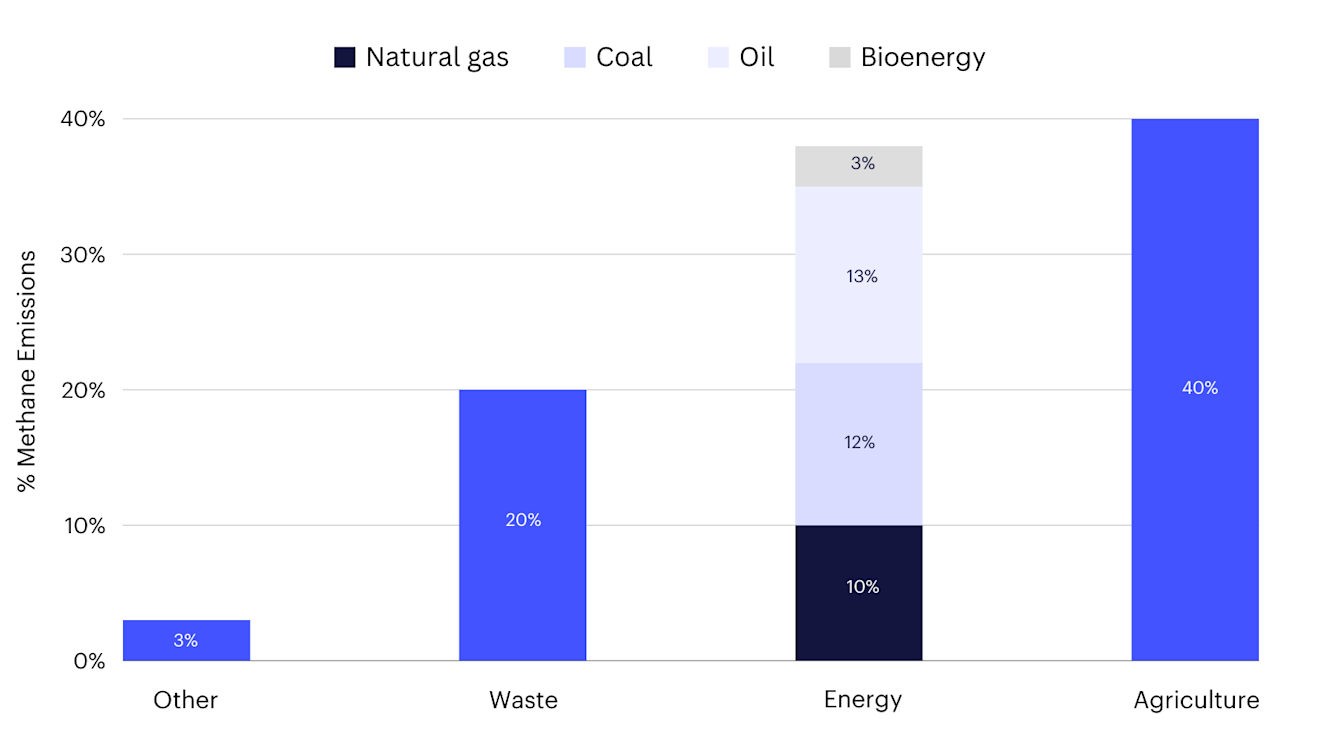

When discussing global warming and its associated greenhouse gases, carbon dioxide (CO2) is commonly emphasised, but methane, responsible for about 30% of the post-Industrial Revolution global warming, also warrants attention.1 The COP26 held in Glasgow highlighted the relevance of this issue through the global methane pledge that recognised the importance of methane in efforts to combat climate change. Later at COP27, John Kerry, Special Presidential Envoy for Climate in the United States, emphasised ‘achieving the Global Methane Pledge is key to meeting the goals of the Paris Agreement on climate change', and said the US will invest USD 20 billion to reduce methane emissions.2 Two years into the pledge, most emission reduction targets on methane still revolve around the oil and gas sector.3 The agriculture sector, despite having the highest share of global methane emissions (even higher than the energy sector) and accounting for approximately 40% as shown in Figure 1, has seen limited action on implementation.4

Figure 1: Global methane emissions by sources

Earlier this year, environment ministers from 13 countries, including the United States, as part of the Global Methane Hub, committed to reducing methane emissions from agriculture.5 While a step in the right direction, given the magnitude of the problem, commitments need to be backed by concrete action plans on how this will be implemented. Only 16 of the 54 countries that have commitments under the Paris Agreement have any targets around the agriculture sector.6 Given the limited focus on agriculture, the inadequate attention to action on methane emissions is unsurprising. However, with COP28 dedicating an entire day to food-related issues this year, targeting methane emissions from agriculture deserves special emphasis.

Why these emissions cannot be ignored

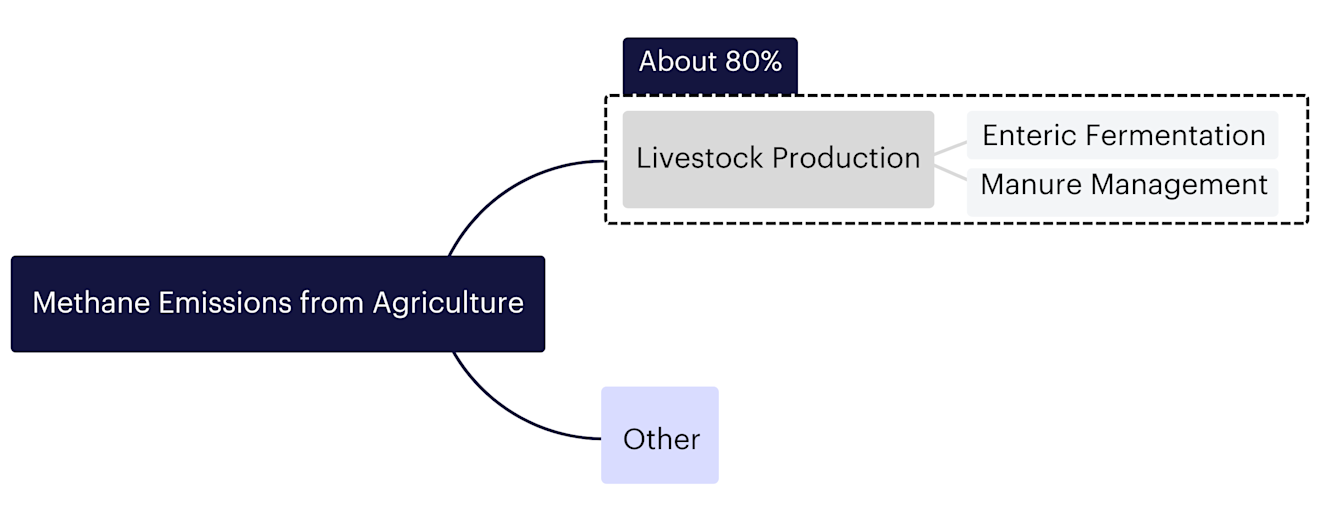

The global warming potential of methane is 27 times higher than that of CO2 over 100 years. The primary sources of methane emissions in agriculture are enteric fermentation and manure management of livestock, which are responsible for 80% of the total methane emissions, as shown in Figure 2.7 Methane is released as a byproduct of the regular cattle digestive process, in which bacteria living in the animal's digestive system ferment the feed consumed by the animal.8 In addition, methane is released for manure management when bacteria break down livestock dung.9

Enteric fermentation generates the highest methane emissions in the agriculture sector. For instance, in China, the primary source of agricultural methane emissions is enteric fermentation, which accounted for 43.92% of the total emissions in 2020. There are also examples from other countries, such as the United Kingdom, where in 2022 the contribution of enteric fermentation methane emissions resulting from cattle-related activities was almost 54% of the overall emissions generated by the agricultural sector.10 In the EU, 69% of methane emissions were attributed to enteric fermentation originating from cattle in 2020.11

Figure 2: Methane emissions from the agriculture sector

The devil is in the details: more cattle does not always mean more emissions

As the momentum to report on methane emissions gains ground, it is important for all stakeholders involved in methane related disclosures and reporting to understand more details of methane related reporting to get a better understanding of how these details can have an impact on driving total emissions up or down.

Global cattle-related methane emissions are responsible for over 70% of livestock emissions in agriculture.12 Despite being both cattle products, beef and dairy cattle emit differing methane levels.

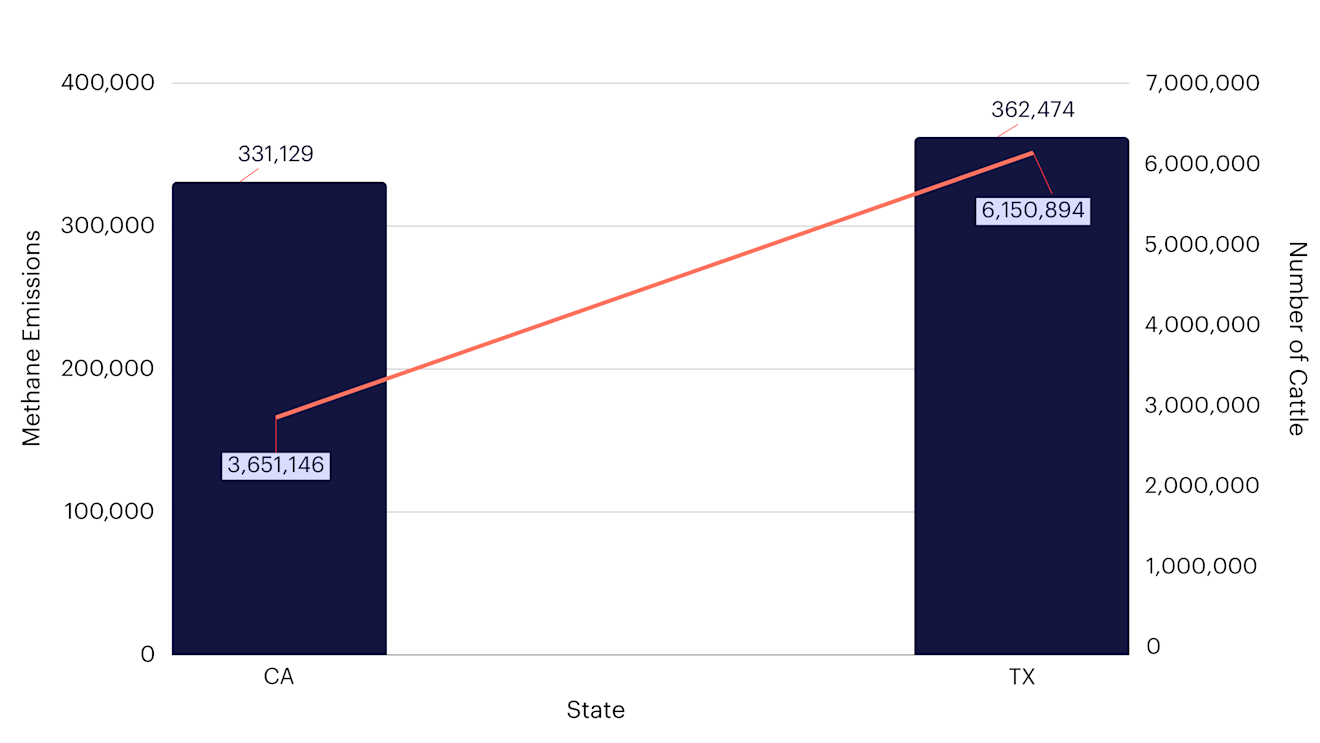

This difference in methane emissions of beef and dairy can be seen in the case of Texas and California, two dense cattle product-producing regions in North America. Texas has twice as many cattle compared to California, so one would expect Texas to have twice as many emissions. However, surprisingly, the aggregate methane emissions of the two states are the same. The reason for this can be found in the details. There are five times more dairy than beef in Californian farms and the emission factor of dairy farms in these states is double that of beef farms, as shown in Figure 3.

These results are based on the intensive global agriculture emission database developed by Climate TRACE, which covers more than 2000 feedlots in the United States and has tracked the locations and activities of about 9.8 million cattle and dairy in Texas and California, USA.13

Figure 3: Methane emissions and farming intensity in California and Texas

Growing trajectory of methane emissions

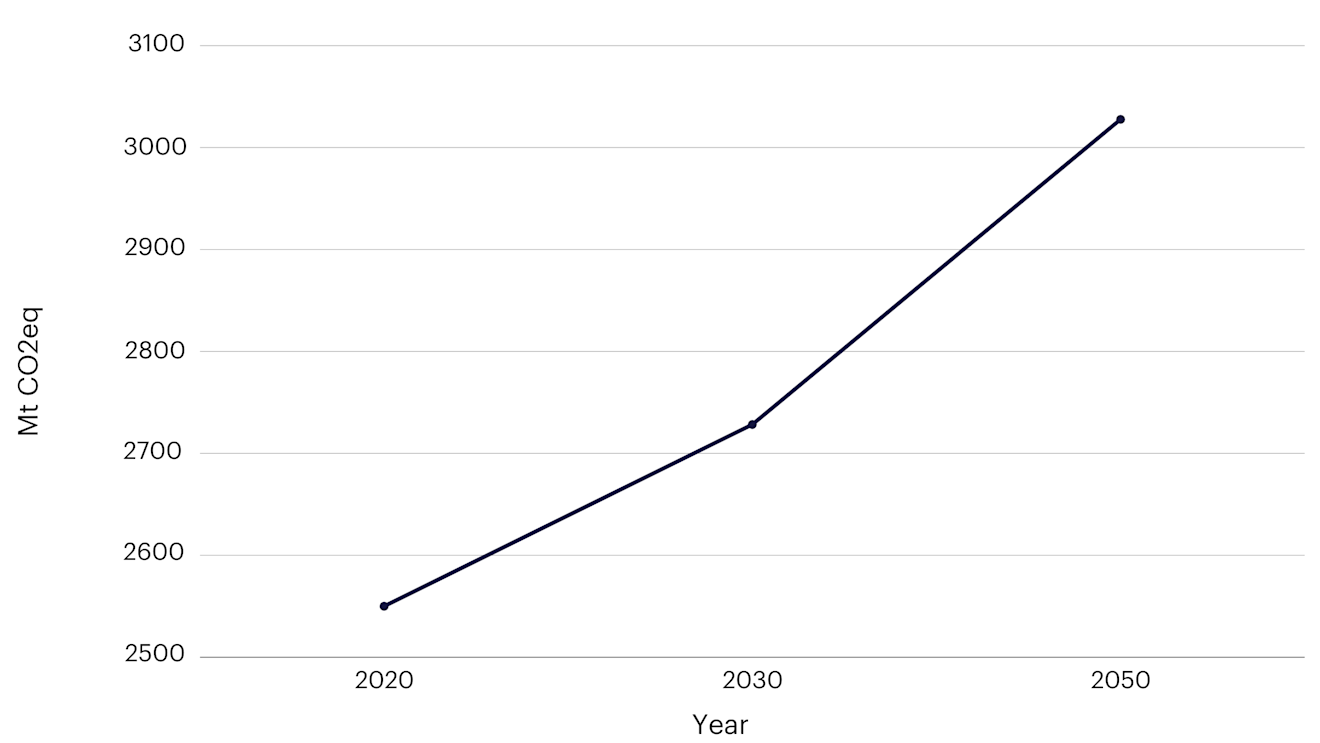

Enteric fermentation emissions have been rising consistently over the past six decades.14 Based on the Food and Agriculture Organization of the United Nations’ estimation, methane emission is expected to continue increasing during the next 30 years, exceeding 3,000 metric tons of CO2 equivalent emissions, as shown in Figure 4. Without sufficient intervention, the situation will only become more detrimental. Based on the scenarios modelled in the Coller FAIRR Climate Risk Tool, methane emissions from enteric fermentation under the High Climate Impact scenario in 2030 are projected to be 22% higher than those in the Net Zero scenario, and 34% higher in 2050.

Several factors account for this upward trend in methane emissions in the High Climate Impact scenario, such as the growth in population, incomes, and the reliance on meat-heavy diets.

Figure 4: Expected global methane emissions from enteric fermentation in 2030 and 2050

Lack of methane-related disclosures by companies

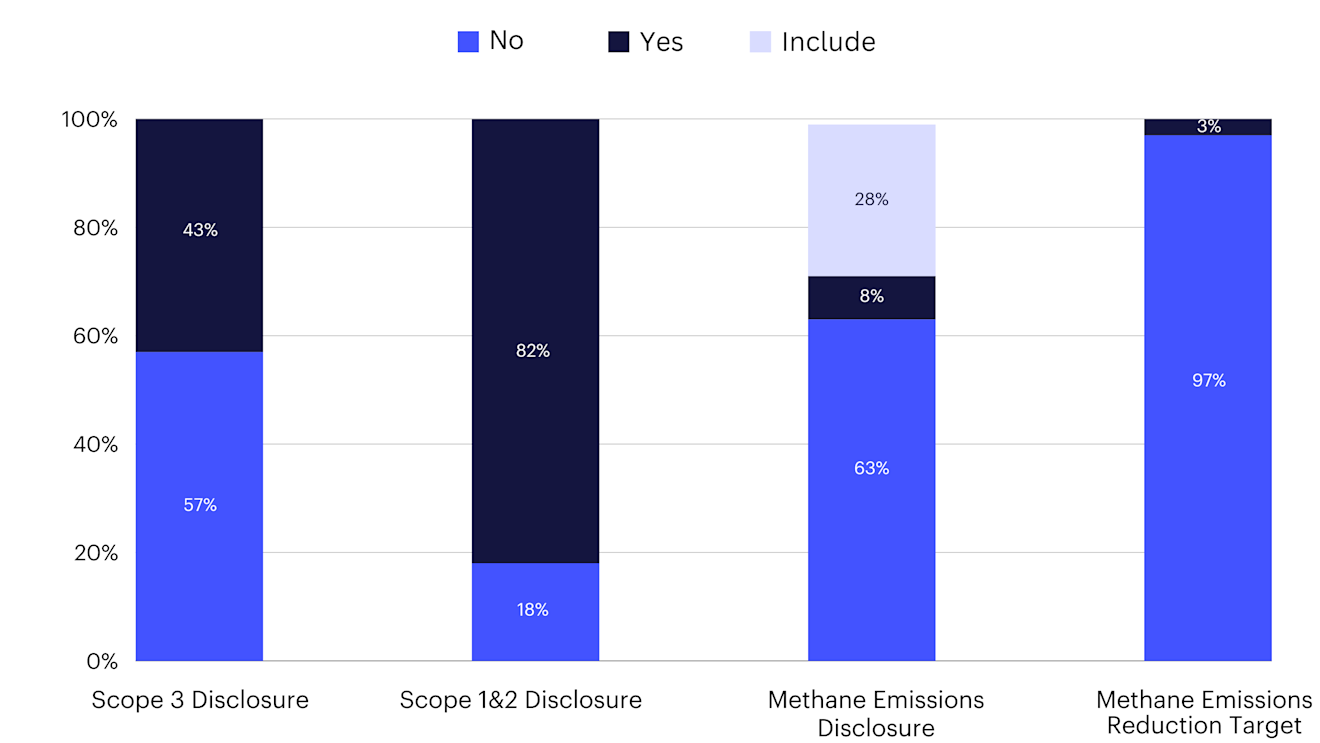

Methane emissions are not commonly included in the emissions data of most companies. Coller FAIRR Protein Producer Index provides a comprehensive analysis of 60 of the largest agriculture companies (livestock producers) on their ESG performance.15 As illustrated in Figure 5, although the majority of companies in the Coller FAIRR Protein Producer Index assessment disclose Scope 1 and 2 emissions, only a handful of them disclose methane emissions.

82% of the 60 largest protein producers assessed thus far have made their Scope 1 and 2 emissions public. Nevertheless, it is noteworthy that only five companies have chosen to publish their methane emissions, and perhaps more concerning is the fact that just two of these companies have established specific targets for reducing methane emissions.

Figure 5: Emissions disclosure of companies in the Protein Producer Index 2023/24

What to note for meaningful discussion at COP

No doubt, there have been regulations in different parts. Some governments have shown growing concerns about methane emissions, prompting the implementation of various regulations aimed at facilitating reductions in such emissions.

California's 2023-2024 budget allocates $25 million to the Enteric Fermentation Incentive Programme to help livestock producers reduce methane emissions, tripling the previous year's funding.16

New Zealand legislation set a methane reduction target of 10% by 2030 and 24%-47% by 2050 from 2017 levels17, with a methane tax on farmers starting in 2025.18

Ireland aims for at least a 10% reduction in livestock methane emissions by 2030.

UK plans to introduce methane-reducing cattle feed in 2025 to cut methane emissions by 30% by 2030.19

It is crucial that more governments proactively undertake efforts to reduce methane emissions. In addition to undertaking efforts to reduce methane emissions, governments must also ensure these efforts take into account just transition for the farmers involved. For instance, farmers took to the streets in protest due to a recent Dutch government target to reduce nitrogen, implying a 30% reduction in total livestock numbers.20 An equitable transition is a crucial precondition for reaching greenhouse gas emission reductions.

Methane emission reduction is urgent and requires greater attention of not just governments but also of companies and investors.

For companies, methane data such as that provided by Climate TRACE has the potential to go global in the future. This will be the impetus for companies to further make the efforts to disclose their methane emissions from different farms they source from. In addition to tracking methane data, some companies are already taking steps to track methane on the ground. For instance, Danone recently launched an initiative partnering with the Global Methane Hub (GMH) to invest in research on the reduction of enteric emissions in its dairy farming.

In terms of action from investors, they should continue to engage with companies on methane, for instance, encourage companies to not just undertake research and set targets but also monitor the results. In their portfolio of companies, identify companies that could have high methane emissions in their value chain and ask questions to assess whether the companies have dedicated CapEx for innovations/technologies to help reduce those methane emissions. With more and more, new and innovative developments in tracking methane and monitoring methane related data, investor interest in raising these questions can go a long way to encourage companies to disclose better emission inventories.

References

1 IEA

2 Reuters

3 IISD

4 IEA

6 OECD

7 McKinsey

8 IPCC

9 IPCC

11 EEA

12 FAO

14 IIASA

15 FAIRR

17 Ministry for the Environment, New Zealand

18 Reuters

19 The Guardian

20 TIME

FAIRR insights are written by FAIRR team members and occasionally co-authored with guest contributors. The authors write in their individual capacity and do not necessarily represent the FAIRR view.