Water is the most essential resource for life – no living species can survive without it. But despite freshwater being critical for humanity and all ecosystems, existing water resources are being put at high risk by challenges such as population growth, climate change, and irresponsible use by some sectors. The challenges of water scarcity are becoming a reality and pose a real short and mid-term danger to multiple industries, with agriculture at the forefront.

Water Risks on the Rise

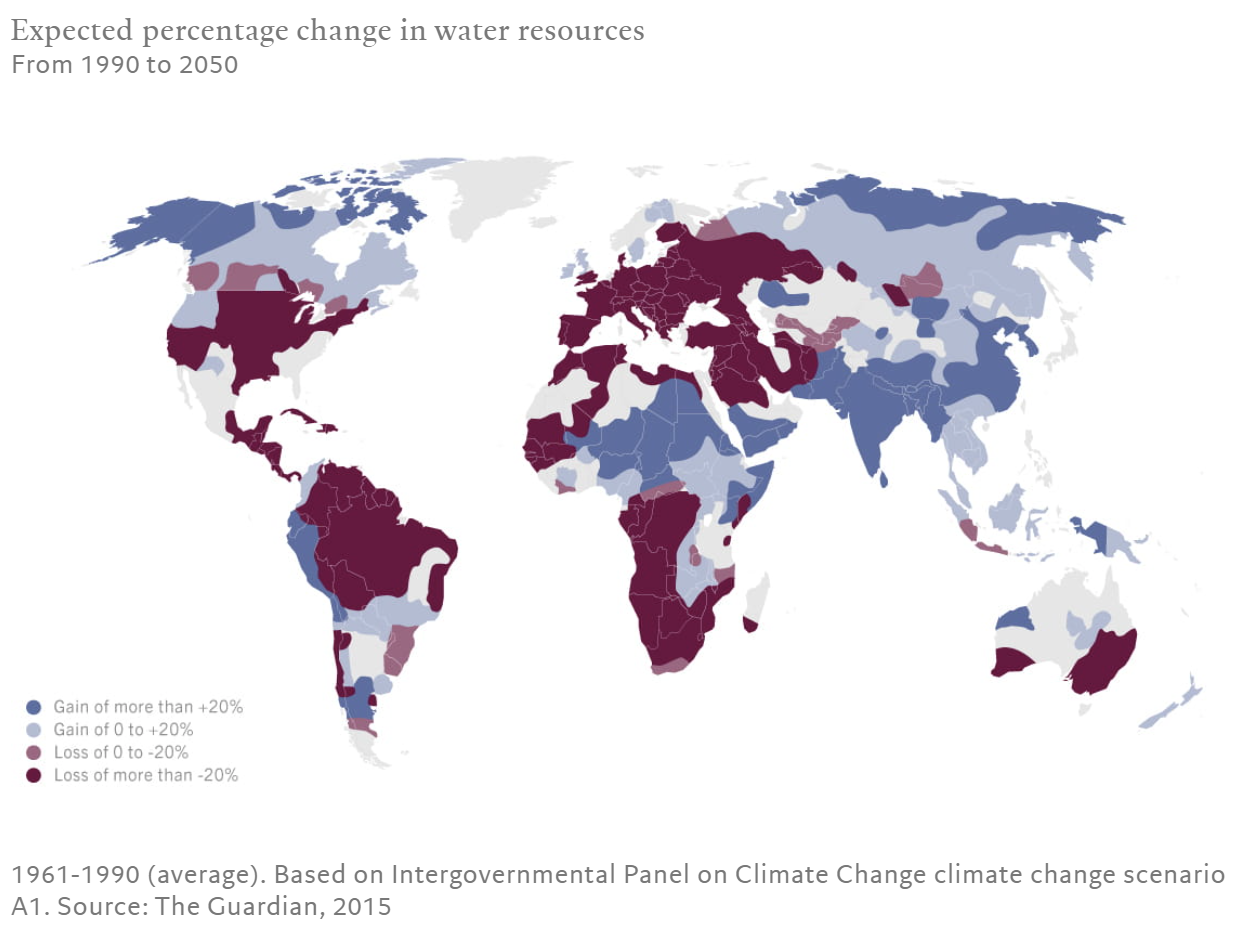

Nearly three-quarters of natural disasters in the last 20 years have been water-related and have amounted to a total economic damage of almost $700 billion. One of the main drivers of water-related risks is climate change, which increases the chance of rainfall extremes, leading to droughts and flash flooding. For instance, Somalia is experiencing the worst drought in decades, causing increased famine risk, while America’s western states are also facing droughts resulting in aridification. Within Europe, the driest winters on record have led to extreme water shortages and depleted river systems increasing the risk of drought. European regulators are responding to this risk through legislation and are embedding water risks into their strategic planning. New laws have been introduced in Catalonia, Spain, this year, to tackle the issue of water scarcity, including a 40% reduction in water used for agriculture. The German Federal government has also released a National Water Strategy for all sectors, including agriculture, to prevent the overuse and deterioration of water resources. The risk of groundwater levels falling to below three-quarters of their monthly average has forced President Macron to develop a national water plan.

The last two years have shown that governments, companies and investors can no longer ignore the risk of water scarcity. In parallel to these developments, several asset managers have launched water-themed investment strategies and funds, including Natixis, Pictet and Robeco. Water ETFs have also increased in popularity, such as the iShares Global Water ETF or the Lyxor World Water ETF.

Source: Pictet; The Guardian

The Water Footprint of Agriculture

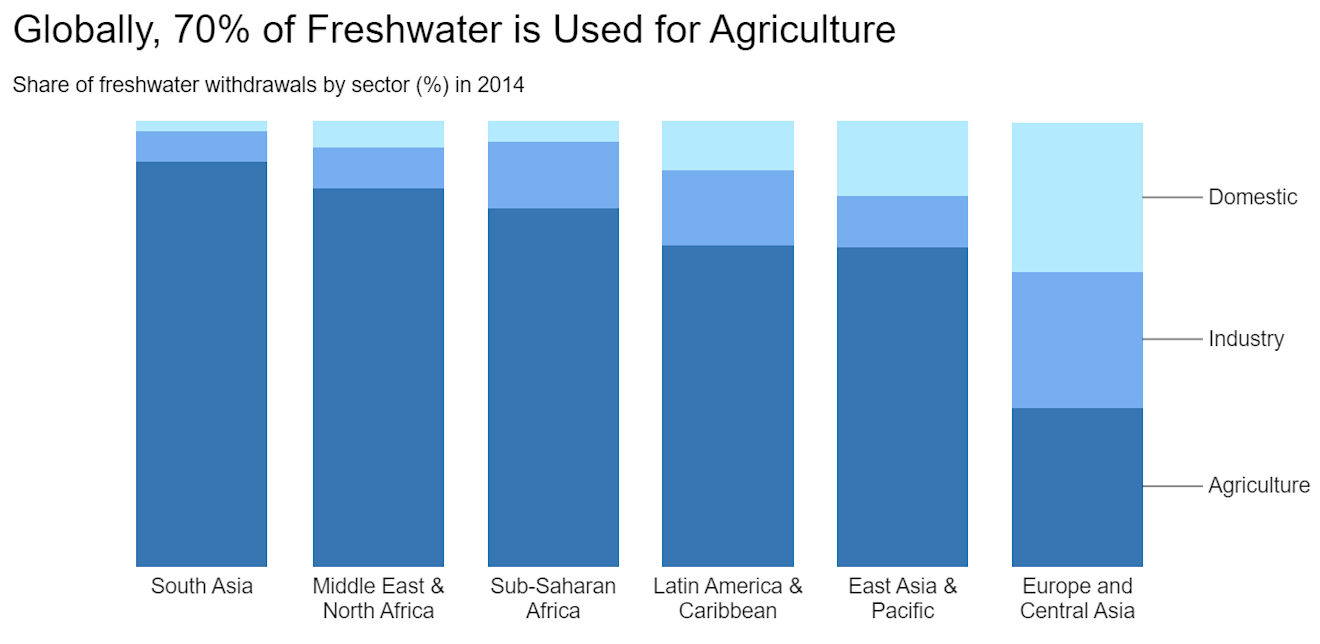

Freshwater is supplied by river systems and groundwater. All industries rely on water in their operations. However, the agricultural industry is responsible for 70% of freshwater withdrawals globally for the production of food fibres, livestock and industrial crops. A recent study of the Colorado River Basin showed that of the 1.9 trillion gallons of water consumed in a typical year, 79% is used in agriculture, out of which 55% is used for livestock feed production. Meanwhile, crops grown for human consumption account for less than 25% of the water required in livestock feed. According to estimates by the Water Footprint Network, producing a kilogram of beef requires 15,000 litres of water, making the average water footprint per gram of beef 60% more than of pulses.

Increasing variations in rainfall patterns, combined with withdrawal rates of surface water, will increase the reliance on groundwater, which accounts for 99% of all freshwater on Earth. In arid and semi-arid regions, groundwater is critical for sustaining local food systems acting as a buffer to droughts where water levels are already low. However, similar to surface water, agriculture accounts for more than 80% of freshwater withdrawals from groundwater.

Source: World Bank

A Double Materiality Scenario

Agriculture is and will be severely impacted by water scarcity, but it also contributes to water risk as a major user and polluter of water resources across the world. Thus, it has a vital role to play in addressing the challenge. Water risks are financially material and can present as physical, transitional/regulatory and reputational risks. In an extreme scenario, if water availability becomes too scarce in specific locations, it can severely impact or even stop a company’s operations. For example, in 2022, the beef industry in Northern Mexico lost 30% of cattle herds due to an unprecedented drought. This year in Argentina, the financial impact of drought on beef producers is estimated to surpass $10 billion and result in a reduction of about $8 billion worth of exports.

The water footprint of livestock production is driven by crop farming for animal feed. It is estimated that 98% of all water used to produce meat is from animal feed production, yet, 72% of livestock companies assessed by the Coller FAIRR Protein Producer Index do not disclose how they address water scarcity risks in animal feed. Additionally, very few companies undertake location-specific water risk assessments and so are unable to understand or navigate the exposure to water-related risks in their operations.

The Coller FAIRR Protein Producer Index has also shown that wastewater management in the livestock sector is not optimal; 64% of companies are still ranked as ‘High Risk’ based on KPIs related to wastewater management. For instance, in the US, slaughterhouse wastewater has the highest discharge levels of phosphorous and second-highest nitrogen discharge levels across all industries. This is despite the industry being regulated by the Environmental Protection Agency (EPA). Lawsuits and community opposition related to pollution in local waterways are becoming more common in the US, highlighting the reputational and legal risks posed to companies and investors.

Throughout the livestock value chain, increased disclosure on how companies minimize their use of water through solutions, such as improved water infrastructure and investing in better wastewater treatment is urgent. However, there are signs of optimism, with a small group of companies leveraging partnerships with NGOs and local governments to help build capacity among suppliers. Chinese company Muyuan has a water conservation system that recycles water from animal husbandry, while Brazilian company Marfrig provides technical assistance for suppliers in regions of high water stress. The livestock sector is highly dependent on water for animal feed but is a crucial driver of water scarcity and pollution, showcasing the need for companies and investors to navigate the risks and allocate capital for water solutions.

Better Finance and Better Policy are Key to Tackle Water Risks and Scale Solutions

Surface and groundwater bodies are increasingly impacted by pollution from the agricultural industry and its reliance on water resources. High concentrations of manure disposed of close to rivers and agricultural run-off lead to nitrogen pollution and eutrophication of large areas of rivers and lakes. It is estimated that 50% of freshwater biodiversity loss is attributed to the food system. Policymakers have the power to enact measures to strengthen regulations that set limits and issue penalties to safeguard water resources from overuse and pollutants. However, investors can play a critical role in using their influence to encourage better management of water resources across industries while allocating capital towards innovations that reduce water contamination and promote more efficient use of water resources. The water utilities and water treatment sector will be critical in developing better systems for water use, filtrating polluted water and cleaning contaminated sources. Investors can use their influence to accompany the sector to push for better disclosures and more significant amounts of investment into such innovations.

Meat-intensive diets are a key part of the challenge as the livestock sector is the largest consumer of water, consuming on average between 25%-33% of global water resources. A shift in dietary patterns towards more diverse diets with less meat can reduce the stress on water systems. This provides an opportunity for investors to allocate capital towards companies (both private and public) that are producing meat and dairy alternatives, as well as promoting more diverse and drought resistant protein-rich crops such as amaranth or cowpeas. Additional opportunities for investors include companies making strides in agricultural water technologies, such as innovative filtration technologies, innovations in drip irrigation, or sophisticated sensors to monitor use which can drastically reduce water consumption. Food and water security are inextricably linked and must be considered in conjunction by policymakers too. Establishing these links and implementing proper governance and regulations across food and water systems is essential to strengthen food security while reaching broader environmental and sustainable development goals.

There is a universe of private and public companies delivering products and services that provide solutions to the challenge of water scarcity. Investing in the companies delivering such innovations is an important way for investors to drive impact and support the scaling of such solutions. In parallel, investors can use their influence to push the water-intensive livestock sector to minimize its contribution to our water challenges. Investing in innovations that preserve water resources and effectively manage water risks is crucial for our planet’s future. Clean water is indispensable and solutions for water risks present a significant investment opportunity.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.