For companies that sell meat, milk and egg products, a diversified protein portfolio is one of the most efficient and profitable paths for addressing the growing ESG risks associated with animal protein supply chains. A key strategy for contributing to the Sustainable Development Goals (SDGs), it’s no surprise protein diversification has become an important growth driver and climate risk-mitigation tool for food companies worldwide.

Unpacking Protein Diversification

Protein diversification refers to the transformation of existing and future portfolio composition by shifting away from an over-reliance on resource-intensive animal proteins towards lower impact protein ingredients and products. These can include plant-based, cell-cultured, fungal-based and whole-plant alternatives to meat, dairy, seafood and other animal proteins. Such a transformation relies on the development of a cross-functional strategy involving research & development, marketing, and sustainable sourcing.

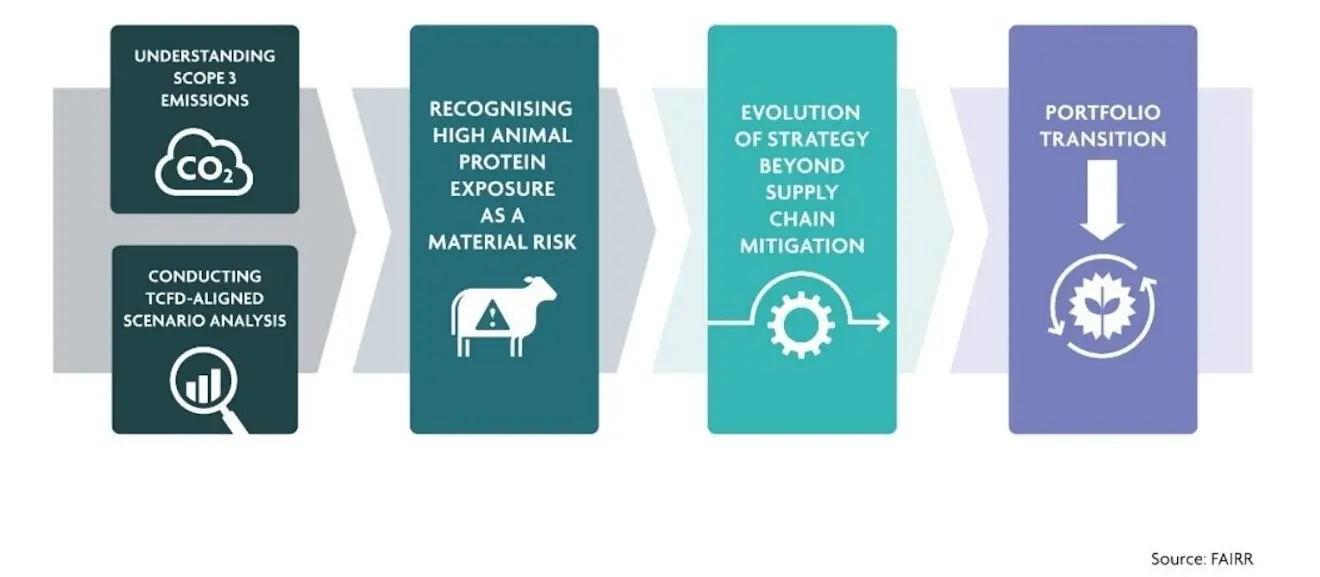

Last month, the FAIRR Initiative published the results of its engagement with 25 of the world’s largest food retailers and manufacturers including Tesco, Marks & Spencer, Unilever, Nestle and Walmart. We found that there is a common pathway that companies are following when establishing their approach to protein diversification. For investors, this pathway to action provides a useful roadmap for charting the different stages companies tend to move through on the road to protein diversification.

The road to protein diversification begins with an evaluation of a company’s current and future risk exposure to animal protein supply chains. This means risk-assessing and quantifying value chain emissions, including those from animal agriculture, to pinpoint the sources of these emissions. It also involves analysing strategic implications of growth plans predicated on a higher reliance on animal protein sources. TCFD-aligned scenario analysis is another important tool for stress-testing the resilience of animal protein supply chains to various future climate outlooks. These quantitative methods provide an evidence base for determining the material risk of high, undiversified exposure to intensively-produced animal proteins, and can then inform the development of holistic climate mitigation efforts.

FAIRR’s engagement found that 87% of companies that carried out TCFD-linked scenario analysis on agricultural sourcing, and/or quantified Scope 3 emissions from animal agriculture, publicly recognise and discuss the environmental impacts associated with their animal agriculture portfolios. More importantly, scenario analysis has influenced the evolution of many companies’ strategies, prompting a re-evaluation of existing supply chain efforts and a move towards a dual approach – one that includes supply chain impact reduction and mitigation, but also reviewing ingredients and transitioning to sustainable alternatives wherever possible.

Mondelez, for example, has assessed its total value chain emissions and identified dairy as a key contributor. As a result, dairy is included in its new SBTi-approved target and the company is working to develop a climate mitigation strategy for its dairy supply chain. Companies like Tesco and Unilever are going a step further and are exploring demand-side interventions that go beyond simply increasing product choice for consumers.

The Recipe for Change: Time-Bound Targets

The next crucial stage in the journey for companies making the shift towards sustainable proteins is the adoption of clear time-bound commitments or milestones, which are crucial for measuring progress and ensuring accountability.

Currently, no company in FAIRR’s engagement has set time-bound, board-endorsed commitments to transition multiple categories and/or brands towards low-carbon and less resource-intensive ingredients and products. Companies like Kerry Group and Unilever have indicated that they have internal targets to support the expansion of plant-based products and solutions, but these are not publicly available. It is also unclear whether these targets are focused on simply increasing volume or sales of plant-based and alternative protein products, rather than guiding a portfolio transition to help moderate the excess consumption of animal proteins.

A Vital Ingredient: Investor Engagement

Investors must, therefore, engage with investee companies, directly and/ or through FAIRR’s engagement to encourage greater disclosure and transparency from food companies on their approach to protein diversification and specifically how progress is being measured at the supply chain and portfolio level.

FAIRR’s Sustainable Proteins Hub shows that many global food brands have laid the foundations for a robust protein transition by undertaking the early stages of the roadmap outlined above, but haven’t yet pledged time-bound commitments to diversify their protein sources. Investors will be watching closely to identify the industry leaders that take that step towards mitigating climate risks and impacts, and driving long-term growth.

Next on the Menu

Next week, FAIRR will be exploring the different types of sustainable sourcing programmes that food companies are using to address growing environmental issues like deforestation, water use and biodiversity loss in animal protein supply chains. Not all programmes are built equal, so stay tuned to find out what a good sustainable sourcing strategy looks like.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.