Antibiotic or Antimicrobial Resistance?

Antimicrobial resistance (AMR) is now globally acknowledged as a fundamental threat to public health and the global economy. The overuse and misuse of antibiotics in both humans and animals has accelerated the process by which bacteria become resistant to antibiotics, threatening our ability to treat common infections. The cost to human life is already evident. In Europe, an estimated 33,000 people die every year due to antibiotic-resistant infections while in India approximately 60,000 infants are dying annually.

Animal agriculture and factory farming are the largest consumers of antibiotics globally and a key contributor to AMR. The industrialisation of livestock production has driven the rise of intensive farms that house thousands of animals in confined spaces. To be profitable, companies have relied on the routine mass medication of farm animals with antibiotics, both as a means to increase feed efficiency and to reduce mortality. As more countries embrace intensive farming systems to meet the growing demand for meat, dairy and fish, the misuse of antibiotics has continued to increase globally. It is projected that by 2030, antibiotic consumption in farm animals will rise by 67%.

"Since the adoption of the Global Action Plan on AMR back in 2015, countries around the world have been responding to the increasing threat posed by antibiotic resistance. This report shows investors doing their bit too. It is important that as responsible investors we push the meat and dairy sector to move further and faster to reduce excessive use of antibiotics.”

Rory Hammerson, Partner, Castlefield Investment Partners LLP

Today, China is the largest consumer of veterinary antimicrobials, both in relative and in absolute terms, and China, U.S., Brazil and India collectively represent nearly 75% of total antibiotic consumption worldwide. While the impacts associated with increased resistance are significant globally, they will disproportionately affect lower-income countries, limiting our ability to meet the Sustainable Development Goals.

AMR is a systemic risk that will impact multiple sectors including food and agriculture, pharmaceuticals, healthcare and insurance industries. According to the World Bank, by 2050, global GDP and world trade could shrink between 1.1% and 3.8% while the impact on global animal production could lead to a decline of between 2.6 and 7.5% per year.

This is why the integration of AMR into investment decision making across assets classes is essential to risk mitigation and long-term value creation. Investors have a key role to play in helping to reform current systems of production to preserve the efficacy of antibiotics against disease in both humans and animals through active ownership and stewardship.

Growing Investor Support

Investors now recognise that the routine non-therapeutic use of antibiotics in livestock production is a leading cause of rising antimicrobial resistance worldwide that affects not only public health, but multiple sectors including insurance, pharma, food and agriculture. Improving antibiotics stewardship in livestock supply chains is therefore crucial to protecting public health, and essential to risk mitigation and value creation across investment portfolios.

“33,000 deaths a year in Europe alone is not something we as investors can ignore anymore. While we support pharmaceuticals developing novel agents to address drug resistance, we must, with the same intensity, support food chains acting responsibly towards antibiotic use. Regulation and consumers are moving fast on antibiotics. Food companies can’t afford to stand still.”

Sophie Deleuze, Senior ESG Analyst, Engagement Specialist, CANDRIAM

In the US, the number of shareholder resolutions filed on antibiotics overuse in livestock production has increased significantly. Between 2010 and 2015, four resolutions were filed. In 2016 and 2017, a total of twelve resolutions were filed. In 2018 and 2019, eight resolutions have been filed to date.

As a global institutional network of investors focused on addressing ESG risks and opportunities associated with global food supply chains, the FAIRR Initiative recognises one of the most effective mechanisms for driving change is active ownership and stewardship through company engagement. For over three years, FAIRR has been working in collaboration with groups of investors to improve antibiotics stewardship in livestock production through direct engagement with companies.

FAIRR has also provided expert research and guidance including a best practice policy for food producers and retailers that was developed in consultation with leading industry and issue experts.

FAIRR’s collaborative investor engagement on antibiotics overuse with the global fast food and casual dining sector was launched in early 2016 targeting 10 companies. The number of companies expanded in 2017 to include a total of 20 companies. Investor support for the engagement has grown significantly since inception, doubling in size during every phase to reach a total of 74 investors representing $4.9 trillion in combined assets in August 2018. A detailed overview of company progress in response to the collaborative investor engagement is available in the full report.

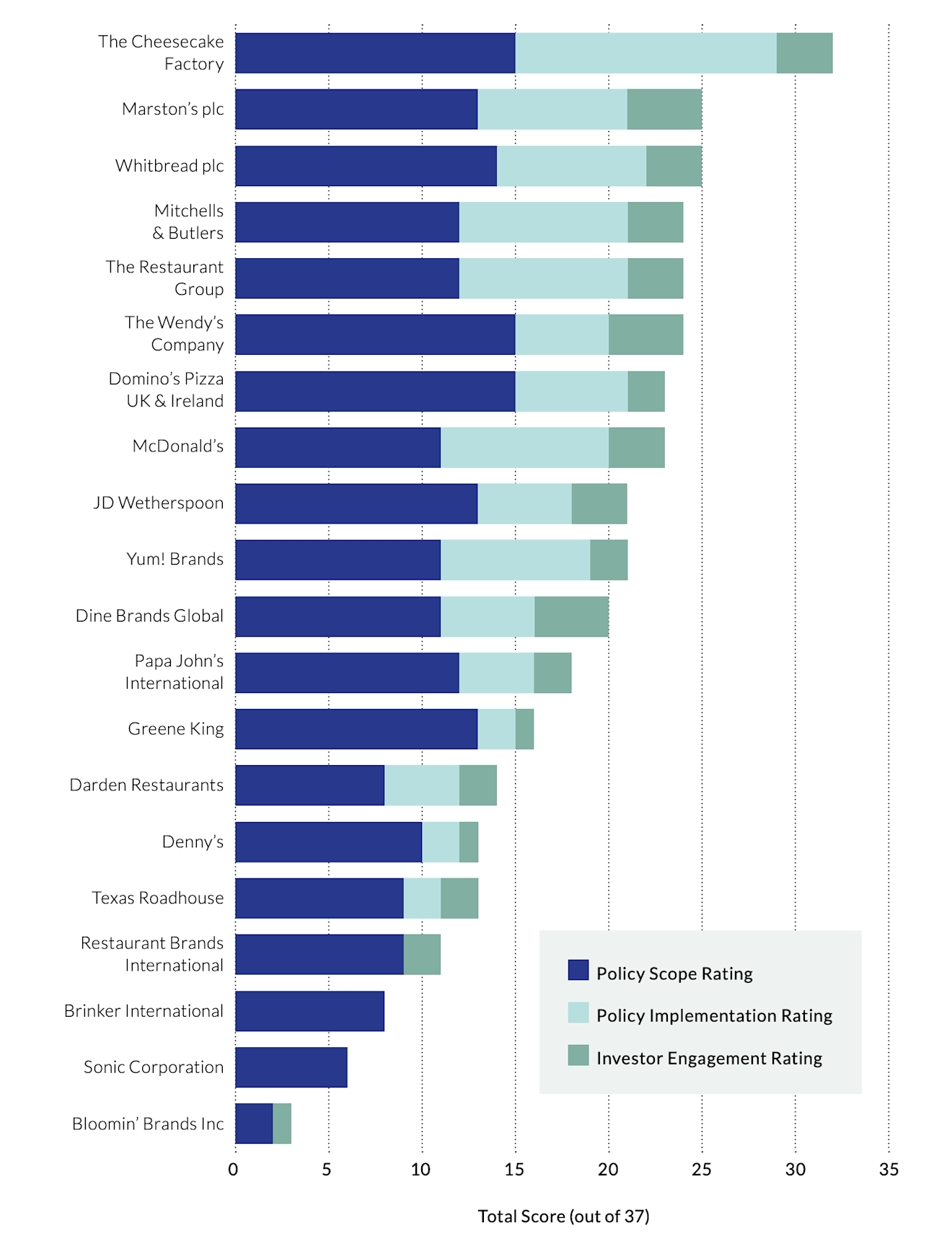

Benchmarking Corporate Practices

Ranking of 20 companies using FAIRR's evaluation framework, which assesses company policies and implementation on antibiotics use.

FAIRR's Investor Members can log in to see our exclusive individual company analysis of how businesses are responding to the AMR challenge, based on insights gained during this engagement.