Key findings and implications for investors

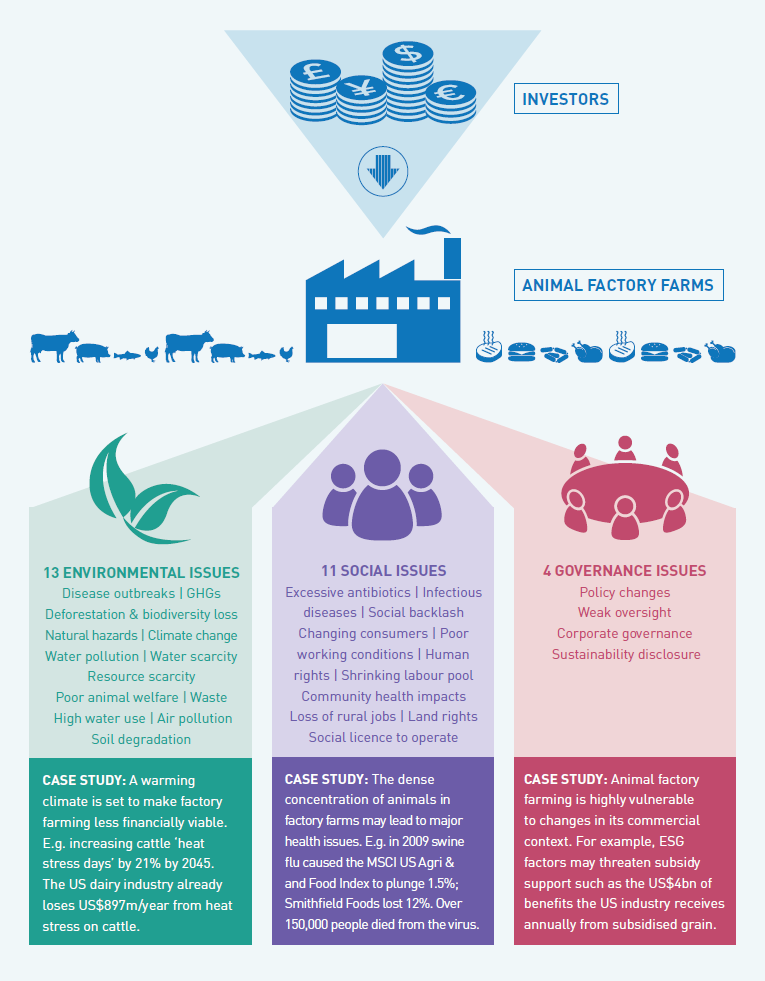

Animal factory farming is exposed to at least 28 environmental, social and governance (ESG) issues that could significantly damage financial value over the short or long-term.

All 28 issues can potentially affect the financial performance of companies across the food value chain. Including large agri-business, food retailers and restaurants.

A knowledge gap exists within the investment community about managing these risks and opportunities. Even among those investors who are integrating ESG issues into their investment decision-making processes.

The window of opportunity for investors to act is finite and shrinking. The magnitude of risks generated by animal factory farming is set to increase through rising capital costs, the shifting gravity of production to developing countries with less robust regulation, the impacts of climate change and increasing social concerns over animal welfare and sustainability.

Investors should undertake additional research in a number of areas to support the initial exploratory findings contained in this report if they are to close the knowledge gap and protect long-term value creation.

Executive Summary

Ignoring ESG issues associated with animal factory farming leaves investors exposed to significant material risks. Animal factory farming has not historically received meaningful attention from the responsible investment community. However, in a relatively short period of time it has come to dominate global meat production despite wider risks over its potential impacts on areas such as public health, the environment and food safety. The available literature studied for this report shows that these risks are material for mainstream investors, especially those with significant exposure to the agricultural and food value chains.

Animal factory farming is a new phenomenon that has established itself as the predominant mode of livestock production. Over the past half century drivers such as population growth, rising incomes and urbanisation have driven a sharp increase in meat consumption and a shift towards factory farming as the way to meet demand. An estimated 70% of farmed animals are now raised in this system, including 99% of US farm animals1. Now many Asian countries have started to industrialise their animal farming systems at pace and scale.

A knowledge gap exists about animal factory farming risks among investors. This report analysed several economic, academic and NGO studies to understand whether there was financial vulnerability for long-term investors due to the rise of intensive farming. Most of these studies focused on the sector’s vulnerability to policy and regulation and we believe that this report is the first study to reveal unpriced risks from the impacts of wider environmental, social and governance issues on animal factory farms.

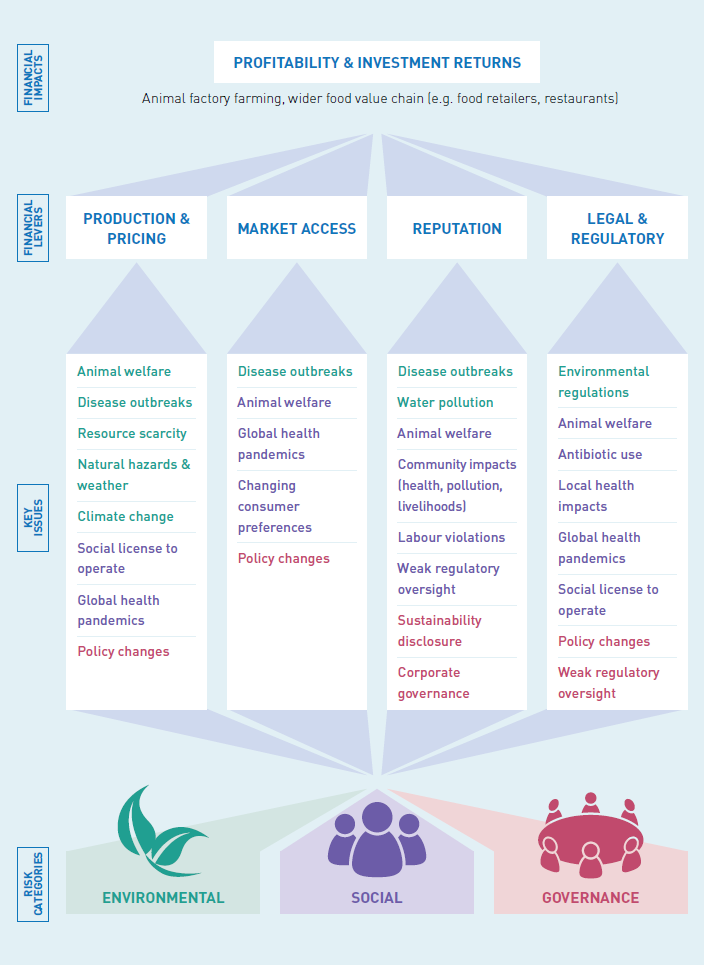

Animal factory farms are vulnerable to at least 28 ESG issues that may damage their financial performance and returns. This diverse range of 28 issues are split into ‘environmental’, ‘social’ and ‘governance’ risks. The links between ESG issues and financial outcomes can be complex and difficult to assess, but nevertheless a hard line can often be drawn between issues such as droughts or food contamination and financial performance. This report has developed a framework to link ESG issues with four key financial levers: ‘production and price’, ‘market access’, ‘reputation’ and ‘legal and regulatory’.

"While industrial farm animal production has benefits, it brings with it growing concerns for public health, the environment, animal welfare, and impacts on rural communities". - Pew Commission on Industrial Farm Animal Production (US)

The key risks are:

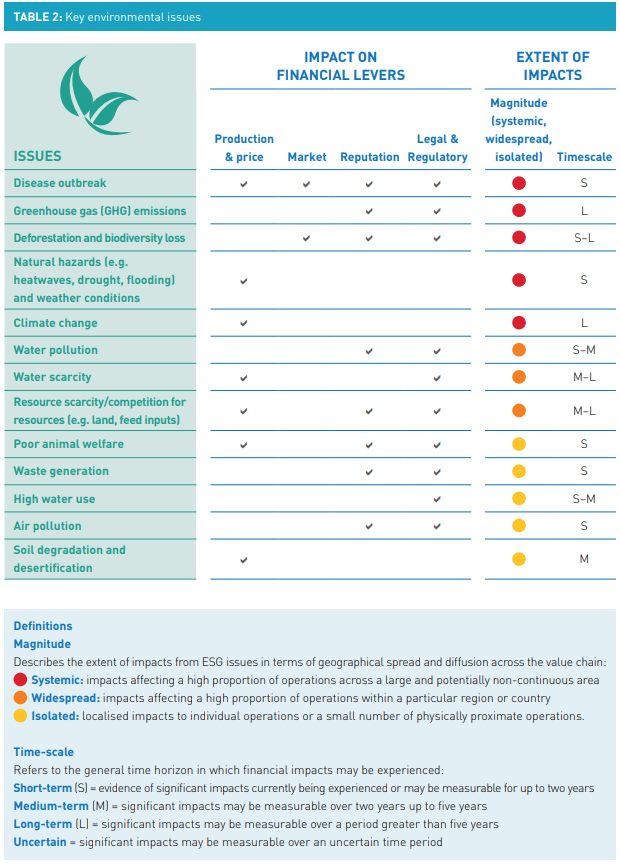

Environmental – These are the most quantifiable of the three (ESG) areas and include issues such as climate change, water scarcity and water pollution. For the latter the example of North Carolina is cited, which permanently banned new pig factory farms in 2007 to protect water courses and prevent pollution. Reports indicate that if the industry was forced to meet the costs of its pollution, this could equate to billions of dollars2. The chapter also cites the large contribution of the livestock sector to climate change (14.5% of all man-made GHGs) and shows how the costs of ‘heat stress’ could significantly harm cattle farmers in the next 30 years.

Social – The report concludes that there is a tremendous amount of financial value potentially at risk as a result of social issues. These include health impacts from the overuse of antibiotics in factory farms, pandemic risk and reputational damage to companies due to changing consumer attitudes. For example, it describes how the 2015 outbreak of bird flu in the US, thought to have been catalyzed by factory farms, caused over $3.3bn of economic costs. The example of Yum! and McDonalds losing US$10.8bn of combined market capitalisation after a food safety scandal in a Chinese supplier is also explored.

Governance - There are four broad governance issues that impact the animal factory farming industry, with potential changes to subsidy support from governments presenting the most significant financial risk. For example, one study argues that the success of the animal factory farming model is due largely to subsidy support, including almost US$4bn that the US industry receives in benefits annually from subsidised grain. Shifting production to developing countries also raises concerns for investors due to less robust corporate governance in these countries.

Some leading investors have already started to integrate animal factory farming risks into investment processes. Historically, investors have been largely unaware of investor risks in this area. However in recent years some parts of the financial community have taken steps to improve their understanding. Some investors have begun to consider it in both their investment analysis and active ownership processes. This includes development financial institutions such as the IFC and EBRD as well as several mainstream investors such as PGGM, BNP Paribas and Aviva Investors. In this report we provide a list of available resources that investors are currently using to integrate animal welfare practices and highlight the Business Benchmark on Farm Animal Welfare (BBFAW) – an independent benchmark that ranks how the world’s leading food companies are managing and reporting their farm animal welfare practices.

A toe in the water. This report aims to broaden the current understanding of risk linked to investment in animal factory farming, but it is clear that further in-depth research and engagement between investors and the industry would help close the knowledge gap that exists. Ideas for further research and other practical steps are offered in the last chapter of this report.

Putting all our eggs in one basket

Over past decades, traditional livestock farming has been largely replaced by highly industrial production systems, or animal factory farms. An estimated 70% of animals farmed for food globally are raised within a factory farming system. Large poultry farms can contain more than 500,000 broiler chickens, pig farms can contain more than 10,000 hogs, and cattle feedlots can hold upwards of 100,000 cattle at any one time (that is almost the entire dairy cow population of Greece in one farm).

Animal factory farming as a production process originated in the United States and has since been replicated in other Western nations. More recently, animal factory farming is becoming established in new geographies, including South Asia (India), East Asia (China), sub-Saharan Africa and South America. In this context, it is more important than ever that investors understand the potential risks associated with investment in animal factory farming and related industries.

ESG issues and their impacts

There is growing evidence that ESG issues can impact the performance of companies connected to animal factory farming across the agriculture and food value chain. The most visible financial impacts come from short-term events, but the financial performance of companies linked to animal factory farming is also contingent on longer-term environmental, social and regulatory trends and the ability for companies to successfully anticipate and navigate these changes. This section highlights these key changes, pointing towards issues that responsible investors may wish to incorporate into their investment approaches.

The animal factory farming industry can cause significant negative environmental and social impacts, and it is also highly vulnerable to wider ESG trends, such as resource scarcity, consumer preferences and regulatory changes. These risks place animal factory farming alongside other high impact sectors such as oil and gas, mining and clothing & apparel as sectors that require diligent monitoring and management.

Definitions

Relationship between ESG issues and their impacts on financial outcome.

Production and price: refers to the impacts on production, which are determined largely by weather conditions and disease. Price risk refers to changes in the prices of inputs and outputs and is generally external to production processes.

Market access: refers to the ability of producers to sell to different markets, including national markets and specific customers (such as government bodies and private sector firms).

Reputation: refers to the damage done to a company’s reputation or brand.

Legal and regulatory: refers to the financial impact that may arise from changes in laws and regulations or from violations of existing laws and regulations.

Integrating animal factory farming risks into investment processes

The food and agriculture sector presents significant investment opportunities with a growing world population driving ever-increasing demands for more food. However there are signs of growing recognition amongst stakeholders, including many in the financial sector, that investments in agriculture should not negatively affect people, livelihoods and the natural environment.

Within this context, animal factory farming is under increasing scrutiny and some leading investors are looking more carefully at risks associated with the sector including development finance institutions and those who define themselves as mainstream responsible investors.

Investing in food and agriculture

The food and agriculture sector presents significant investment opportunity. Overall food production must increase by around 70% between 2005/07 and 2050 to meet rising global food need. This is being driven by population growth and, currently, by greater demand for animal protein as a result of rising wealth. Meanwhile, there has also been an upward trend in food prices in recent years. On the back of these fundamentals, appetite for agricultural investment is strong and can be met through several options including commodity futures, equity in farming and food production companies, and agricultural ETFs. For many investors the sector is attractive because of the significant potential for positive returns or value preservation. It also provides an opportunity to diversify portfolios, manage inflation risks and provide exposure to emerging markets.

"Businesses that address or enhance animal welfare are likely to win or retain a competitive advantage in the global marketplace"

International Finance Corporation

However, there are signs that the financial community is beginning to recognise the need to ensure that investments in agriculture, including meat production, are responsible and do not negatively affect people, livelihoods and the natural environment. In response, a number of instruments – guidelines, compacts, principles, standards, etc. – have been created to help inform responsible investment across the agricultural sector and specific sub-sectors, such as livestock production. For example, the International Finance Corporation (IFC) issued voluntary guidelines and recommendations for clients on how to incorporate animal welfare considerations in intensive livestock operations. Instruments such as these are increasingly being used by investors to help improve financial performance, manage risk and contribute to the economic, social and environmental sustainability of the agricultural sector.

How investors should respond

This report draws on a wide range of sources to assess the potential material risks of animal factory farming from an ESG perspective. A strong case is made for responsible investors to incorporate these risks into their investment approaches. However, the limited extent to which investors have engaged with animal factory farming historically indicates a need to raise more awareness of the financial risks associated with the sector.

A number of activities can be undertaken to help address existing knowledge gaps and provide the investment community with a better understanding of the risks associated with animal factory farming. These activities include:

Further in-depth research, which explores in more detail the connection between the issues and financial returns and distinguishes animal factory farming from traditional livestock production.

Analysis of the effect of strong ESG management (including high animal welfare standards) on the long-term financial performance and investment returns of the animal factory farm sector.

Increased engagement with stakeholders in countries that are expected to see the highest future growth in animal factory farming.

Deepening understanding and raising awareness of how investors are engaging with animal factory farming and shifting investment to less intensive production systems or plant-based agriculture.

These activities will also help to build the momentum around responsible investment and animal factory farming.

Implications of the findings for investors

The social and environmental impacts of animal factory farming identified in this report support the case for greater scrutiny of the sector as part of responsible investment practice. Animal factory farming is associated with severe environmental and social impacts, which can be experienced at local, regional and global scales. This places animal factory farming alongside other high impact sectors including oil and gas, mining, and clothing and apparel. Environmental and social risks can have a significant financial impact on investments, including reducing the value of the asset or diminishing dividends as a result of changes in the operating costs. The reputation of investors may also be at stake if stakeholders associated them with environmentally or socially damaging investments.

The negative financial impacts of ESG issues on animal factory farming highlight the importance of integrating analysis of these issues into investment research and decision-making. ESG issues can affect financial outcomes through a range of pathways, including production and pricing, market access, legal and regulatory and reputation. The manner in which ESG issues affect these financial levers can be relatively straightforward, such as in the case of short-term events like natural hazards or food scandals. However, the magnitude and time-scales over which effects are felt can vary tremendously. Disentangling the longer-term effects of ESG issues from other drivers of company and investment performance is more challenging.

Investors that integrate analysis of ESG issues into their investment approach must look across agriculture and food value chains, particularly as the magnitude of financial risks is likely to increase over the long term. Companies directly involved in animal factory farming are most exposed to key ESG issues. However, consumer-facing companies at the end of the value chain – such as food retailers and restaurants – are also exposed to financial harm. The magnitude of risks to companies involved in animal factory farming and industrial food production are likely to increase as a result of rising capital costs, the shifting gravity of production to developing countries with less robust regulation, the impacts of climate change and increasing social concerns over animal welfare and sustainability.

There is a need to raise awareness of ESG issues related to animal factory farming and the financial risks they present to more investors, and to companies with links to the sector. Outside of a few far-sighted institutions there is a general lack of awareness among the wider investment community of the short and long-term risks that are inherent to the continued growth of the animal factory farm industry.

Finally, there is a clear need for additional research in a number of areas to support the initial exploratory findings contained in this report. The bulk of the evidence for this report has been drawn from a) academic, government and industry studies on short-term events that are well recognised by the livestock industry; b) pressure group reports, with some lacking the perceived rigour of objective, peer reviewed research; and c) anecdotal media stories. However, there is still a significant knowledge gap with respect to the financial implications of ESG issues for companies associated with the animal factory farming industry. Suggestions for further research are included in the ‘Next Steps’ section below.

Next steps

Greater scrutiny of animal factory farming by a wide range of stakeholders has highlighted the need for further research and engagement on critical ESG issues. Governments, civil society, the public, companies and financial institutions would all be wise to take a closer look at the negative impacts of animal factory farming and how the industry may potentially be affected by external changes to the operating environment. These stakeholders can ask challenging questions to help them write laws and regulations, mobilise support for opposition campaigns, buy goods, develop business strategies and to help inform investment decisions.

Despite increasing interest and momentum, many of these questions remain unanswered. A number of steps would help to address these knowledge gaps.

These include further research that may include:

Research to clearly distinguish between the effects of ESG issues on animal factory farming and traditional (or ‘smaller scale’) production.

Research which more clearly identifies the specific effects of ESG issues on different types of animal factory farming, such as cattle, poultry and pig production.

More detailed analysis of the extent to which strong ESG management (including high animal welfare standards) in the farming sector could improve long-term financial returns. This should include a clear definition of the animal farming universe and how the performance of these companies would compare to those with poor ESG management.

Research to establish practical steps that can best retool and improve industry practices so that the sector can both help meet the demand for global meat while exhibiting strong ESG management.

Practical steps to close the knowledge gap can also include:

Increased engagement from investors with animal factory farming stakeholders in countries that are expected to see the highest growth in animal factory farming over coming decades, particularly China and India.

Publishing more case studies that demonstrate how private investors are engaging with animal factory farming (including shifting investment towards less intensive production systems or plant-based alternatives to meat) and the results that have been achieved.