Investing for Tomorrow’s Environment in Partnership With the CFA Institute

Overview

FAIRR is delighted to announce our partnership with the CFA Institute and Content with Purpose in the investing for tomorrow's environment series. This digital series aims to raise awareness of key ESG risks and the pivotal role finance professionals play in mitigating these challenges.

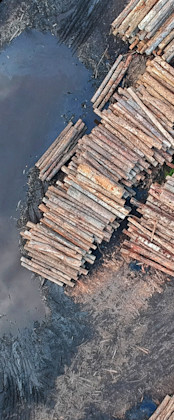

As the world undergoes immense change, integrating sustainability into investment decision-making is critical, particularly in the context of intensive animal agriculture. This sector poses significant environmental and social risks, including GHG emissions, deforestation, and water pollution. Additionally, social issues such as labour rights and animal welfare cannot be overlooked. Addressing these material risks is essential for safeguarding both our planet and the long-term value of investment portfolios.

The series will explore the urgent need to incorporate climate change and natural capital considerations into investment strategies through expert interviews and compelling short films. By highlighting the transition to new energy systems and sustainable business models, we aim to inspire investors to leverage their capital towards a low-carbon economy.

Our collaboration with the CFA Institute underscores FAIRR’s commitment to driving positive change in the global food system. Together, we can support investors in making informed, responsible decisions that promote sustainability and address the critical challenges posed by intensive animal farming. Join us in this vital journey towards a prosperous and sustainable future.

Amplifying Investor Impact in the Food Sector

Through its tools and research, FAIRR enables investors to better comprehend the ESG risks and opportunities within the global food sector.

The food sector faces significant interconnected global challenges like climate change and biodiversity loss, making it complex for investors to navigate. FAIRR provides investors with the necessary tools to understand ESG risks and opportunities within this sector and helps to amplify their collective influence through engagements to impact and accelerate change in company disclosure strategies or practices.

FAIRR enables investors to comprehend ESG dynamics in the global food sector, focusing on financially consequential issues tied to intensive animal production. Through access to comprehensive data-driven ESG analysis covering various facets of the food value chain, investors are empowered to address challenges faced by the intensive animal agriculture sector and contribute to positive change.

Assessing Climate Risk and Opportunity

FAIRR's Climate Risk Tool aids investors in aligning sustainability with material interests through informed decision-making.

In today's investment landscape, fiduciary duty mandates aligning sustainability with client interests. FAIRR’s Climate Risk Tool offers members an extensive model to evaluate ESG risks in conventional agriculture and opportunities in alternative protein companies. Analysing varied climate change scenarios empowers companies to make informed investment decisions, positively impacting sustainability.

Alternative Proteins

Alternative proteins are crucial to define the future of the food system; FAIRR engages, researches, and drives systemic change in the food sector, in line with global climate goals.

Alternative proteins play a significant role in addressing climate, health, and sustainability challenges. FAIRR engages the food sector to support protein diversification, driving systemic change aligned with planetary boundaries.

With rising global protein demand, alternative sources offer significant benefits, focusing on innovation and sustainability, from reducing GHG emissions to improving public health. Diversifying proteins to include alternative proteins represents tangible opportunities to improve sustainable sourcing practices and drive healthier and more sustainable consumer habits.