Avian influenza – also known as bird flu – is actively spreading and mutating, with growing concern from virologists, public health experts and governments that the virus is one mutation away from being able to spread between humans.

Last month, the European Centre for Disease Prevention and Control noted that bird flu viruses are posing “an increasing threat, with the potential to adapt to humans and trigger future pandemics.”

Over the past year in the US, it has infected millions of laying hens, thousands of dairy cows, and dozens of people. To date, everyone who has caught bird flu has had direct contact with ill animals, with no evidence of person-to-person spread.

But if the virus evolves to spread easily between people, it could – depending on severity – present a systemic risk to the global economy and food system, like that experienced as a result of COVID-19.

Bird flu already presents material risks to investment portfolios, as this Insight piece explores, while also highlighting how investors can prepare to address them and navigate future shocks.

Bird flu has been around for years, so what’s new?

Highly Pathogenic Avian Influenza (H5N1), first seen in domestic birds in 1996, has become increasingly prevalent among wild and domestic birds around the world, with a large-scale infection in commercial poultry flocks recorded in Europe between 2021 and 2022.

In the spring of 2024, for the first time, bird flu was detected in dairy within weeks, the first case of a person contracting bird flu from a cow was reported, as FAIRR has previously highlighted, and in the time since, the virus has been spreading virtually unchecked through dairy cow populations across the United States.

So far, 957 dairy herds across 16 states have been infected by bird flu, while 67 people – mostly dairy workers – have become infected with bird flu from cattle.

Although this cattle strain (B3.13) is milder in humans than those circulating the world for the past three decades, the number of people infected and the rapidness with which it is mutating are concerning to virologists and public health officials.

H5N1 also continues to decimate poultry populations around the world. In the US, more than 40 million egg-laying chickens died in 2024, about 13% of the national total. In the first five weeks of 2025, another 27 million have died.

Cases of humans being infected with bird flu from interactions with sick birds have also been reported in the US, Canada and the UK in recent months, furthering concern around the possibility of mutations.

These incidents are concerning and importantly, are not emerging in a vacuum. Stressful and overcrowded conditions in industrial farming can increase the risk of disease outbreaks, which then necessitates the heightened use of antibiotics to prevent and treat illnesses, resulting in antimicrobial resistance, as FAIRR has highlighted extensively.

The effects of climate change, such temperature fluctuations and droughts, only add to the likelihood of bird flu outbreaks in “genetically similar and stressed animals”, conservation scientists point out.

How do bird flu outbreaks impact investor portfolios?

The spread and development of the current bird flu outbreak has varied and complex implications for consumers, businesses, and investors alike, ranging from supply chain disruptions to potential product recalls.

Bird flu in poultry

Since October 2021, H5N1 has killed more than 300 million birds worldwide, through a combination of flu-related deaths and culling, affecting the livelihood of millions of people. It has been reported in 108 countries and territories over five continents in the last three years, the UN estimates.

The US Department of Agriculture (USDA) has pumped more than US$1.7bn into combatting bird flu on poultry farms since 2022, including reimbursing farmers that have had to cull their flocks.

Compensating farmers for livestock losses may not be feasible for governments in low- and middle-income countries, and even in wealthier nations, it is a financial strain on public coffers. Further, even in countries able to make such payments, they do not eliminate other materially relevant consequences of bird flu outbreaks and culling that can impact companies and investor portfolios.

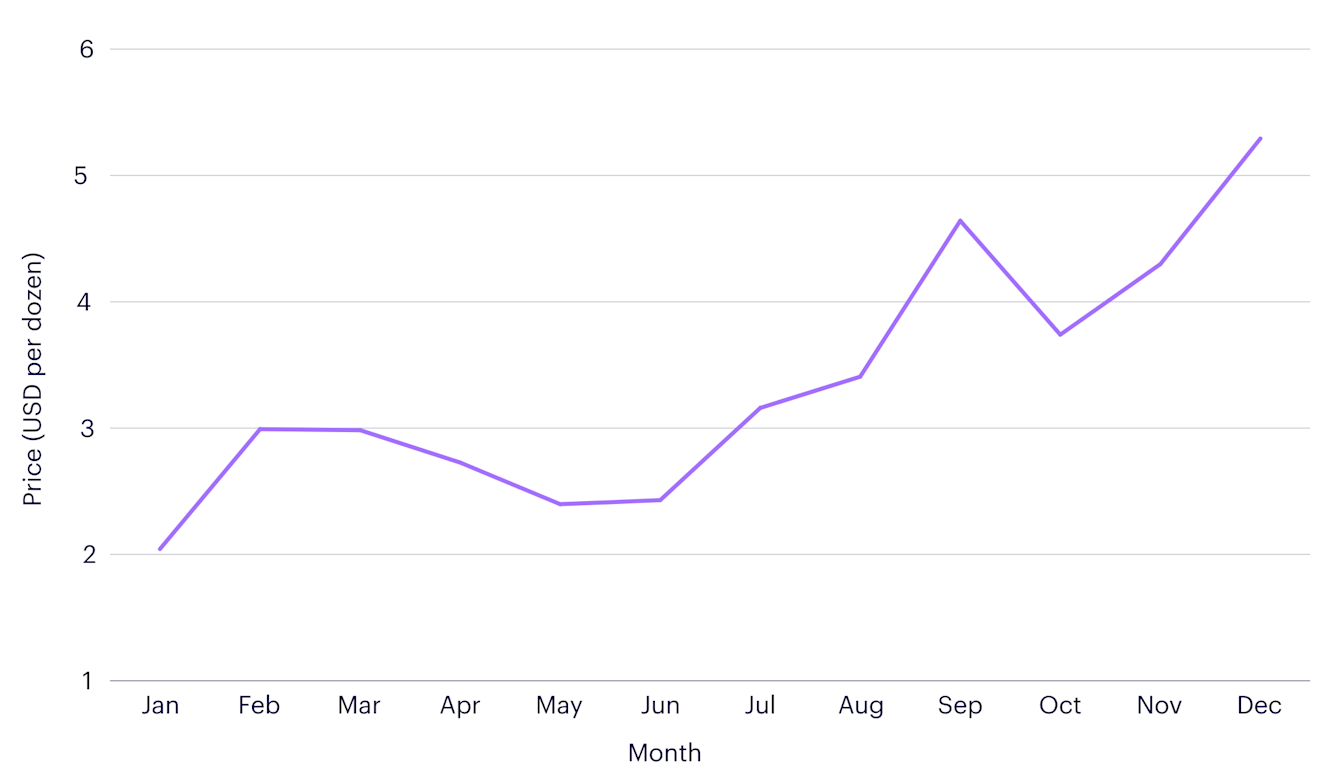

Bird flu in poultry has seen egg supplies tighten and prices increase significantly, a trend the USDA expects to continue, with potential for supply chain disruptions and increased operating costs, for farmers, retailers and restaurant chains, as well as other food manufacturers that rely on eggs to make their products.

Earlier this month, Waffle House became one of the first US restaurant chains to introduce a US$0.50 surcharge on eggs, while reports suggest some supermarkets are limiting consumer purchases to prevent stockpiling.

Figure 1: Average cost of large Grade A eggs between January 2024 and January 2025

Source: US Bureau of Labor Statistics. Retrieved 3 February 2025, from https://data.bls.gov/home.htm

Bird flu in cows

The USDA has spent more than US$430m trying to combat the bird flu on dairy farms so far, with measures including nationwide milk testing announced in December, although experts have lamented the speed of the US government’s response.

Bird flu has killed roughly 2% to 5% of infected dairy cows and can reduce a herd’s milk production by 20% to 30%.

The spread of bird flu to humans, via dairy cows, is estimated to be underreported, as farm workers have few protections regarding sick pay and sick leave, and many are undocumented, creating a disincentive to report their illness and isolate, as the LA Times highlights.

The consumption of raw (i.e. unpasteurized) milk infected with bird flu – whether by humans or animals – also poses risks, such as the product recalls, quarantines and distribution suspensions raw milk producer Raw Farm, faced at the end of last year.

No human cases of bird flu had been associated with raw milk at that time, but in December, a child who drank raw milk later tested positive for H5N1, while several domestic cats have contracted the virus after being exposed to raw milk or raw pet food.

Product recalls and suspensions can prove costly, from lost sales and lawsuits to brand and reputational damage, potentially impacting a company’s share price as well as its creditworthiness.

Mitigating risks and emerging opportunities

The effects of the COVID-19 pandemic on the health of people, companies and economies were multiple, estimated to have cost the US some US$14trn, making it crucial that governments, farmers and other stakeholders get ahead of the current bird flu outbreak to avoid a similar crisis.

Understanding the links between bird flu, intensive animal agriculture, and the associated material risks, and engaging with holdings to mitigate these, is crucial for investors seeking to protect their investment portfolios.

Improving the welfare and hygiene conditions of livestock, reducing flock numbers and the stocking density of facilities, and reducing the distance animals travel from breeding to slaughter could all help reduce the risk of further outbreaks, as the Coller FAIRR Protein Producer Index 2024 key findings and other industry research highlight.

Building more resilient supply chains and improving food security are also measures that could help prevent the current outbreak from mutating into a fully-fledged pandemic, some of which may also present investment opportunities.

For example, plant-based protein company Burcon NutraScience Corporation highlighted the recent egg supply disruption caused by bird flu when it launched an alternative egg protein last year, Food technology start-up Eat Just has attracted funding from investors such as the Qatari sovereign wealth fund and private equity manager Charlesbank Capital Partners in recent years, found that sales this January jumped by five times from the same period a year earlier. This success points to the potential of egg substitutes in helping to build more resilient, safer and more sustainable food system.

Life sciences company Labcorp also announced in its full-year financial results that it has developed a test to help diagnose H5 bird flu in humans.

Preparing to navigate future shocks

The ongoing and evolving bird flu crisis underscores the growing risks that animal-borne diseases pose to global markets, supply chains, and public health.

Investors need to pay close attention to how the outbreak continues to unfold, as disruptions across the agri-food sector can impact operating costs and earnings, and warnings from global experts that another pandemic could be triggered should not be underestimated.

Asset owners and investment managers that prioritise risk mitigation and sustainability—whether through engagement with protein producers and retailers or diversification into emerging health and food technology investments—may be better positioned to navigate future shocks.

An earlier version of this piece was first published on ImpactAlpha.

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.