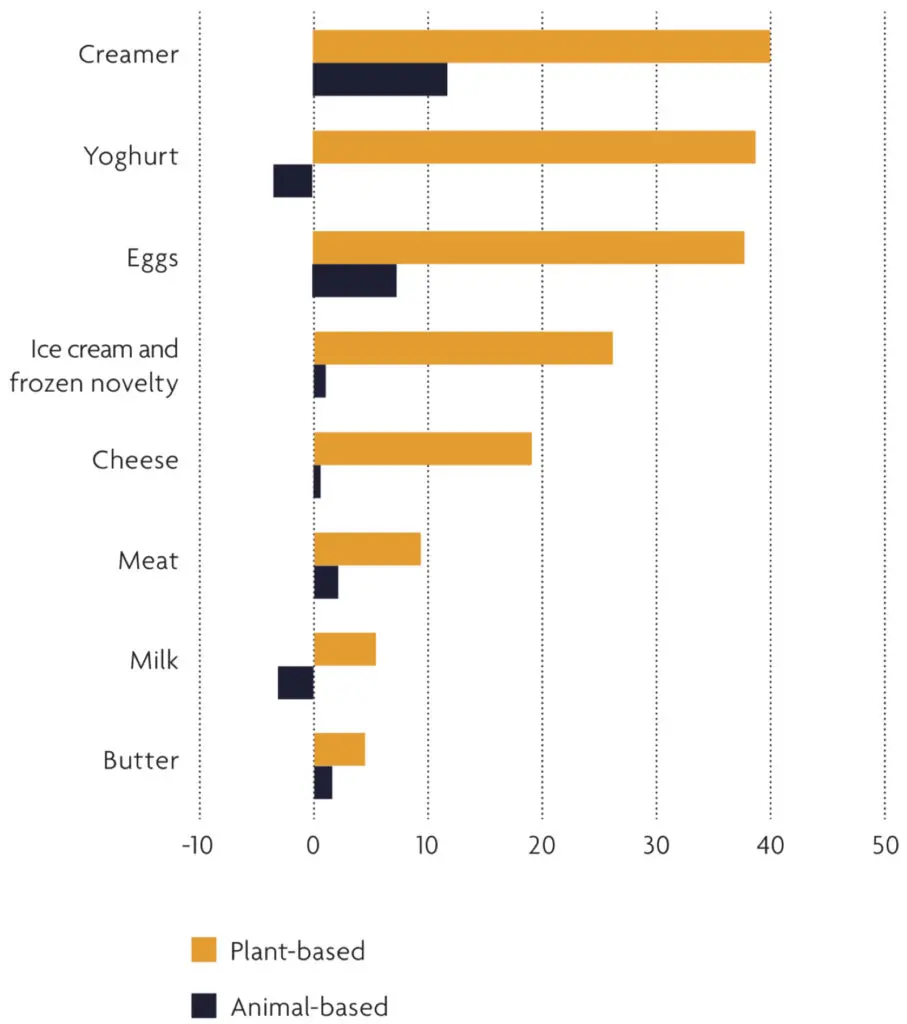

This is mirrored across individual product categories such as milk, cheese, creamer and yoghurt, where plant-based foods are significantly outpacing the sales growth of animal-based foods, and animal-based yoghurt and milk are demonstrating declining sales (see graph below). In terms of sales, plant-based milk was the largest individual category, with retail sales of $1.8 billion, constituting 13% of the total US retail milk market. The category has a household penetration of 37%, meaning a third of US households purchase plant-based milk.

Dollar sales growth (%) in plant-based categories compared to animal-based categories, year ending April 2019

(Source: Good Food Institute)

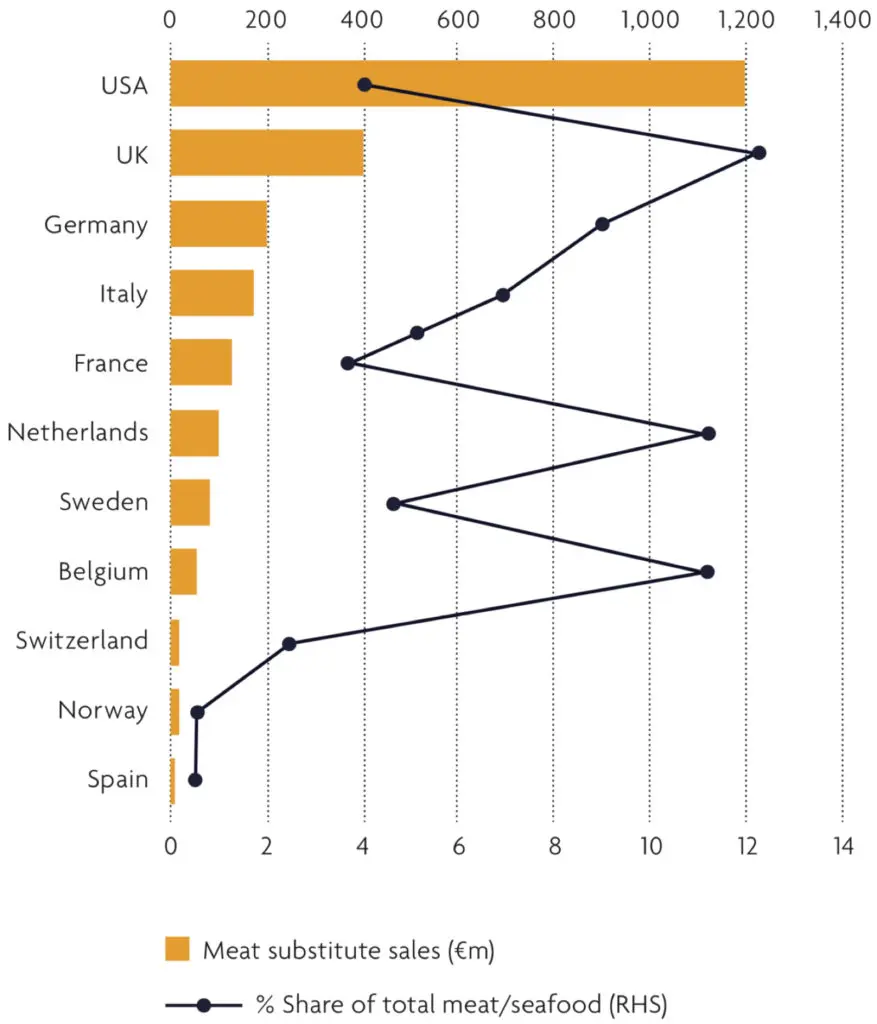

On a country level, the US remains the largest market for meat substitutes. Barclays Research estimates the US market to be three times the size of the UK, which is the largest market for a European country (€1.2 billion vs. €0.4 billion).

The US meat substitute market is far ahead of Europe and is three times larger than the second-placed UK

(Source: Barclays Research, Euromonitor)

Europe

Growth in Western Europe has remained relatively stable over the last three years with growth rates at around 10%, despite stable consumption for traditional meat products. A 2017 report from Rabobank suggested that alternative proteins could represent one-third of a total EU protein demand growth over the next five years.

In terms of market size, Europe is substantially smaller than the US. However, European countries typically have a higher market penetration for alternative proteins. For example, market penetration in the UK is 12%, which is three times that of the US, at 4%. Similarly, other major European markets including Germany and Italy show higher market penetration rates between 9-12% (see Barclays' graph above).

Asia Pacific

Traditional diets in Asian countries commonly incorporate non-animal sources of protein - for example, plant-based proteins such as tofu are a standard part of Chinese and Japanese cuisine. Similar to Western markets, however, there has been a dramatic spike in meat and dairy consumption in recent years. In China, for example, dairy consumption per capita has gone up from nearly zero in the late 1980s to 30kg per year today.

While Asia is the new frontier for meat and dairy consumption, it could just as well be the same for alternative proteins. Driven by health and food safety concerns, consumers are beginning to understand and respond to the benefits of switching to alternative proteins. For instance, Mintel research concluded that "Asia is a hot market for new alternative meat formats" and found that "over two in five urban Indonesians followed a plant-based/vegetarian/vegan diet in 2018, while three in five urban Thais cite avoiding red meat due to health reasons." In China, annual sales of plant-based meat have demonstrated consistent year-on-year growth rates of around 15% since 2014.

According to Allied Market Research, this region will show exponential growth in demand through 2025 with the highest CAGR of any region globally (9.4% in terms of value), driven by rising disposable income, and reflecting a nascent shift in social attitudes, as consumers become increasingly aware that current levels of meat consumption are environmentally unsuitable and can damage human health.

Food Technology and Innovation Overview

Food technology innovation picked up pace in 2018, with an explosion of activity from both start-ups and mainstream industry players. This innovation has been accelerated by an influx of investment into alternative proteins over 2018, with an estimated $673 million invested in the plant-based food industry alone.

Although total capital invested in 2018 was lower compare to 2017, due to Danone's $12.5 billion acquisition of WhiteWave Foods in 2017, the number of investments in 2018 increased by 39% compared to the previous year to reach a total of 46 deals.

In addition to a growing number of angel investors, venture capitalists, and accelerators and incubators infusing cash into the space, there is an increasing amount of investment activity from strategic food industry investors, including corporate venture capital arms such as General Mills' 301 Inc and Kraft Heinz's Evolv Ventures, as well as direct investments from producers such as Mapleleaf Foods, Cargill and Danone.

Areas of innovation

Primary innovation in food technology can be categorised into three technology areas. While these areas are presented as discrete categories in this overview, it is important to remember that use cases for the technologies as they go to market could be products that sit on a spectrum and exist as hybrid products, utilising more than one of these technology approaches to create a final product.

Plant-based proteins: These constitute products that replicate animal proteins in texture, flavour and aroma through the use of plant sources that can mimic the structure of animal proteins on a molecular level (e.g. mung bean, lupin, algae, mycoprotein) and/or through novel processing methods (e.g. extrusion, shear-cell technology). These products are helping to rethink 'meat' and 'milk' as products defined by their molecular structure and composition rather than their animal-based origin.

Biotechnology approaches

Two new approaches to alternative proteins are creating real animal proteins without the animal, rather than replicating these proteins with plant ingredients. Both of these technology areas build on recent advances in biotechnology and hold immense promise for efficient and sustainable protein production in the future.

Fermentation: Fermentation technology is already used for selected existing food applications, such as rennet in cheese, and also produces the heme used as a key ingredient in the Impossible Burger; it is poised to expand to broader product categories, such as dairy. Specific animal proteins such as caseins found in milk and ovalbumin in egg can be produced without the animal through a fermentation or brewing process where yeast organisms or another host are programmed to produce the proteins. These proteins are identical to proteins produced by an animal and can be combined with other ingredients to create identical protein products, such as milk, cheese or egg whites.

Cell culture technology: This technology refers to the growing of meat cells in a nutrient-rich culture medium to create whole pieces of meat instead of harvesting meat from animals. The process involves many of the same tissue engineering techniques that were developed for regenerative medicine.

Regulatory Overview

The acceleration of the alternative protein sector has kickstarted a new era of regulatory activity as governments try to keep pace with the proliferation in product development and innovation.

Overall, regulatory activity is favourable to the sector, with policymakers creating regulatory pathways to account for new production methods, technologies and ingredients while ensuring sufficient oversight on areas like food safety. Equally, however, regulation is being used as the new battleground by the traditional (and powerful) animal protein lobbies to push back on the alternative protein sector's explosive growth.

FAIRR View

Investors must be wary of proposals to constrain the labelling of alternative proteins

Similar to health, nutrition and sustainability issues, it is important that companies do not use their lobbying and financial support to constrain the growth of alternative proteins. This presents a potential arena for greater company engagement so investors can assess how global companies (and their trade associations) engage policymakers and governments in the sector.

Alternative proteins offer major opportunities for investors while enabling a reduction in the externalities associated with intensive animal-based food production. Multiple studies, from the ground-breaking EAT Lancet report to research by Oxford scientists and the World Resources Institute, have emphasised the need for a dramatic reduction in meat and dairy consumption to stay within planetary boundaries. IPCC’s most recent report stated that “dietary shifts could contribute one-fifth of the mitigation needed to hold warming below 2°C.”

The legal basis for similar ‘standards of identity’ claims is limited, at least in the US, as previous court rulings have been sceptical of claims regarding consumer confusion.

There is considerable diversity in views even within the food industry on this issue. Meat companies, including Tyson, Cargill and Maple Leaf, which have made investments in plant-based and cell-culture technologies, have stayed silent. And wider industry groups such as the Grocery Manufacturers Association have come out against labelling restrictions.

Investors have been clear: regulation should not be misused to stifle innovation, consumer choice and climate action. The issue highlights some interesting parallels with other carbon-intensive industries, including oil and gas. In these cases, investors have pushed for companies to engage positively on climate change policy rather than oppose the development of alternative solutions.

Lobbying on labelling is not an effective use of company resources. In the EU, where the European Court of Justice has ruled that plant-based foods cannot be sold using terms such as milk, butter and cheese, brands have gotten around this by labelling themselves as ‘mylk’ or ‘m*lk’.

Investor Engagement on Protein Diversification

FAIRR's sustainable protein engagement is the first global investor engagement to encourage the world's largest food companies to develop a global, evidence-based approach to diversify protein sources away from an over-reliance on animal proteins.

Phase 1 of the engagement was launched in September 2016 and focused on 16 food companies. In its first year, it was supported by 36 investors with a combined $1.25 trillion of assets. This investor support has doubled at each round of the engagement since launch (coinciding with an increase in the company targets from 16 to 25). Currently, in Phase 3, the engagement has 74 investors with combined assets of $5.3 trillion in support. This illustrates the growing investor interest in the importance of sustainable protein, and understanding of it as a cross-cutting business issue, which is critical to long-term value creation and mitigating key risks, from climate risk to resource scarcity and human health.

Investor support for FAIRR's sustainable proteins engagement has quadrupled since its launch

Evaluating Company Progress

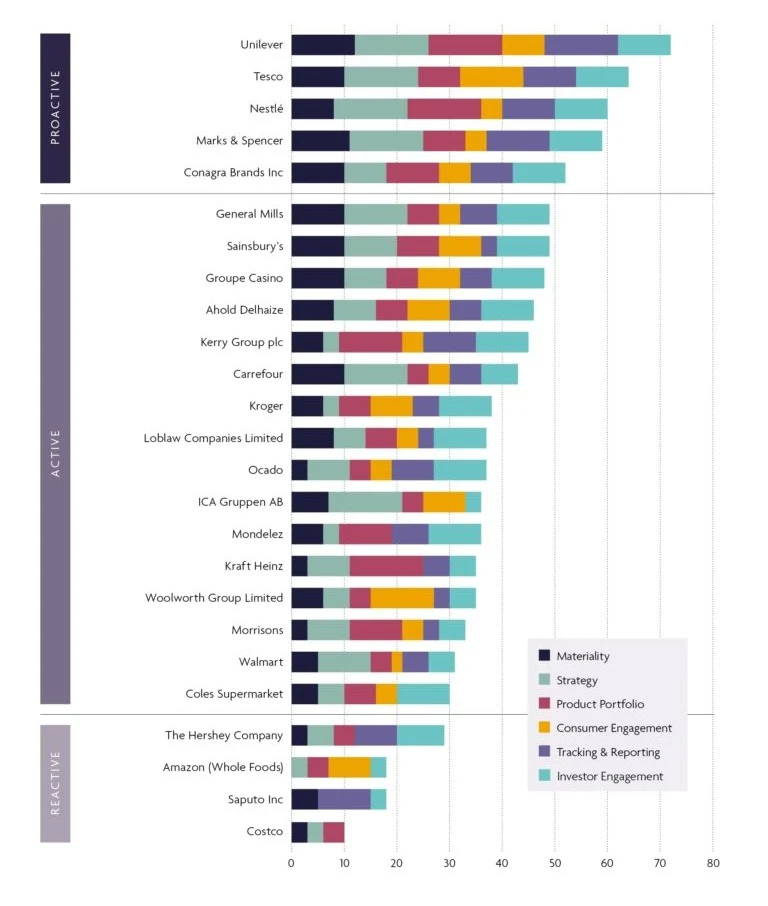

FAIRR's evaluation framework assesses companies in six categories: Materiality, Strategy, Product Expansion, Consumer Engagement, Tracking & Reporting, and Investor Engagement. The assessment categories are designed to track company approach to mitigating supply chain risks in animal protein commodities, as well as their approach to expanding alternative protein portfolios through product development and consumer engagement.

The six assessment categories are each supported by five key performance indicators (KPIs), which have been customised for retailers and manufacturers.

Overview of FAIRR's Six-Part Evaluation Framework

Materiality

Company acknowledges high animal protein exposure as a material business risk and board-level support for portfolio transition

Company has completed scenario analysis and has developed a clear understanding of climate risk impacts on protein sourcing

Strategy

Company has time-bound commitment(s) in place to transition multiple categories to more sustainable product choices

Percentage based absolute emission or science-based target on Scope 3

Product Expansion

The company demonstrates evidence on:

Resourcing in R&D and/ or cross-sectoral collaborations

Product reformulation across categories

Expanded product portfolio

Consumer Engagement

The company demonstrates evidence on:

Product promotions and marketing initiatives to encourage plant-based consumption

Merchandising plant-based products adjacent to conventional categories

Tracking and Reporting

The company discloses formal metrics to track protein exposure and Scope 3 emissions in annual public reporting

The company engages with the investor coalition on this issue

Benchmarking Company Progress

Ranking of 25 companies using FAIRR's evaluation framework. Proactive companies demonstrate evidence of addressing the risks in their animal protein supply chains as well as expanding their alternative protein portfolios.