It is estimated that to date, the world has lost roughly one third of its forests – equal to the area twice the size of the United States. According to the FAO, around 420 million hectares of land suffered forest loss since 1990, primarily in Africa and South America. In addition, current rates of deforestation could put 28,000 species at risk of extinction and threaten the livelihoods of more than 1.6 billion people.

One of the main drivers of deforestation is commodity agriculture. For example, cattle ranching accounts for 80% of deforestation in the Amazon. In addition, soya covered 76,400 ha of recently deforested land in the Amazon in 2020, with 77% used as feed for animals farmed for human consumption. The loss of nature and biodiversity that stem from deforestation poses material risks for investors as over $44 trillion of economic value generation – over half the world’s total GDP – is moderately or highly dependent on nature. Some industries, such as pharmaceuticals, rely on the direct extraction of resources from forests – while others, like food production, depend on the provision of ecosystem services like clean water and a stable climate.

EU consumption alone is responsible for 16% of tropical deforestation linked to international trade, second only to China. Action on Agriculture, Forestry and Other Land Use (AFOLU) emissions is vital for achieving the Paris Agreement goals, with the largest potential for reduction stemming from reduced deforestation and forest degradation. Investor interest in the issue has been on the rise for years but is bedevilled by the problem that investor tracking of deforestation can be problematic and inaccurate. It therefore comes as very welcome news to investors that the EU has agreed to adopt a law that will ban the trade of commodities associated with deforestation and forest degradation. This blog takes a closer look at the new EU legislation and examines similar policies globally.

EU Deforestation Regulation in a Nutshell

On 6 December 2022, the European Council, Parliament and Commission agreed on a preliminary deal to adopt the deforestation-free regulation. This is a first of its kind law that tackles deforestation caused by consumption, including key agricultural commodities that are the main drivers of forest loss: cattle, cocoa, coffee, oil palm, rubber, soya, wood and derived products (such as leather).

Under the legislation, companies will be required to issue a due diligence statement verifying that the goods they import into the EU do not originate from deforested land and have not led to forest degradation anywhere in the world after 31 December 2020. Commodities will be benchmarked to ascertain the risk of the product being linked to deforestation (high, standard or low), with the benchmarking system to be updated periodically to reflect changes in production patterns. However, financial institutions that lend to commodity producers are currently excluded from its scope.

The EU regulation on deforestation-free products assesses the level of traceability within the importing corporates’ supply chains. Within two years after the law enters into force, the financial sector will be required to conduct due diligence checks and stop investments that cause deforestation. Therefore, the legislation has the potential to disrupt both corporates and investors that fall short of the required level of traceability and responsible supply chain sourcing.

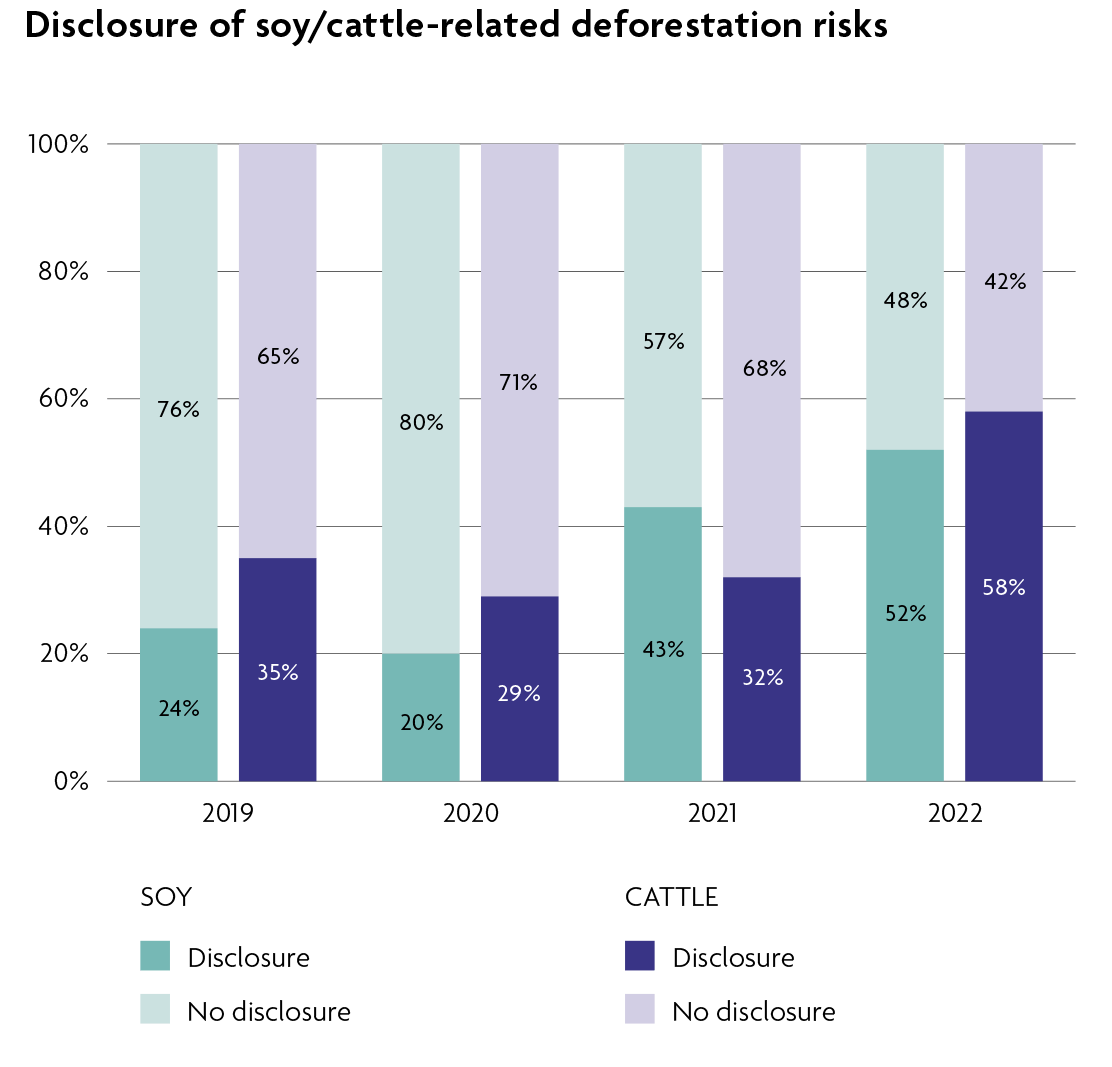

The new legislation is an essential step as the livestock sector remains highly exposed to ESG risks linked to direct deforestation for cattle, as well as indirect deforestation in the form of soya for animal feed. FAIRR’s analysis of the robustness and strength of the largest animal protein producers’ deforestation targets shows that nearly half of the companies assessed on soya/cattle sourcing have no public discussion of deforestation risks linked to their supply chains (Figure 1).

Figure 1

Source: FAIRR

What’s Missing?

Not All Relevant Commodities Are Covered

Dairy is excluded from the legislation, but dairy cows will be indirectly affected by it if they are fed soya. For example, soya use in dairy cow feed in the UK accounts for 8-15% of the total. In addition, the EU law will not regulate corn, which is often imported into the EU for chicken feed and has been linked to Amazon deforestation in the past. The legislation also excludes salmon, poultry, pig, and sheep meat derived from all soya-fed animals. Agrifood stakeholders and the EU farmers’ association COPA-COGECA issued concerns over this loophole which is likely to put the EU farming sector at a competitive disadvantage. Although imported goods are subject to the same standards as those produced in the EU, this only applies directly to those commodities but not further down their supply chains.

Does Not Protect Other Wooded Ecosystems

Other wooded ecosystems, such as savannas and wetlands, which have trees but are not a dense, closed forest, are currently excluded from the EU legislation. While savannas and wetlands are considered non-forest ecosystems, they are important carbon stores, serve as a refuge for wildlife, and provide livelihoods for indigenous people and local communities. This means the new legislation will not apply to the Cerrado in Brazil, the most diverse tropical savanna in the world and with one of the richest vascular plant flora on the planet. Around 40–55% of the Cerrado has already been converted to croplands, pastures, and planted forests. More than half of Brazil’s soya crop is produced in the Cerrado, of which 16% is exported to the EU, primarily for animal feed. A 2020 study found that a fifth of EU soya imports from Brazil may originate from illegally deforested land.

However, in the first review of the regulation, due to take place before September 2024, the EU will consider including ‘other wooded lands’, which would increase coverage of the Cerrado from 26% to 82%. Subsequently, in September 2025, the inclusion of grasslands and wetlands will be considered.

Loose Definition

The European Parliament adopted a wider definition of ‘forest degradation’, covering conversion of primary forests or naturally generating ones to plantation forests. It therefore does not address the degradation within an existing forest due to timber harvesting and large-scale clear-cutting of native forests unless the land is converted to another use. The definition was adopted under pressure from the European forestry sector and the Canadian government and, unless made more precise, will allow continued unsustainable logging of natural forests.

The good news is, however, that the EU Commission proposes a ‘progressive scope’ of the commodities to be regulated, reviewing and updating the list regularly, taking into account new data, which will allow adapting it to changing deforestation patterns.

What About Other Countries?

Governments in a handful of other countries have proposed similar policies. The US recently unveiled the FOREST Act, a bipartisan risk-based framework for increasing transparency and reporting in companies’ supply chains, which will provide financial and technical assistance to reduce illegal deforestation. If this bill passes, it will apply to commodities like cattle and soya and, as the US is one of the largest beef importers in the world, could be transformative. This legislation is not expected to pass for another couple of years but when it does, it would only cover illegal deforestation, lagging behind the EU legislation which will apply to all deforestation.

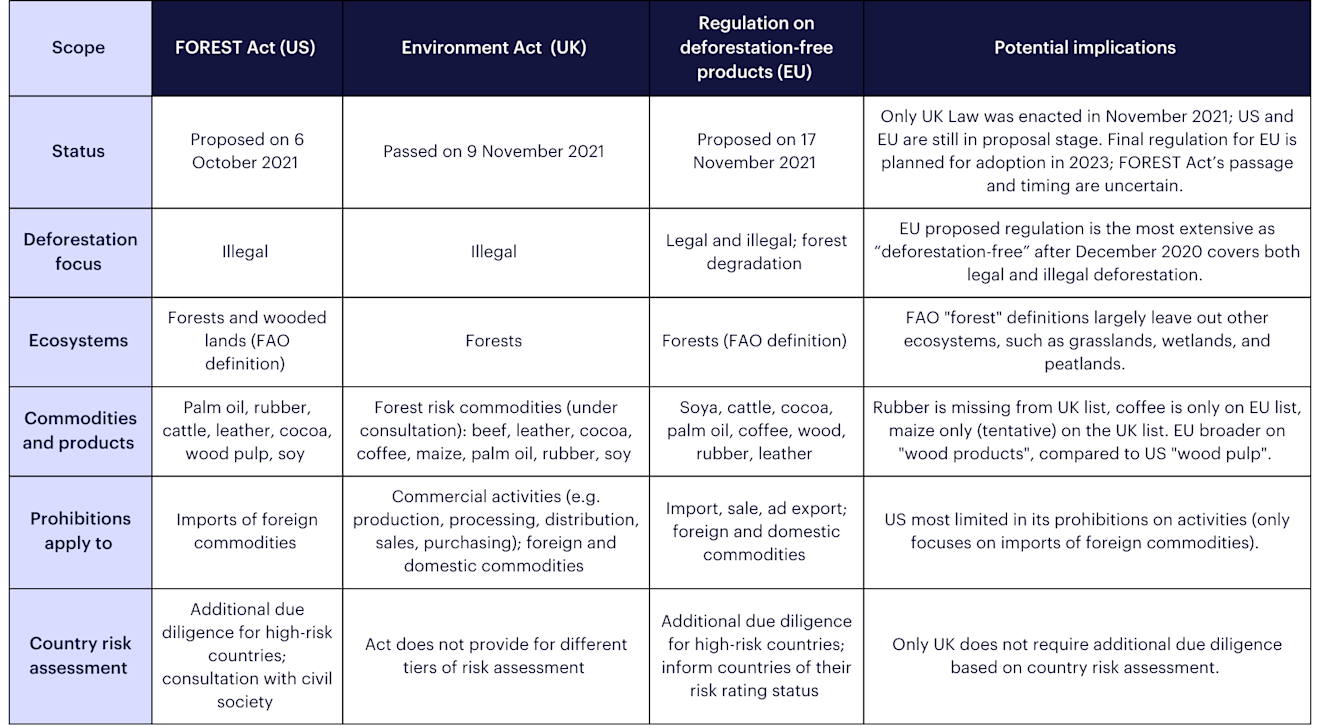

Other similar regulations to the EU law include the UK Environment Act 2021, which limits imports of commodities linked to illegal deforestation, and deforestation-free procurement laws and policies, such as those in France (policy, 2018), Norway (law, 2016), and Wales (policy, in progress). Table 1 presents an overview of differences and similarities between the US, UK and EU regulations.

Table 1

Sources: Etelle Higonnet; AidEnvironment, based on Brazil Climate Action Hub, Presentation at COP26, 10/11/2021; Steptoe Global Trade Policy Blog, January 2022

How Can Investors Engage With Policymakers to Address These Risks?

Investors have been one of the most important and powerful voices in helping pass the EU regulation. Investors worth several trillions in AUM spoke out positively in favour of deforestation-free laws, and this helped to counterbalance some negative lobbying by other entities endeavouring to water down the law.

Going forward, investors can play a key role engaging with companies to improve the disclosure of deforestation risks and protections in their supply chain, so as to be in compliance with current laws but also in order to be compliant ahead of time with future bills that are likely to pass. They can also engage policymakers on deforestation risks include supporting and providing comments to governments and policy makers on deforestation-related disclosure requirements. As noted above, investor letters to policymakers have backed the US FOREST Act with similar support for deforestation-free US state level legislation by California and New York legislators. In addition, investors and businesses have also called on policymakers to make nature-related disclosure mandatory which would provide more information for investors on exposure to deforestation risks.

Previously, FAIRR convened a Statement of Support for the objectives of the Cerrado Manifesto aimed at halting forest loss associated with agricultural commodity production in the biome. In addition to engaging with policymakers, at COP26, investors with over $8 trillion coordinated by the High Level Champions team also committed to tackling deforestation in their own portfolios.

Sustainable management of land that prohibits and prevents deforestation, land conversions and land use change linked to commodity agriculture and other anthropogenic activities is essential for both tackling climate change and preserving biodiversity – two systemic risks facing the world economy today. If left unaddressed, they present significant implications for clients’ assets in wealth management. The EU regulation on deforestation-free products will provide the required level of traceability, which will improve environmental impact accounting, reporting, tracking progress and assessment of organisations’ deforestation impact.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.